Subscribe to Our Insights

Thought Leadership

Tocqueville Gold Strategy First Quarter 2015 Investor Letter

By John Hathaway on April 7, 2015

Gold and gold mining shares appear to be as contrarian today asin 1999, before a decade‐plusrun in which bullion rose nearly seven‐fold in US dollar terms. For those who are concerned that the financial markets are overvalued, we believe that gold offers an out‐of‐favor investment strategy with asymmetric and dynamic potential. For those who see the US dollar as an overcrowded trade, gold could represent a sensible hedge against a reversal. And for those who view the practice of extreme monetary policies by world central bankers as unsustainable and laden with potential adversity, meaningful exposure to gold would now seem to be imperative.

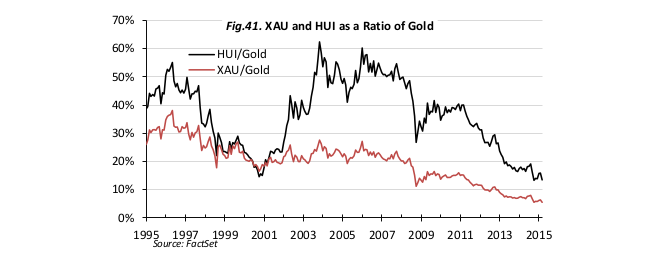

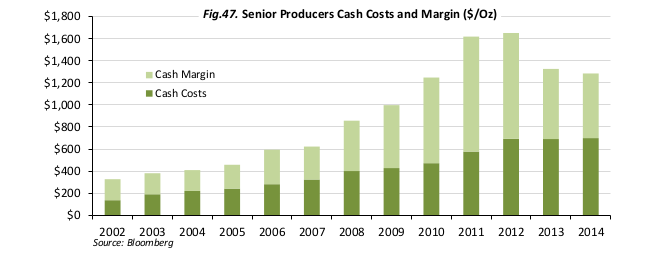

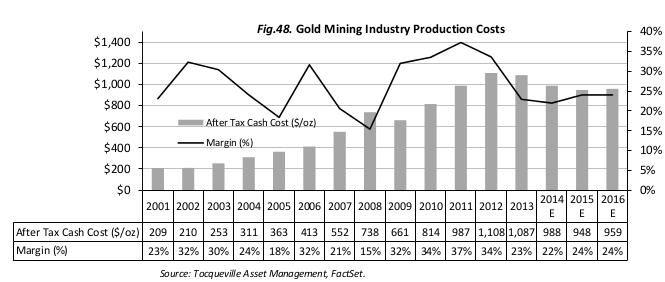

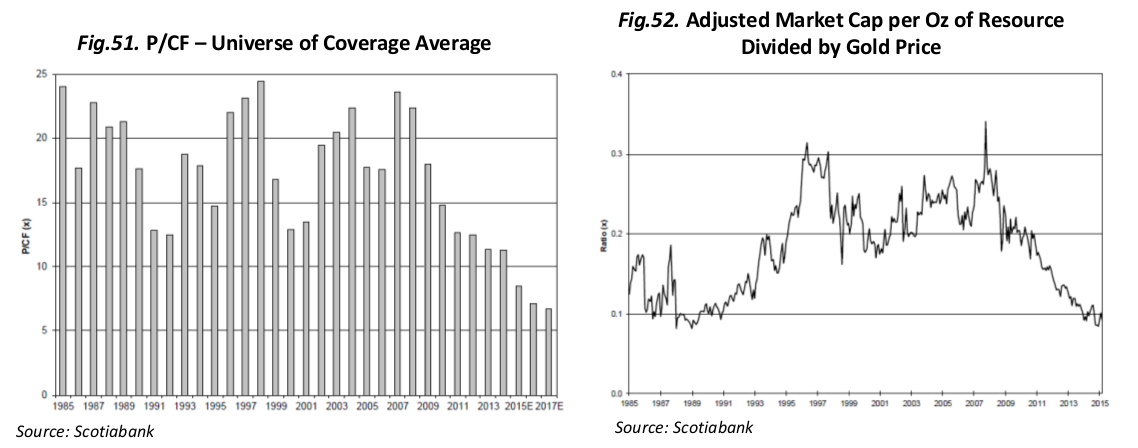

During the first quarter of 2015, the precious metals complex wasstrong out of the gate, rising 15.6 percent during the month of January. The rest of the quarter was more of a backing‐and‐filling affair, with the net result that the benchmark XAU Index declined 4.4 percent while bullion declined 0.1 percent. The gold mining industry continues to adjust to the realities of lackluster gold prices. Cost‐cutting is the norm; capital budgets have been pared. There should be no growth in newly mined gold as long as prices stay in the $1,200 range. As always, some companies handle adversity better than others. And there are always companies that add value during difficult periods. We believe that our research discipline has resulted in the selection of such companies in our portfolios.

The Financial Markets and Gold

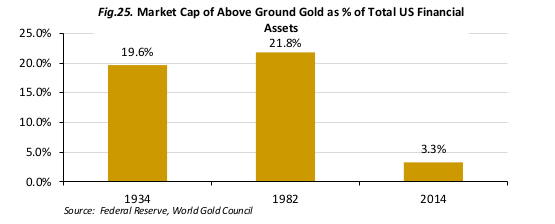

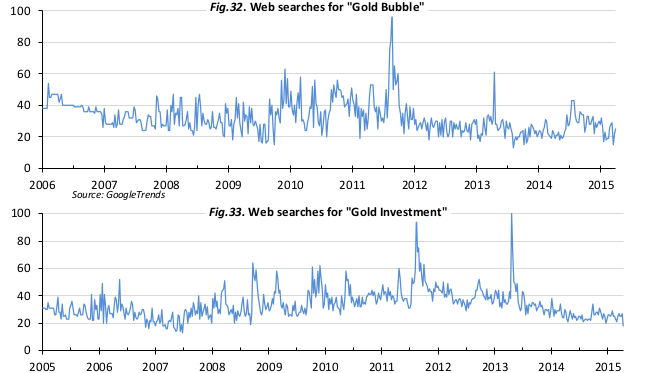

Strong returns in equities and bonds have been a major headwind for gold. The multiyear bull market in both has increased investor appetite for risk while disabling critical thinking that would lead to some consideration of gold. We have little doubt that a setback in the financial markets would benefit gold.

In the March 18, 2015, Wall Street on Parade, Pam Martens reports on a March 17 US Treasury Office of Financial Research study, “Quicksilver Markets,” by Ted Berg. The study, says Martens, warns “that by three separate measures the US stock market is approaching dangerous ‘two‐sigma thresholds’ which can lead to ‘quicksilver markets.’ Translation: we could be heading for a big crash.

“A two‐sigma threshold is when market valuation metrics move at least two standard deviations above the historical mean. The study notes that ‘valuations approached or surpassed two‐sigma in each major stock market bubble of the past century.’ Think 1929, 2000, and 2007. A quicksilver market, as defined by the study, is when stable markets turn on a dime and ‘change rapidly and unpredictably.’” The three ratios are the CAPE ratio, the Q‐ratio, and the Buffett Indicator. The CAPE ratio, devised by Robert Shiller, is the ratio of the S&P Index to trailing 10‐year average earnings. The Q‐ratio removes financial corporations and measures the market value of non‐financial corporate equities outstanding divided by net worth. The Buffett Indicator is the ratio of corporate market value to GNP. [Berg’s study can be found at

http://financialresearch.gov/briefs/files/OFRbr‐2015‐02‐quicksilver‐markets.pdf.]

While valuation metrics are interesting in terms of measuring potential risk, they are less useful in terms of exact timing. Conditions of extreme overvaluation or undervaluation can persist over long periods. However, there are signs that suggest a turning point is approaching. These include the extremity of position exposure by speculative capital and weakening fundamentals. Consider this:

It appears to me that the U.S. stock market is cruisin’ for a bruisin’. Valuations are stretched, sentiment is at an extreme (too bullish), liquidity isslowly leaking out, there’s no QE, the economy issinking, the strong dollar is killing our multinational corporations’ exports, and earnings expectations for 2015 are being slashed. S&P earnings estimates for 2015 at the start of the fourth quarter were $137. The estimates are now $117. That means that the P/E ratios, already high, are heading higher as the estimates for 2015 are cut (Fred Hickey, High Tech Strategist, March 4, 2015).

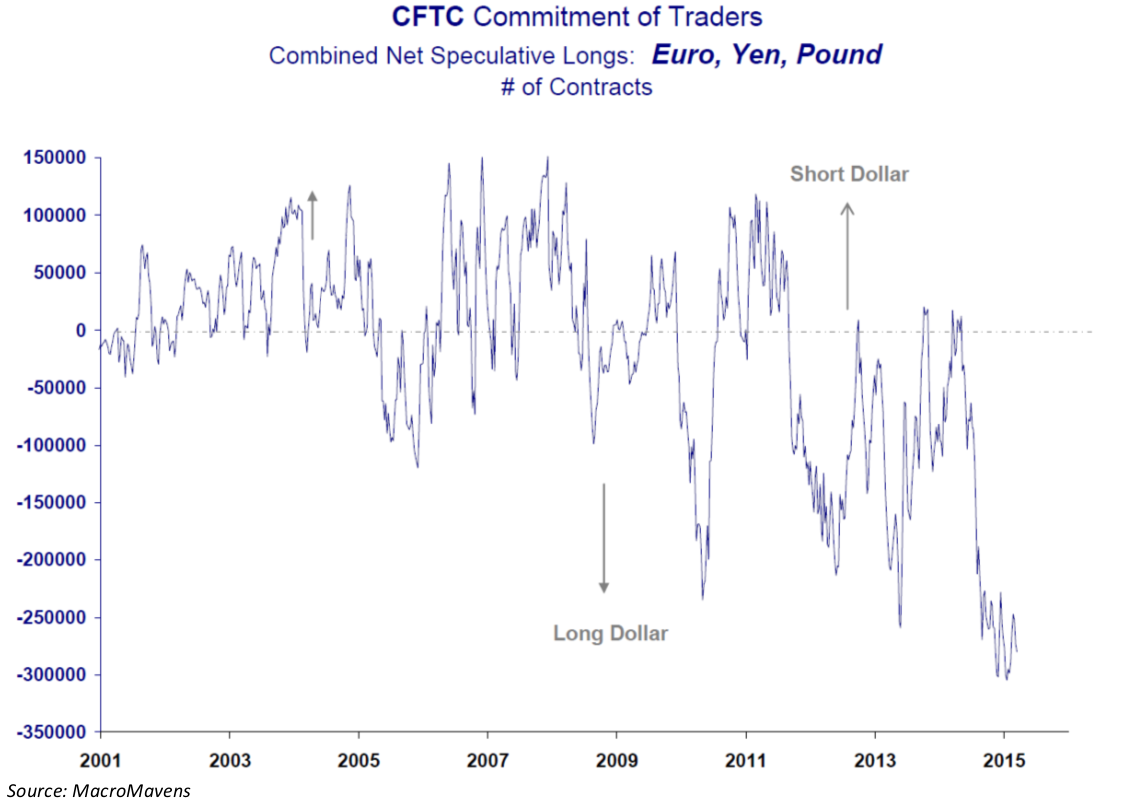

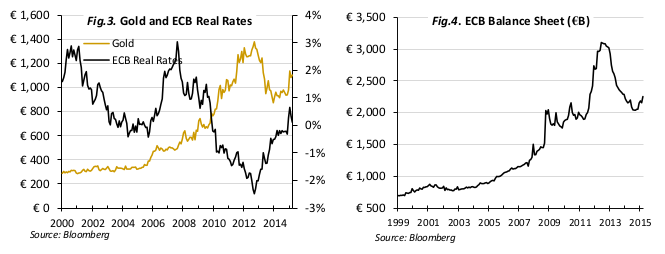

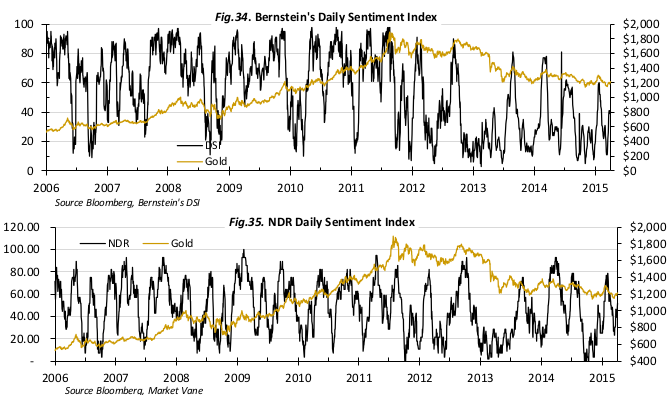

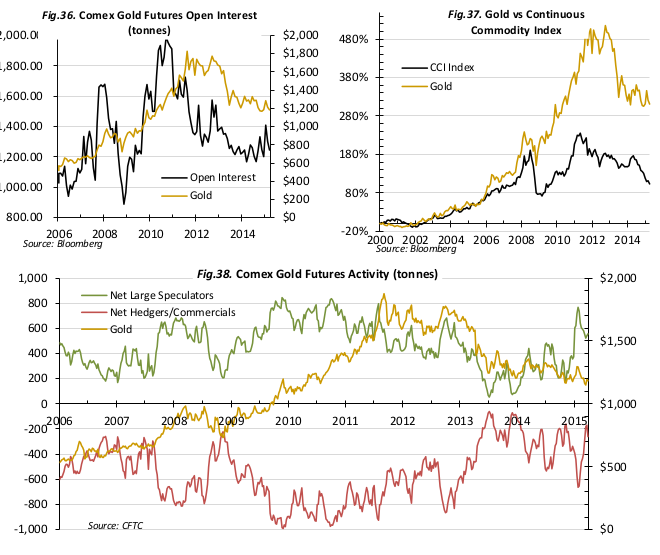

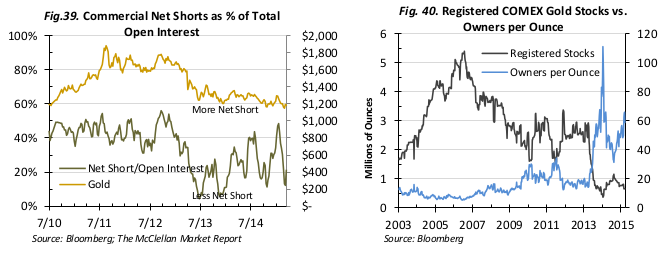

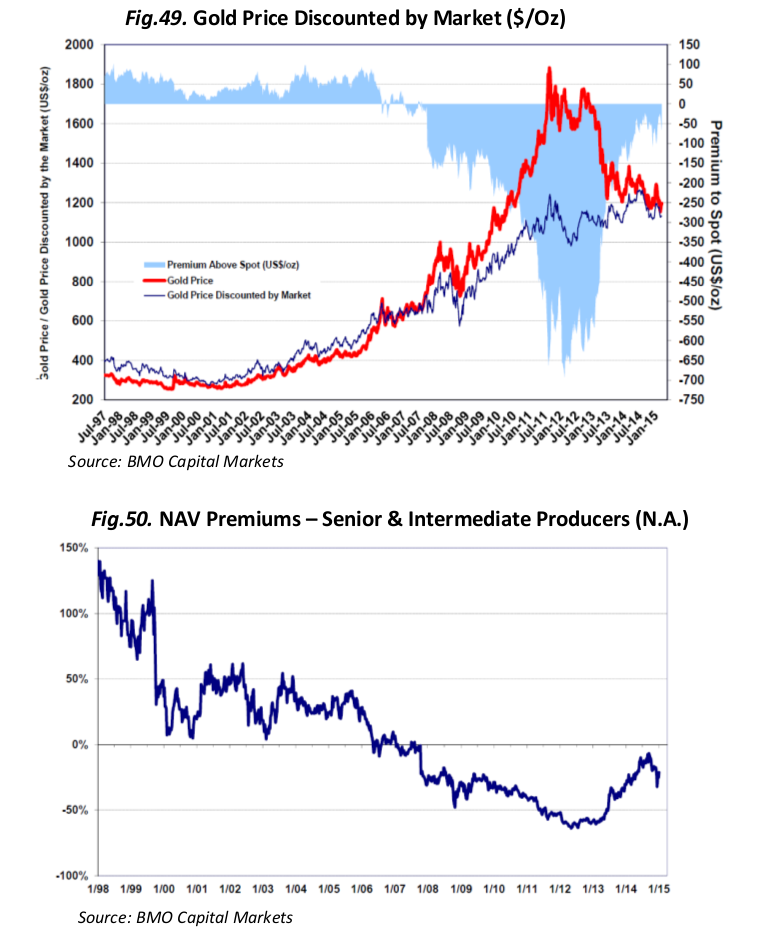

The chart above shows that hedge funds are shorting gold at the highest level since 2006, which is as far back a these data go. What this chart reflects is paper or “synthetic” gold. Financial institutions create synthetic gold for macro investors, such as hedge funds and high‐frequency traders. In many cases, these gold positions are simply an extension of credit to traders who do not possess the actual bullion. Physical gold does not change hands, and contracts are settled in the vast majority of instances for cash. The price gyrations and sentiment for synthetic gold reflect views on non‐gold matters such as BLS jobs reports and other economic data releases, FOMC statements, anticipated Fed policy, statements by various Fed officials, and geopolitical headlines, to name a few examples. In other words, the synthetic gold price is a composite of financial market sentiment.

Synthetic gold is a deep and active market (think “casino”) that provides significant capacity for macro traders t establish bullish or bearish positions on matters totally unrelated to the supply‐and‐demand fundamentals fo physical metal. As noted by Grant’s Interest Rate Observer, the market’s appraisal of gold is the inverse of investor confidence in the institution of central banking. To us, the above chart synchronizes perfectly with the valuation measures highlighted in Mr. Berg’s study, and supports our view that the prospects for the dollar gold price are closely tied, inversely, to investor sentiment.

Synthetic gold is a deep and active market (think “casino”) that provides significant capacity for macro traders to establish bullish or bearish positions on matters totally unrelated to the supply‐and‐demand fundamentals for physical metal. As noted by Grant’s Interest Rate Observer, the market’s appraisal of gold is the inverse of investor confidence in the institution of central banking. To us, the above chart synchronizes perfectly with the valuation measures highlighted in Mr. Berg’s study, and supports our view that the prospects for the dollar gold price are closely tied, inversely, to investor sentiment.

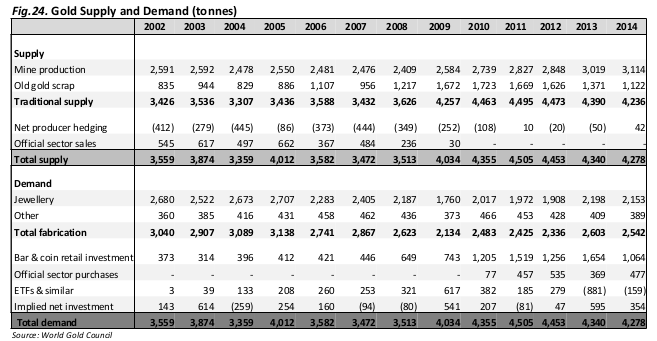

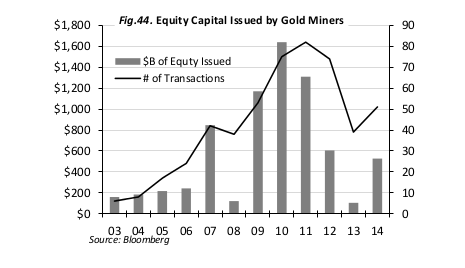

The supply and demand flows of physical gold tell an entirely different story than the negative one portrayed by the synthetic market. Gold supply has peaked out for years to come barring higher prices, while demand shows healthy growth. The mining industry will not and cannot finance new gold mines in the current price environment.

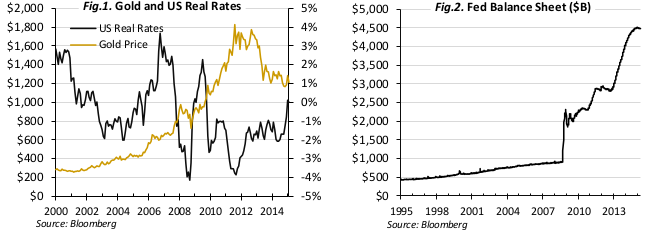

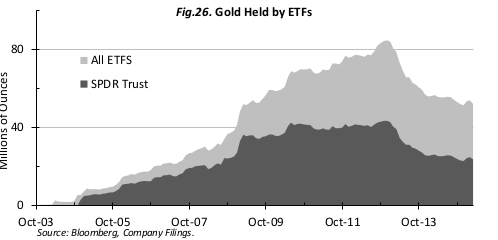

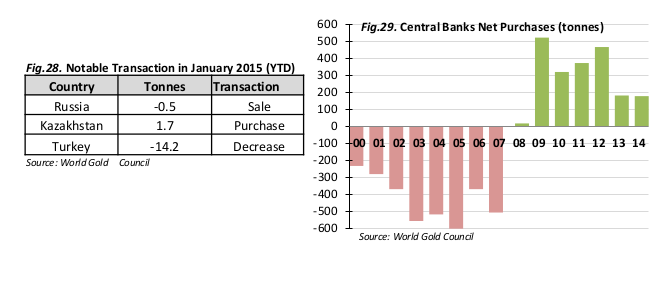

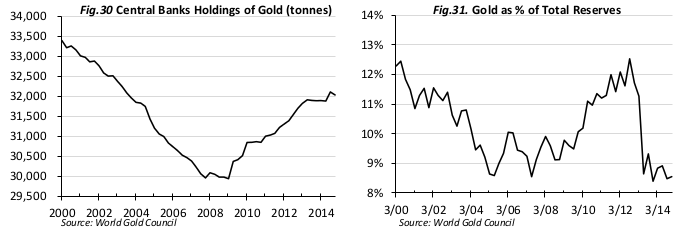

We expect global gold production to decline beyond 2015 in the absence of sustained higher prices. Demand for gold from central bank purchases, China, and India exceeds current gold production by a substantial margin. According to the World Gold Council, over the past five years, global gold demand was 20,315 metric tonnes, compared to cumulative global mine production of 14,504 metric tonnes. Persistent demand that exceeds gold production by 40 percent without rising prices is largely explained by divestment from Western hands, such as

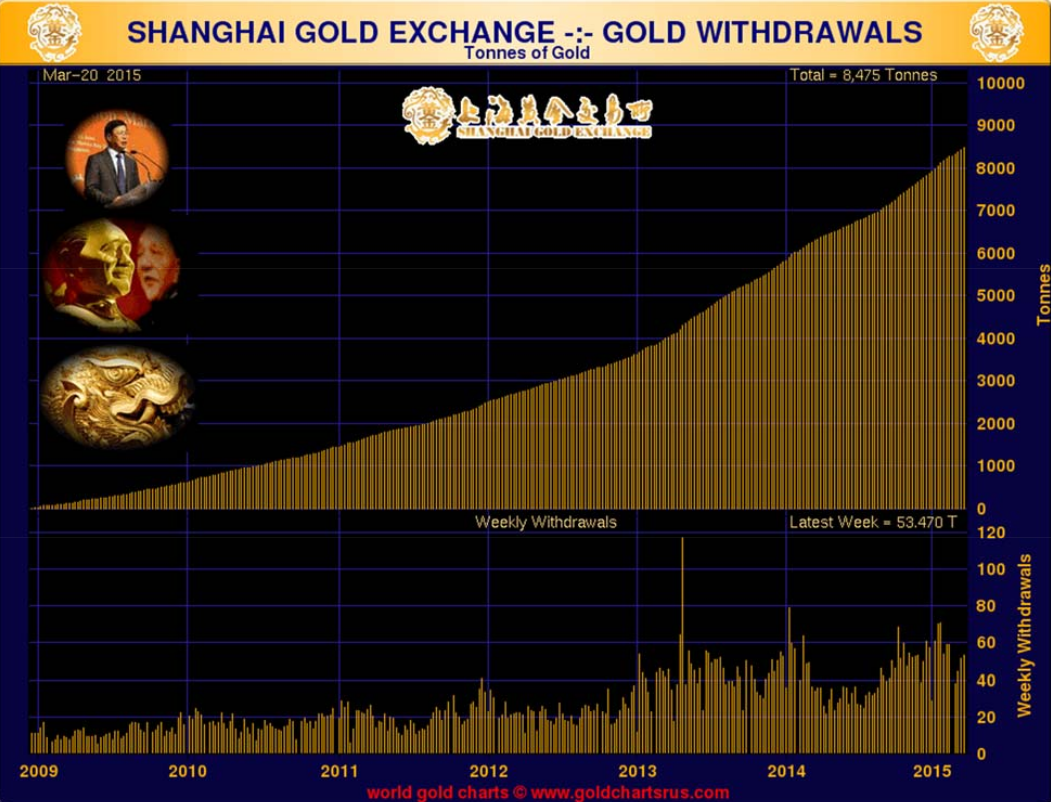

gold ETFs and other removals from gold stored in vaults in London, New York, and other financial centers. Based on this view, the market for physical gold can only be described as taut and robust. It would tighten significantly if warehoused gold stocks reached a point of depletion or if holders of remaining stocks refused to sell, which typically happens whenever confidence in financial assets falters and demand for physical gold spikes. The chart below shows cumulative consumption of gold by the Chinese public of 8,475 tonnes since 2009. Shanghai Gold Exchange withdrawals do not, however, reflect possible purchases by the Chinese central bank or other official sector entities. The Chinese last updated official gold reserves since 2009 and it seems all but certain that they have continued to accumulate bullion since then. It seems likely that their secrecy on this matter is designed to take advantage of weak gold prices caused by Western divestment.

It seems to us that a shift in macroeconomic perceptions, which would most likely be precipitated by a reversal in the financial markets, would also lead to a significant move higher in the dollar gold price. In a recent research note (“What is gold about to tell us?”), UBS analyst Julien Garran comments, “The key issues facing gold: Excess returns in the US are under pressure as the strong US$, falling energy…[and wage pressures] squeeze cash flow….

That in turn is limiting the Fed’s ability to tighten policy and may induce it to ease in the future.” In brief, the bull‐ market cycle is threatened by the strong dollar and shrinking profits. The onset of a bear market will cause the Fed to abort any tightening, which in our opinion would seriously undermine confidence in central bankers, their policies, and the paper money they issue.

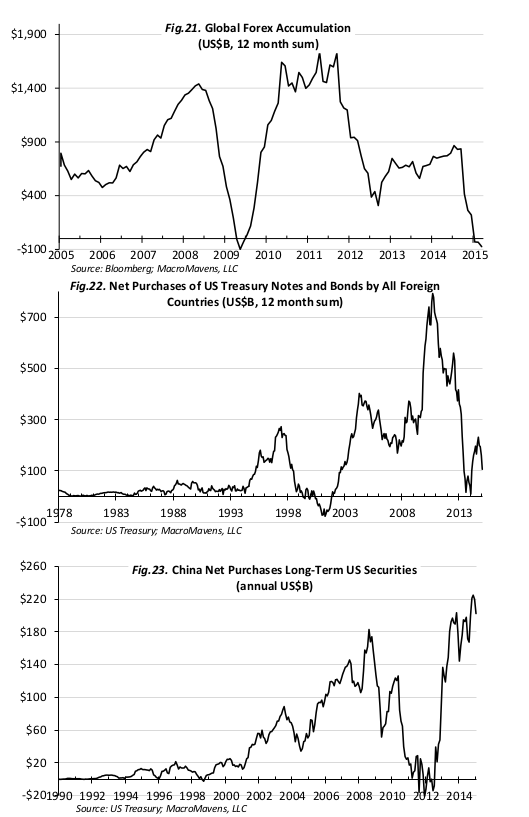

Record gold short exposure is matched by record bullish dollar bets, as shown in the chart below. As noted by Stephanie Pomboy of MacroMavens, “The dollar isn’t up because foreigners are buying. It’s up because US specs are selling all other currencies against it.” In our opinion, speculative capital has crowded into the dollar in large part based on the expectation of impending Fed tightening.

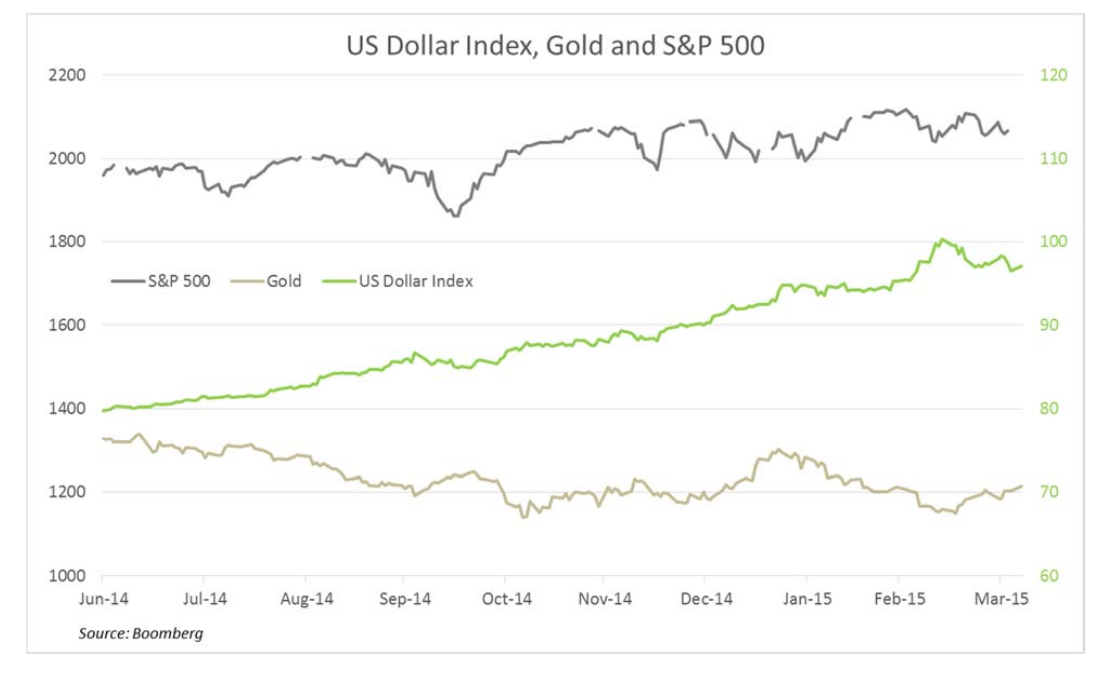

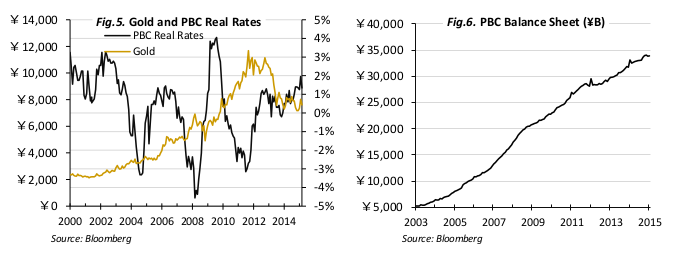

It appears to us that the storyline for gold, the dollar, and world equity markets over the past nine months are inextricably linked. Blatant debasement of the yen and the euro has propelled their respective equity markets while propping up the US currency and the US financial markets. Strong nominal returns are in our opinion based on two fatal flaws. First, the returns are measured in currencies that are deteriorating in value. And second, the returns are based on the expansion of valuations that have been stretched to historical extremes.

Against a background of investor complacency, the strong dollar has been perceived as bad for gold. A weak gold price, especially in US dollar terms, is an essential part of the illusion. The unifying narrative thread is confidence in the Fed and central bank policies in general. Investors, both of the cynical and gullible variety, have bought the party line. By design, zero interest rates and financial repression have forced capital into risky assets. In our opinion, valuation metrics and position extremes suggest the potential for capital losses on a scale similar to 2008.

As an alternative investment to overvalued equities, or as a hedge against a reversal of the relative strength of the dollar, gold exposure has potential appeal as a tactic that may produce positive returns over the short to intermediate run. The possibility of a general loss of confidence in the policies and practices of central banking is an entirely different matter. It is this possibility that makes exposure to gold a potential game‐changer. We endorse without reservation the view expressed by James Grant (of the aforementioned Interest Rate Observer): “The fixers of interest rates and the raisers‐up of financial assets, which is to say…the Federal Reserve Board…the European Central Bank, and…the Bank of Japan—are the unwitting enemies of macro prudence. If price control is a policy that tends to backfire on the governments that implement it (and it is), and if interest rates are among the most critical prices in finance (and they are), 21 st century monetary policy is riding for a fall” (3/20/15). A monetary orthodoxy that embraces competitive devaluation, money printing, financial repression, and creeping nationalization of banking institutions via regulation is in our opinion unsustainable.

Similar views are expressed by a growing number of respected voices:

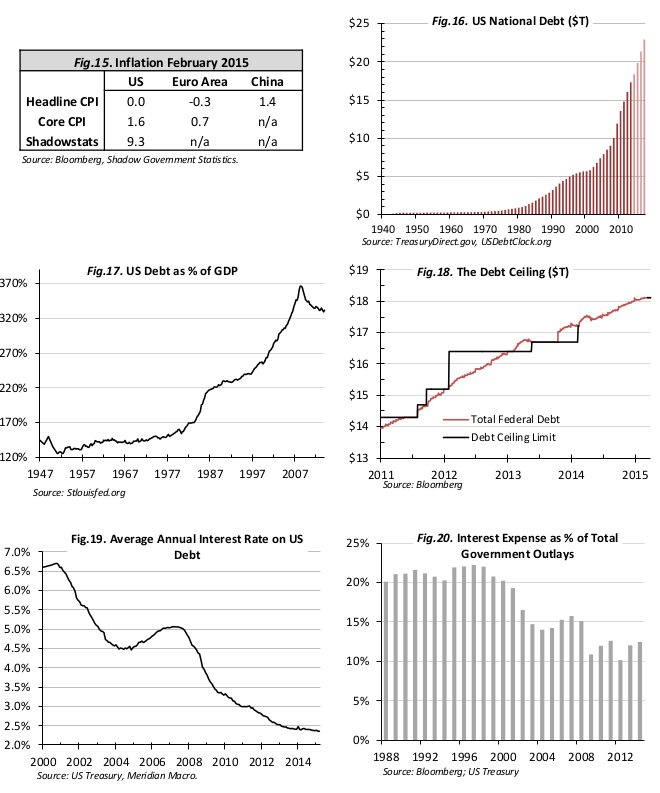

- “Low interest rates globally destroy financial business models that are critical to the function of modern day economies. Pension funds and insurance companies are perhaps the most important examples of financial sectors that are threatened by low to negative interest rates…. Negative/zero‐bound interest rates may exacerbate, instead of stimulate, low growth rates in all of these instances by raising savings and deferring consumption…. The financial system has become increasingly vulnerable only six years after its last collapse in 2009.” – Financial manager Bill Gross, 3/15/15

- “The Fed and the ECB have decided to address the issue of debt by slowly confiscating value from investors via negative rates…ZIRP [zero interest‐rate policy] and QE as practiced by the Fed and ECB are not boosting, but instead depressing, private‐sector economic activity. By using bank reserves to acquire government and agency securities, the FOMC has actually been retarding private economic growth, even while pushing up the prices of financial assets around the world.” – Christopher Whalen, Kroll Research, 3/23/15

- “Central bankers have been left to paper over the global malaise with reams of fiat currency. With politicians lacking the willingness or ability to implement labour and tax reforms, monetary policy has morphed into a new orthodoxy where even central bankers admittedly view it as their job to use the balance sheets as a tool to implement fiscal policy…. The depressed returns available on fixed‐income securities, largely a result of QE, are a tax on investors, including savers, pension funds and insurance companies…. Under the new monetary orthodoxy, the responsibility for critical aspects of fiscal policy has been surrendered into the hands of appointed officials who have been left to salvage their economies, often under the guise of pursuing monetary order.” – Financial Times, 3/26/15

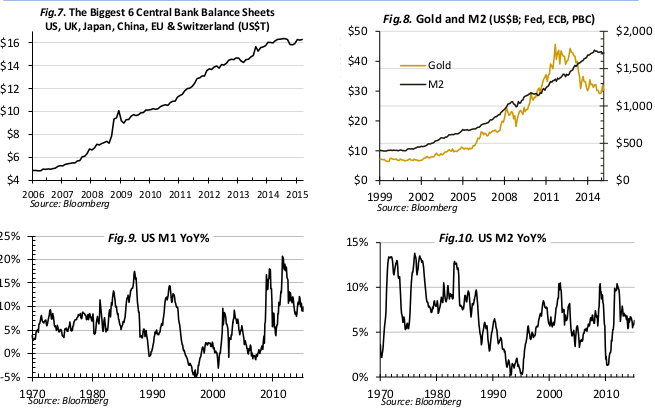

We believe that confidence in central banking is the principal explanation for the current lofty valuations of financial assets and the corresponding low esteem for gold. That confidence, in our opinion, will dissipate if investment gains of the past five years begin to turn into losses. As noted last year by Elliott Management’s Paul Singer, “Our feeling is that confidence, especially when it is unjustified, is quite a thin veneer. When confidence is lost, that loss can be severe, sudden and simultaneous across a number of markets and sectors.” We believe that ZIRP and financial repression have skewed the investment thought process, short‐circuiting critical analysis via the seduction of high nominal returns. The only way for this to continue, in our opinion, is for central bankers to advance ever more preposterous explanations for their policies and practices against what we expect to be a never‐ending backdrop of stagnant or sinking global economic activity. Nobody, in our opinion, can predict the inflection point in confidence. The absurdities should collapse under their own weight.

As noted in our previous commentary (1/15/15), we believe that dollar strength is a precursor of systemic weakness. We thus see little virtue in the relative strength of the US currency, which, in our opinion, signifies capital flight from risk: “When the currencies in which investments are denominated experience historic levels of volatility (i.e., the euro has dropped by 20 percent against the dollar since last July), a new dimension enters the investment landscape. The unstable currency regime has created a highly unstable investment environment that is placing capital at risk” (The Credit Strategist, 4/1/15). As noted by analyst Paul Mylchreest, volatility in currency markets has historically led to destabilizing flows in speculative capital, which ultimately affects other financial assets (1873, 1929, and 1987).

We agree with Mr. Singer that a loss of confidence can and will lead to a severe, sudden, and simultaneous decline across a number of markets and sectors. Moreover, we do not believe that confidence in the practitioners of 21 st ‐century monetary policy is deserved. Modern‐day central bankers consist largely of academics with little practical business experience. Their policies have not generated growth, and they have in our opinion exacerbated systemic risk. Market expectations for economic growth seem destined for repeated disappointment. In our view, the coming reconciliation of illusion to reality promises to be epic, one in which ownership of real, not financial, assets, is essential. We have always believed that gold is the most liquid, easily acquired real asset with a legacy of protecting capital during periods of financial instability. That it has become discredited in Western capital markets speaks for itself. It is a message for contrarians to heed.

John Hathaway

Senior Portfolio Manager

© Tocqueville Asset Management L.P.

April 7, 2015

This article reflects the views of the author as of the date or dates cited and may change at any time. The information should not be construed as investment advice. No representation is made concerning the accuracy of cited data, nor is there any guarantee that any projection, forecast or opinion will be realized.

References to stocks, securities or investments should not be considered recommendations to buy or sell. Past performance is not a guide to future performance. Securities that are referenced may be held in portfolios managed by Tocqueville or by principals, employees and associates of Tocqueville, and such references should not be deemed as an understanding of any future position, buying or selling, that may be taken by Tocqueville. We will periodically reprint charts or quote extensively from articles published by other sources. When we do, we will provide appropriate source information. The quotes and material that we reproduce are selected because, in our view, they provide an interesting, provocative or enlightening perspective on current events. Their reproduction in no way implies that we endorse any part of the material or investment recommendations published on those sites.

Gold Monitor

Section I. Macro

Section II. Gold

Section III. Gold Mining Equities

Mutual Funds

You are about to leave the Private Wealth Management section of the website. The link you have accessed is provided for informational purposes only and should not be considered a solicitation to become a shareholder of or invest in the Tocqueville Trust Mutual Funds. Please consider the investment objectives, risks, and charges and expenses of any Mutual Fund carefully before investing. The prospectus contains this and other information about the Funds. You may obtain a free prospectus by downloading a copy from the Mutual Fund section of the website, by contacting an authorized broker/dealer, or by calling 1-800-697-3863.Please read the prospectus carefully before you invest. By accepting you will be leaving the Private Wealth Management section of the website.