Subscribe to Our Insights

Thought Leadership

Trump’s Victory: What Does it Mean for Gold?

By John Hathaway on November 21, 2016

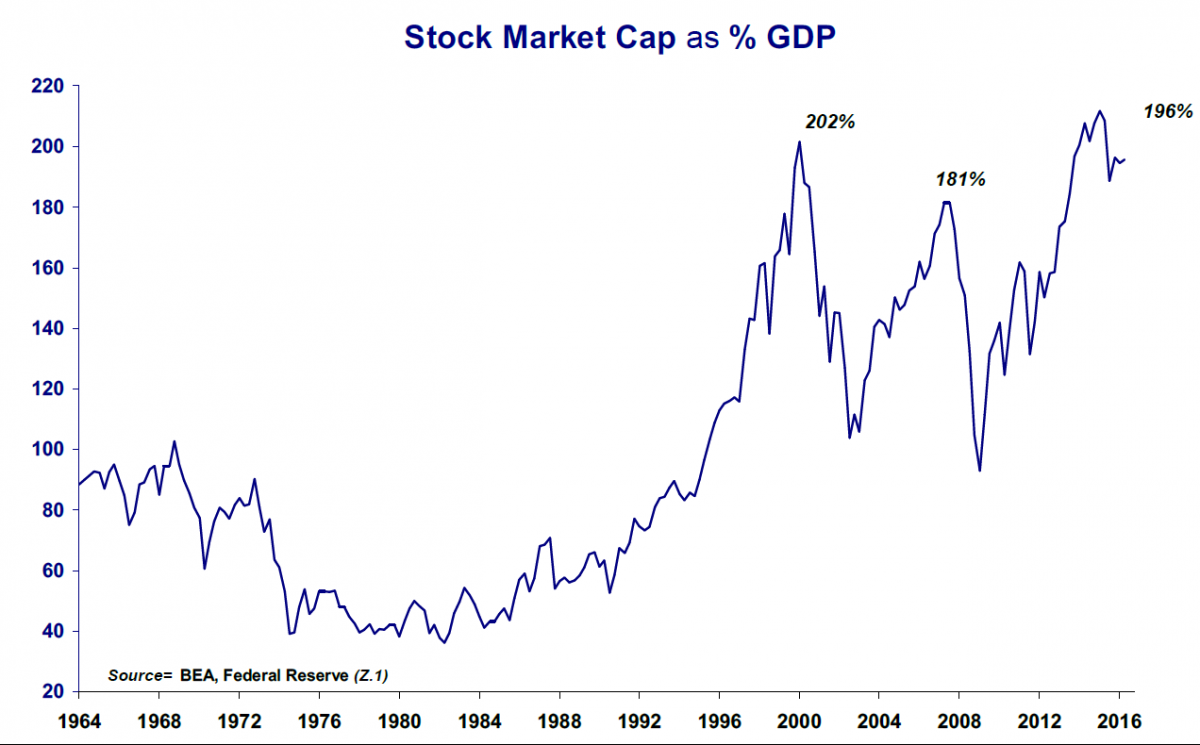

In our view, the systemic risks that existed prior to the presidential election have not suddenly vanished. Most important among these is a massive bond-market bubble. Close behind, equity valuations remain at historically extreme levels. How the new administration deals with these vexing issues, assuming that it even begins to comprehend them, is a complete unknown. Any unwinding promises to be precarious, full of pitfalls and setbacks, all of which are reason enough to hedge bets on a trouble-free return to robust economic growth with exposure to gold and precious-metals equities.

Reasons for post-election optimism abound. We agree with the following assessment by MacroMavens (11/17/16):

The vicious cycle of low rates – forcing households to save twice as hard, further depressing growth and inflation, pushing interest rates lower still and making saving even more urgent – will finally be broken. Rather than ping-ponging from one asset bubble to the next, papering over the deep wounds in between with more and more debt, we will finally get back to genuine economic growth built on entrepreneurial spirit and a rising standard of living for the populace. Velocity of money will at last lift off the mat.

To us, the key word in the above quote is “finally.” Getting from point A to point B could prove extremely challenging and time-consuming. Gratification of market expectations seems unlikely to be instant.

Markets have responded to the Trump victory in several ways that seem contradictory. Base metals and the dollar index are on a tear (inflationary expectations), while gold and oil have been weak (deflationary). A very strong dollar is deflationary, as are weak emerging-market currencies. According to Jonathan Lewis of Fiera Capital, “The strong dollar is destabilizing for markets, for foreign assets, for emerging market nations that pay back their debt in dollars…” (WSJ, “Dollar’s Rapid Gain Triggers Angst in Emerging Markets,” Nov. 19)

And according to David Rosenberg of Gluskin Sheff, “There is no bid in the Treasury market and the price chart looks like Bank stocks in the summer and fall of 2008. Globally, we have seen (post-election) $1.2 trillion of bond value wiped out.” Bonds are weak based on expectations of rising deficit spending and inflation. Higher bond yields would seem to undermine the idea of higher stock prices, especially with valuations near all- time highs, perhaps second only to levels seen during the dot-com bubble.

Source: MacroMavens

The surprising win by Trump has triggered frenzied repositioning across asset classes. Jumping to conclusions, investors seem to have been caught up in a highly speculative and emotional game of musical chairs. If only the future were so easy to divine! The prevailing snap macro-wisdom seems based more on the perceived certainty that Obama-Clinton was a road to ruin rather than any knowledge whatsoever of the realities of the future world of Trump. If consensus analysis were such a reliable approach, how does one explain the massive capital losses that followed the dot-com bubble or the 2008 credit meltdown? It has been our experience that when markets are convinced of a certain outcome, the bell is ringing to get out of the pool.

“Trumpmania” has had the opposite effect on gold. After rising during the night of the election to $1340 on the initial fears of a Trump victory, the morning-after “discovery” of the “moderate and statesmanlike Trump,” somehow revealed only after the campaign, resulted in a fall of $70 intraday, after which the metal settled at the end of the week at $1227, a peak-to-trough move of 8.4%.

What seems more incredible, record COMEX volume during the reversal amounted to two million contracts, or 6,200 tons, which is the equivalent of two years of global mine production. This fact alone, in our opinion, highlights the absurd disconnect between synthetic paper instruments and the real assets they represent. What one can say with absolute certainty is that relatively little physical gold changed hands to explain this price swing. While the gold ETF (GLD) did shed approximately 600,000 ounces during the week (17 tonnes), this is a far cry from the 6200 tonnes of synthetic that was dumped. In our opinion, the selling was driven almost entirely by panicky ultra-long speculative investors who were wrong-footed by the morning-after reaction to the Trump victory, and who were then unceremoniously cleaned out by commercial traders who staged an opportunistic short-selling raid.

We have observed on repeated occasions that purely speculative paper transactions distort the price of real-world physical goods. In our view, price-disruptive distortions of this sort (including commodities other than gold) are enabled and encouraged by the willingness of the Chicago Mercantile Exchange (CME) to promote high-frequency trading to build profitability. (We have commented more extensively on the disconnect between synthetic and physical gold here and here).

Our view is that these recent wild price gyrations are little more than just that. The round-trip from euphoria to despair took only three days. It takes the mining industry two years to produce the 6,000 tonnes of metal that supposedly changed hands in that brief interval.

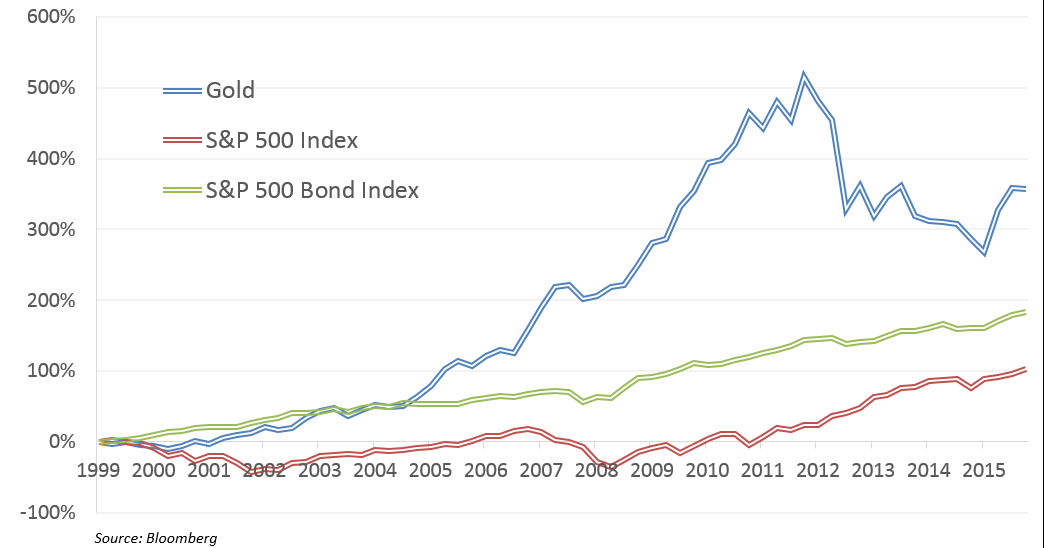

Since 2000, gold has been the top-performing asset class, winning out over both equities and bonds by a wide margin (see chart below).

Gold has advanced during both Republican and Democrat administrations. We predict that it will continue to rise during the coming uber-populist/pragmatist regime, if that is what lies ahead. The common thread driving gold higher for the past 17 years has been radical monetary policy, which seems immune to politics and rests on an unshakeable bipartisan consensus to avoid the economic and political pain that would be required to undo nearly five decades of bad public policy.

For us, there seem to be too many unknowns to discard the protection afforded by gold. While the markets appear to be saying “good riddance” to the past eight years, that does not translate into certitude that there are magical solutions. If interest rates continue to climb (and bond-market losses continue to mount), and if inflation begins to rise, especially as public spending expands, we may be only one or two Tweets from completely unsettling the markets. Trump is a pragmatist who may or may not turn out to be everything the markets are fantasizing.

If Trump proves to be everything one can hope for, the future is indeed bright; but it can become so only if his administration truly confronts the imbalances of the past 45 years. In our opinion, the process of wringing out the omnipresent manifestations of those policy excesses cannot take place without inflicting a substantial loss of paper wealth. Even Ronald Reagan, who, unlike Trump, had the good fortune to inherit financial markets that were substantially undervalued by present-day metrics, proved to be unpopular during the first two years of his administration, during which the S&P declined by 24%. If there is plausibility to our reservations, gold exposure is a “must have,” and may make more sense than ever.

John Hathaway

Senior Portfolio Manager

© Tocqueville Asset Management L.P.

November 17, 2016

This article reflects the views of the author as of the date or dates cited and may change at any time. The information should not be construed as investment advice. No representation is made concerning the accuracy of cited data, nor is there any guarantee that any projection, forecast or opinion will be realized.

References to stocks, securities or investments should not be considered recommendations to buy or sell. Past performance is not a guide to future performance. Securities that are referenced may be held in portfolios managed by Tocqueville or by principals, employees and associates of Tocqueville, and such references should not be deemed as an understanding of any future position, buying or selling, that may be taken by Tocqueville. We will periodically reprint charts or quote extensively from articles published by other sources. When we do, we will provide appropriate source information. The quotes and material that we reproduce are selected because, in our view, they provide an interesting, provocative or enlightening perspective on current events. Their reproduction in no way implies that we endorse any part of the material or investment recommendations published on those sites.

Mutual Funds

You are about to leave the Private Wealth Management section of the website. The link you have accessed is provided for informational purposes only and should not be considered a solicitation to become a shareholder of or invest in the Tocqueville Trust Mutual Funds. Please consider the investment objectives, risks, and charges and expenses of any Mutual Fund carefully before investing. The prospectus contains this and other information about the Funds. You may obtain a free prospectus by downloading a copy from the Mutual Fund section of the website, by contacting an authorized broker/dealer, or by calling 1-800-697-3863.Please read the prospectus carefully before you invest. By accepting you will be leaving the Private Wealth Management section of the website.