In light of the dramatic developments of the past six months, this letter addresses seven key investor concerns:

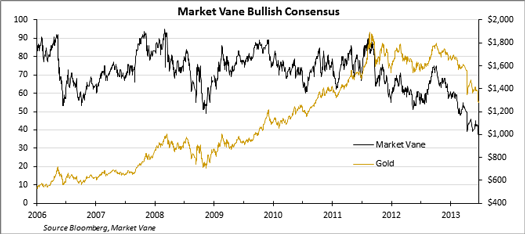

In our opinion, the severe pressure on gold prices since April 16, 2013 has been caused by a coordinated bear raid orchestrated by large bank trading desks and hedge funds. The method used was naked shorting of gold contracts on the futures exchange (Comex), which means that physical gold was never sold, only paper. Gold was rarely, if ever, delivered to a buyer. Trades were settled in cash. The notional amounts of the transactions on many days exceeded annual mine production, absurd on the face of it. The motive was most likely to break the gold price for profit. The result is that short positions of these traders are higher than at the bottom in 2008 (chart below), after which gold rallied 167% and mining shares 256% (basis XAU).

Traders exploited and exaggerated the technical vulnerability of gold in our opinion simply because it was possible to do so. Because the gold futures market offers deeper capacity than almost any other physical commodity market, it was a perfect target for bonus seeking traders who have also profited (some of which are now being prosecuted or investigated) in the manipulation of Libor and Foreign Exchange rates.

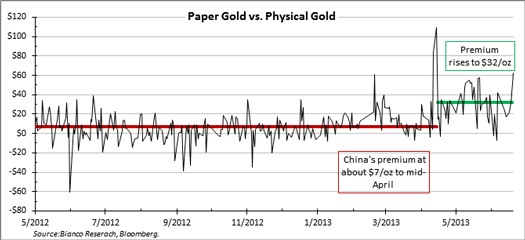

The price decline in paper gold has been met with a surge in physical demand worldwide. The most dramatic image is the disparity between paper and physical gold, which is depicted in the chart below showing the premiums over paper gold prices paid in China for physical.

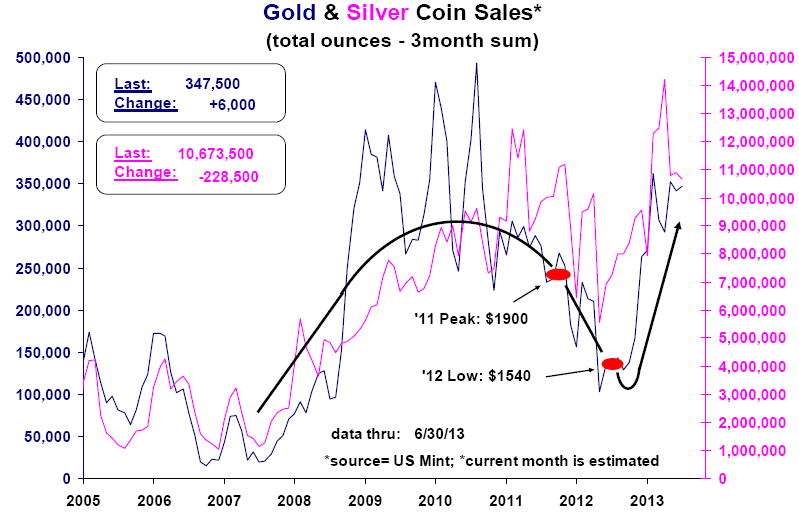

While China is by far the larger market, U.S. coin sales are exceptionally strong as well, surpassing volume at the 2011 price peak by 23%. The conclusion we draw is that the paper market has severely mispriced gold on the downside. The physical market indicates a shortage of gold at the same time the paper market is extremely short.

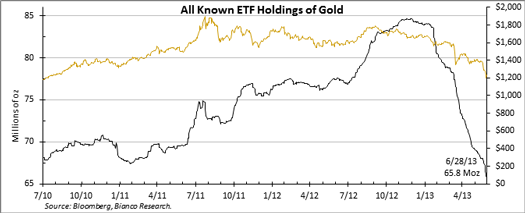

In April 2013, Dutch banking giant ABN Amro notified clients that they would no longer be providing physical delivery of precious metals including gold. Claims would be settled in cash with account balances adjusted by the prevailing bid prices “offered by merchants.”???? The bank explained that new custodial relationships would no longer allow physical “extradition.”???? In January 2013, the WSJ reported that Germany, which stores 1500 of its 2600 ton gold reserve within the vault of the NY Federal Reserve bank, was taking steps to return 300 tons to Germany. One would think this would be a simple matter, with 1000’s of tons trading daily on the COMEX and LBMA. Not so fast, Germany. The requested delivery of German gold will not be completed until 2020 even though 300 tons could easily be shipped overnight on a few jumbo jets. ???? Could it be that the NY Fed, in the heart of the NY financial district, had allowed many of the 6700 tons of gold held there for the account of foreign central banks, to be re-hypothecated to investment banks for the lucrative gold swaps, leasing, and derivative business? As commercial (i.e., bullion dealers such as JP Morgan and Goldman Sachs) CFTC positions have swung sharply away from the short side (refer to chart on p.1), Comex warehouse stocks have dwindled precipitously, dropping 32% or nearly 100 metric tonnes since the beginning of 2013. Since the beginning of 2013, physical gold held by ETF’s such as GLD has dropped by 586 tonnes. Where does the liquidated gold go? The final destination is impossible to know, but the first stop is into the accounts of “authorized participants”, aka, bullion dealers such as JPMorgan and Goldman Sachs. There are quite a few dots to connect here, but in our opinion, (and it is admittedly our speculation) an historic short squeeze is looming, and the insiders (bullion dealers) see it coming. By using the paper market to crush the price of gold, they have attempted to shake loose physical gold to reduce their short exposure in order to minimize the damage from what lies ahead.

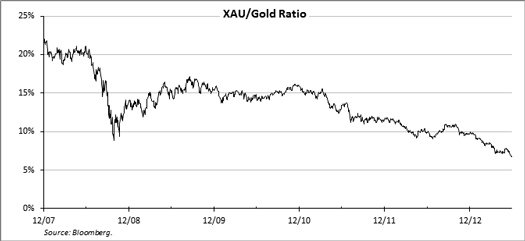

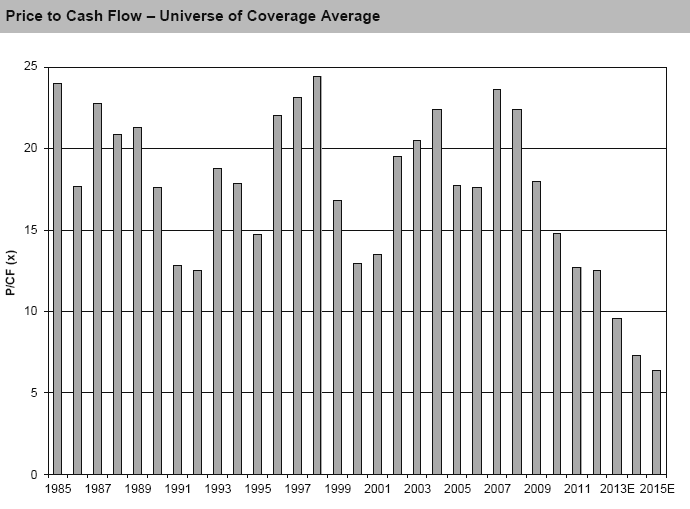

The steep decline in shares of gold and silver miners is in our view collateral damage from the carpet bombing of paper metals’ prices. There is not much more to say. We believe, all of the negatives that have been written about by sell side analysts and the financial media, such as cost pressures, cap ex blowouts, resource nationalism etc., have been more than priced into the equities at these low valuations. Mining stocks outperform metals’ prices on the upside and downside. The only fundamental that matters at this point is the future gold price, in our opinion. We observe profound internal change within the industry which suggests to us that the strongest companies will deliver compelling upside performance when the metals markets turn. These changes include substantial scale backs of capital spending and other measures to preserve cash and reduce expenses. As managers, we are focusing on companies with the strongest financials and best assets.

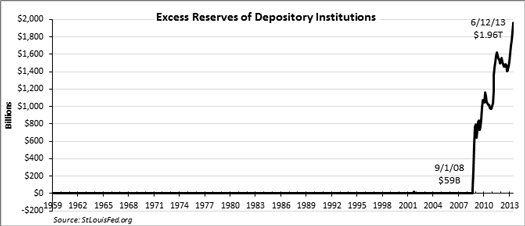

The central premise for investing in gold and mining stocks is that the radical monetarism practiced by world central banks since 2008 (see chart below) will end badly. The end game could be inflation, a prolonged economic downturn inviting even more radical monetary and fiscal policies, destabilized financial markets, or a combination of these three. Assets denominated in paper currencies are bound to suffer. Gold exposure provides a hedge to these outcomes. Should worst case outcomes not materialize, financial assets will perform well and the negative contribution from gold hedge positions will not matter in the bigger picture.

In our view, Fed policy is more muddled than ever since Bernanke’s announcement last week that asset purchases could end by mid-2014. The Fed appears to have painted itself further into a corner by mentioning a time frame for its exit from emergency policies. This view was expressed by James Bullard, President of the St. Louis Fed, in his dissent to the most recent FOMC policy statement: “Policy actions should be taken to meet policy objectives, not calendar objectives.” Should the timing of exit actions be called into question by the financial markets, Fed credibility could be at substantial risk among mainstream investors.

In the press conference immediately following the FOMC statement, Bernanke backtracked from the time commitment:

I think one thing that’s very important for me to say is that, if you draw the conclusion that I just said that our policies — that our purchases will end in the middle of next year, you’ve drawn the wrong conclusion, because our purchases are tied to what happens in the economy. And if the Federal Reserve makes the same error and we overestimate what’s happening, then our policies will adjust to that. We’re not — we have no deterministic or fixed plan. Rather, our policies are going to depend on this scenario coming true. If it doesn’t come true, we’ll adjust our policies to that.

So what has really changed? The Fed’s exit is still data dependent meaning the scope and timing of an exit is still unknown, which has been the Fed posture since 2009. The mere reminder that an exit is being contemplated within a specific time frame sent the financial markets into a tailspin, surprising the likes of Minneapolis Fed President Kocherlakota as revealed in his CNBC interview of 6/26/13. Since the Bernanke press conference, the Fed has been in a full damage control mode, suggesting internal terror at the prospect of adverse market reaction to the application of exit measures. As we have suggested, a Fed exit from extreme monetary ease may be theoretically possible but impossible to execute. Yogi Berra reminds us that “in theory, there is no difference between theory and practice. But in practice, there is.” The principals of Long Term Capital Management learned this the hard way more than a decade ago. Scale and risk increase asymmetrically. Markets have a habit of not clearing the way they are supposed to.

Adding to the confusion is the impending departure of Bernanke as Fed Chairman early next year and the way the announcement was handled by President Obama in his 6/17/13 interview with Charlie Rose. “He’s (Bernanke) already stayed a lot longer than he wanted to or he was supposed to.” Could it be that the President’s inner circle of financial advisors are also alarmed by the obvious difficulties and political backlash that could accompany exit measures? If so, perhaps the dovish Janet Yellen is not the shoo-in replacement for Bernanke that the market expects. Might Obama nominate a purely political appointee who will obliterate the façade of a politically independent central bank? If exit difficulties lead to extreme market outcomes, extreme measures might be called for that an independent central bank would be reluctant or unable to implement. For example, why not impose interest rate ceilings on longer term U.S. treasuries and then mandate that all 401-K’s, IRA’s, pension plans etc. must hold a certain percentage of treasuries in return for tax free status? If that proves too difficult, why not authorize direct purchases of bonds from the Treasury? We may not know for seven months.

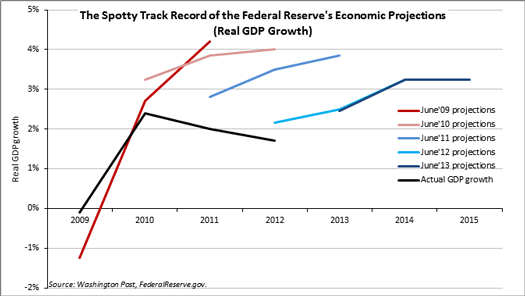

Finally, since the Fed exit is data dependent, what credibility does Bernanke’s projection of a mid-2014 cessation of asset purchases have in light of the Fed’s abysmal record of economic forecasting?

It astonishes us that market belief in the Fed’s ability to apply monetary measures in a precise and effective manner remains generally high. It has been stated on many occasions by Grant’s Interest Rate Observer that the price of gold is the reciprocal of faith in central bankers. We agree and see no basis for that faith. We believe that faith will be called into question by many others in the coming months.

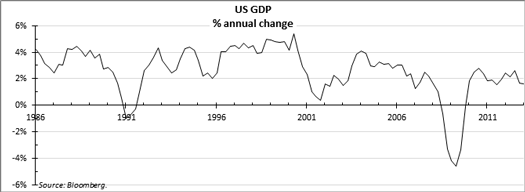

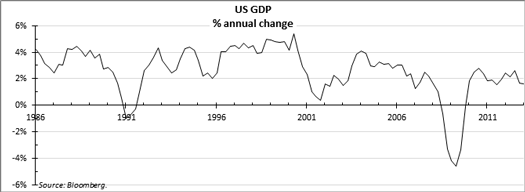

It appears to us that the economic growth required for a timely exit by the Fed is nowhere in sight. The unusually large first quarter GDP downward revision to 1.8% from previously estimated 2.4% illustrates that economic forecasts in general have been overly optimistic and perhaps crafted by wishful thinking and a desire to justify equity market valuations. As can be seen in the chart below, year over year GDP growth has not exceeded 3% since 2005. Anemic growth is not the answer to a smooth exit from extreme QE.

Mainstream media, conditioned to do whatever it can to support bull markets in financial assets, spins much of the data without a shred of skepticism. Should economic activity remain sluggish, as we believe it will, fiscal deficits will remain larger than anticipated and prospects for the Fed’s “data dependent” exit will become ever more remote.

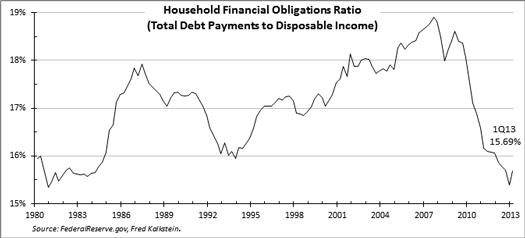

An alternative scenario that cannot be ruled out is that monetary stimulus has yet to fully impact the real economy. Evidence for such a view is that bank lending has picked up, based on the substantial growth of required reserves (chart below) which may suggest that monetary velocity is beginning to turn positive. Is inflation, which nobody seems to expect, just around the corner?

Another piece of evidence is that household debt increased in the first quarter 2013, the first time since 2007 (chart of household financial obligations ratio below). Translation of free reserves into buying power through expanding consumer and business borrowing could be the precursor of an inflationary cycle. If the Fed remains behind the curve, as it has historically done in recognizing and acting on a surge in inflationary pressures, real interest rates will dip further into negative territory and thereby heighten the appeal of gold.

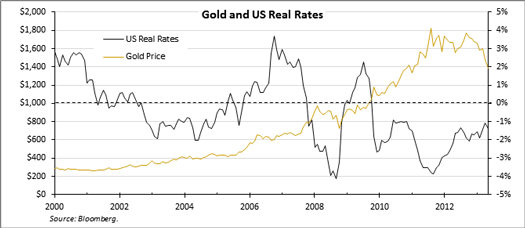

As we and others have frequently observed, negative real interest rates are positive for gold, because they offer no competition and in fact incentivize risk avoiding capital to seek alternative havens for safety. The relevant real interest rate is that on 90 day treasuries, which unlike longer term bonds have no duration risk. Despite price volatility, gold has no duration or counterparty risk.

Therefore, while longer term interest rates (real and nominal) may rise in anticipation of a cessation of Fed buying, they do not necessarily compete with gold. The best example is the experience of the 1970’s when nominal rates rose steadily but real rates remained negative due to inflation.

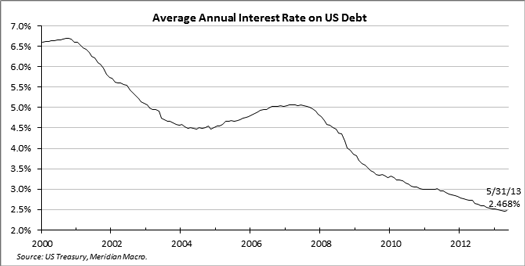

More important is that a rise in nominal rates could impact the fiscal position of heavily indebted sovereigns such as the U.S. The average interest rate on the $17 trillion of US debt is only 2.5%, the lowest in more than a decade (chart below), and seems to have nowhere to go but up. Every 100 basis point rise in the cost of that debt would add $170 billion to the fiscal deficit and therefore require incremental issuance of treasury obligations.

In addition, it seems to us that a sequence of rising interest rates would be negative for equity valuations, first because of competition for money flows, and secondly because rising rates could act to slow interest sensitive sectors of the economy. There has been much commentary that rising interest rates are the sign of a healthy, growing economy. That would be nice if it were credible. However, revised first quarter GDP figures suggest an economy at little more than stall speed. With Obama Care kicking in over the next several months, rising rates possibly dampening interest sensitive economic sectors, and a possible stagnation in the advance of equities adversely impacting the wealth effect, there seem to be more headwinds to growth than before the latest FOMC announcement.

Because the Fed has already cornered the market on longer term Treasuries (they own more than 40% of all maturities greater than five years, and have purchased 41% of new Treasury issuance since 2009), any valid attempt to exit will, in our opinion, drive interest rates to levels far higher than compatible with sustainable economic growth. The same can be said for a reduced pace of asset purchases or tapering. The Fed’s dilemma is that its actions have caused interest rates across the yield curve to be well below likely free market rates. The thought that the gap between artificial and market rates can be closed gradually seems delusional. The mere whisper of tapering has already lead to substantial markdowns of fixed income valuations. The specter of tapering or exit will not go away. The prospect of a controlled exit is likely to be extremely challenging. If the markets force the Fed’s hand ahead of its schedule, as we expect, the second order effects on financial asset values could be as unprecedented as the Fed’s past five years of intervention.

Tocqueville Gold Strategy Letter 2Q13

Best regards,

John Hathaway

Portfolio Manager and Senior Managing Director

July 1, 2013

© Tocqueville Asset Management L.P.

This article reflects the views of the author as of the date or dates cited and may change at any time. The information should not be construed as investment advice. No representation is made concerning the accuracy of cited data, nor is there any guarantee that any projection, forecast or opinion will be realized.

References to stocks, securities or investments should not be considered recommendations to buy or sell. Past performance is not a guide to future performance. Securities that are referenced may be held in portfolios managed by Tocqueville or by principals, employees and associates of Tocqueville, and such references should not be deemed as an understanding of any future position, buying or selling, that may be taken by Tocqueville. We will periodically reprint charts or quote extensively from articles published by other sources. When we do, we will provide appropriate source information. The quotes and material that we reproduce are selected because, in our view, they provide an interesting, provocative or enlightening perspective on current events. Their reproduction in no way implies that we endorse any part of the material or investment recommendations published on those sites.

View PDFYou are about to leave the site of Tocqueville Asset Management, L.P. The link you have accessed is provided for informational purposes only and should not be considered a solicitation to become a shareholder of or invest in the any mutual fund managed by Tocqueville Asset Management, L.P. Please consider the investment objectives, risks, and charges and expenses of any mutual fund carefully before investing. The prospectus contains this and other information about the Funds. You may obtain a free prospectus by downloading a copy from the Poplar Forest (www.poplarforestfunds.com), by contacting an authorized broker/dealer, or by calling 1-877-522-8860. Please read the prospectus carefully before you invest. By accepting you will be leaving the site of Tocqueville Asset Management, L.P

You are about to leave the site of Tocqueville Asset Management, L.P. The link you have accessed is provided for informational purposes only and should not be considered a solicitation to become a shareholder of or invest in the any mutual fund managed by Tocqueville Asset Management, L.P. Please consider the investment objectives, risks, and charges and expenses of any mutual fund carefully before investing. The prospectus contains this and other information about the Funds. You may obtain a free prospectus by downloading a copy from the Tocqueville Funds website (www.tocquevillefunds.com), by contacting an authorized broker/dealer, or by calling 1-800-697-3863. Please read the prospectus carefully before you invest. By accepting you will be leaving the site of Tocqueville Asset Management, L.P