Subscribe to Our Insights

Thought Leadership

Down is Far From Being Out

By John Petrides on September 23, 2021

If there is one thing investors should have learned since the Great Recession it is that simply because stocks sell off does not mean they are down for the count. The list is long and extensive as to what has added volatility to the stock market not only during, but post, 2009. How many times over the past twelve years have financial market prognosticators attempted to call the next stock market selloff? Indeed, even in recent history there have been some short and sharp selloffs: the Greek-debt crisis of 2011; the announcement of Brexit in 2016; the first and fourth quarters of 2018; the onset of COVID in 2020. Yet, in retrospect, every stock market retreat produced a great opportunity to buy.

As of this writing, the S&P 500 is off ~3.5% from its all-time highs. Headlines of a 10 to 20% correction are garnering more attention mainly because some feel “what goes up, must come down.” The proverbial wall of worry is high: the Federal Reserve on the cusp of reducing its quantitative easing program (a.k.a. tapering), and the Biden Administration’s tax proposal to increase the corporate tax rate and capital gains tax rate at the same time, which hasn’t occurred in over fifty years. Additionally, Covid has wreaked havoc on the global supply chain, and the delta variant is causing economic growth to tap on the breaks. The list could easily go on, and it’s these worries along with a stock market nearing all-time highs that have investors expecting a sell-off.

The S&P 500 has gone nearly one year without a 5% drop from peak to trough. Why not now? The answer is ironically followed by a question: if one is selling stocks, where will the proceeds be reinvested? Cash yields a pittance. Bonds are staring in the face of potentially rising interest rates. If volatility in stocks is your concern, are cryptocurrencies your answer? Hardly. Therefore, it seems all roads are leading back to equities.

Yes, on the surface, stock valuations appear higher than historical averages. Yes, the corporate tax rate will most likely be higher next year than this year, which is clearly an earnings headwind for most companies. Yes, costs are going up, which could pressure profit margins, which in general are above pre-Covid levels. However, by and large, companies’ balance sheets are strong. Free cash flow generation is high. Cash returns to shareholders through stock buybacks and dividends are reaching pre-Covid levels. Finally, merger and acquisition activity are strong once again. Over the past three quarters, more than 80% of the companies in the S&P 500 have beaten the average Wall Street analyst earnings per share expectations. This means, when looking at the Price-to-Earnings (P/E) ratio for the S&P 500 as a whole, the “E” has been understated. Should this trend of outperforming expectations continue, the stock market could look more attractive than what is currently perceived.

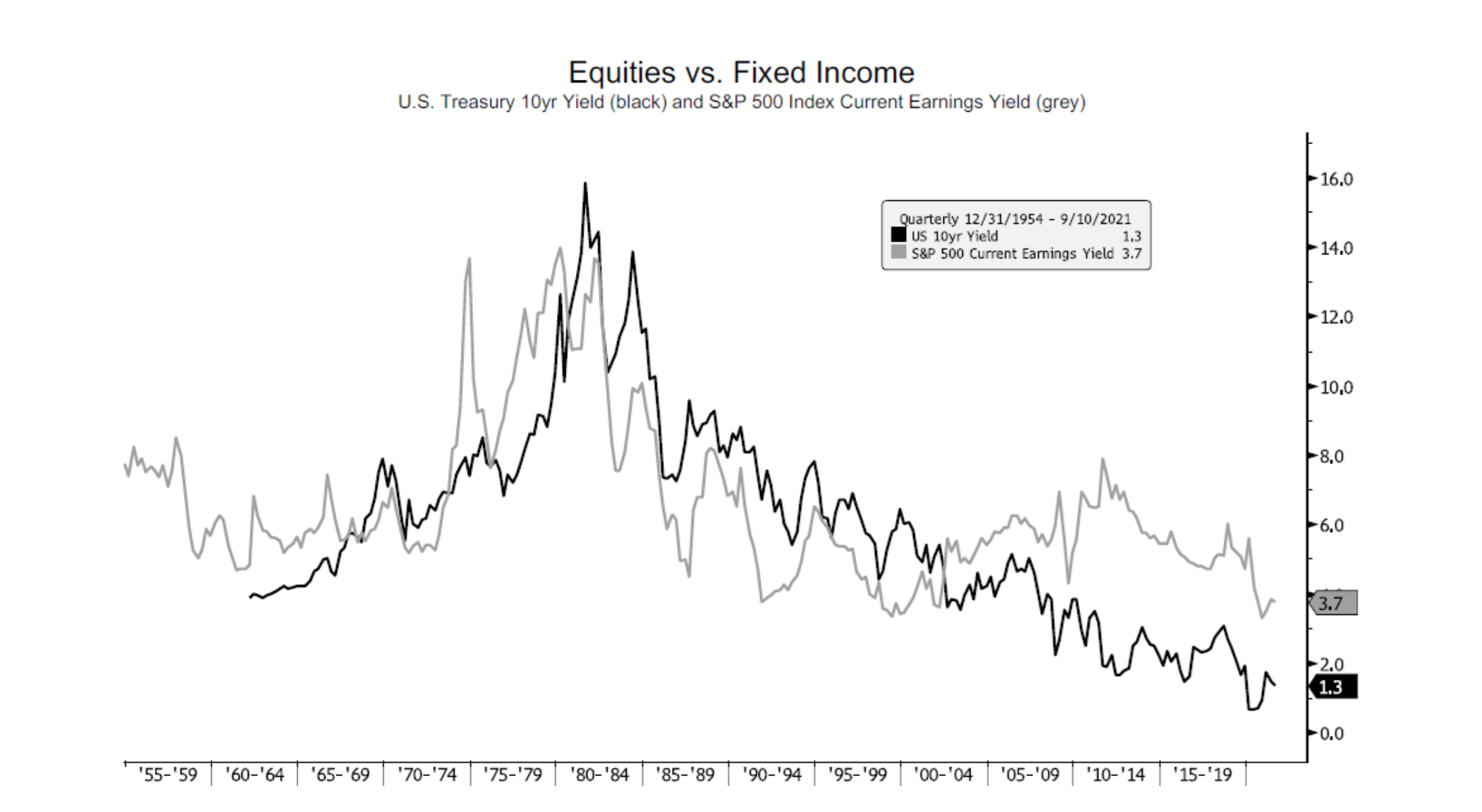

As the chart below shows, the earnings yield (earnings/price) for stocks is nearly three times that of the yield on the U.S. 10-year Treasury. Until yields on bonds become more attractive, or valuations on stocks go even higher, the difference between the earnings yield on stocks and yield on bonds remains in favor of being overweight equities.

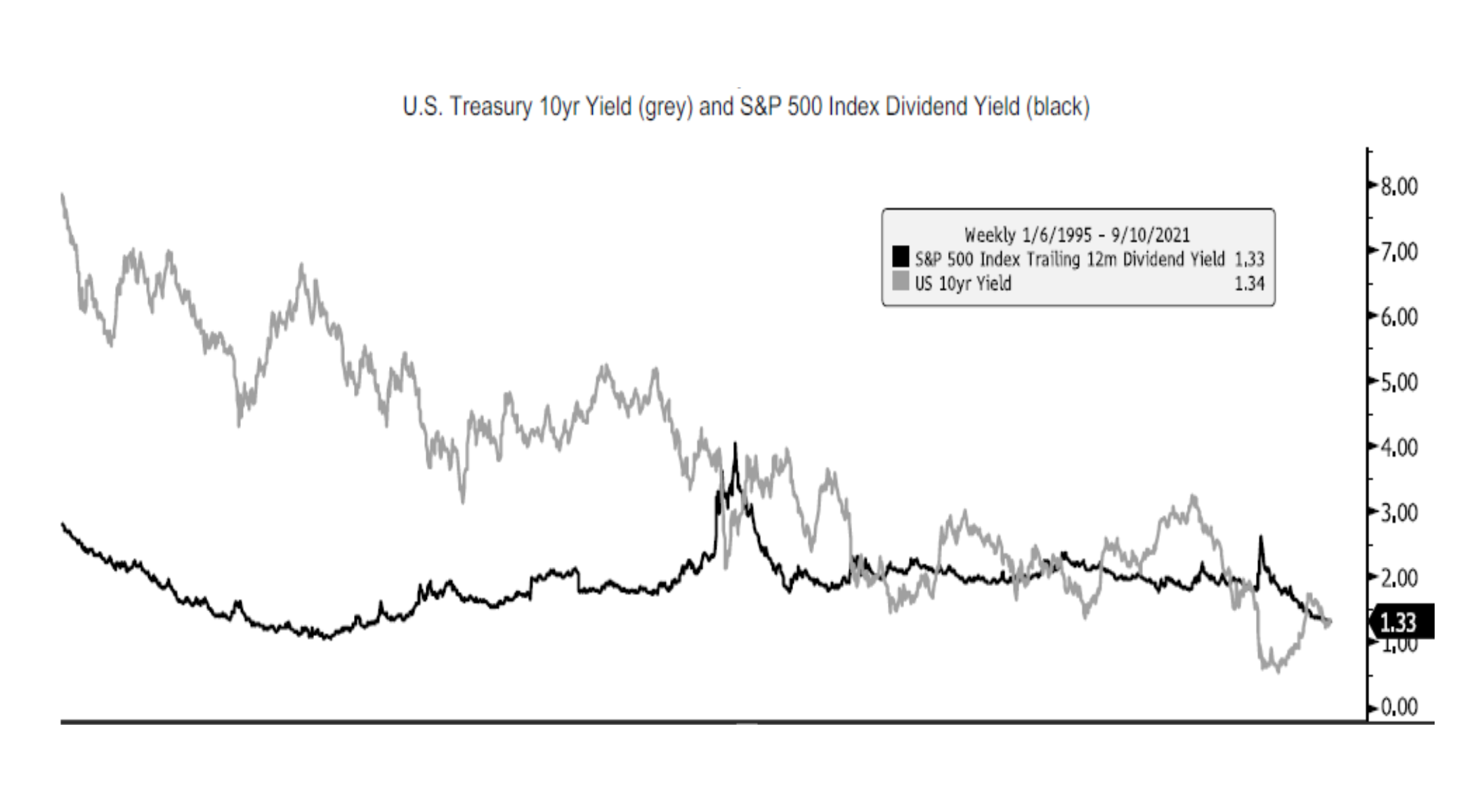

Finding income has become tricky over the past fifteen months. Yields on all asset classes have compressed. However, when comparing the dividend yield on the S&P 500 to the U.S. 10 Treasury yield, they are almost the same. Let’s not ignore that the yield dividend on the S&P 500 is growing, because in most instances, the income in a bond is fixed.

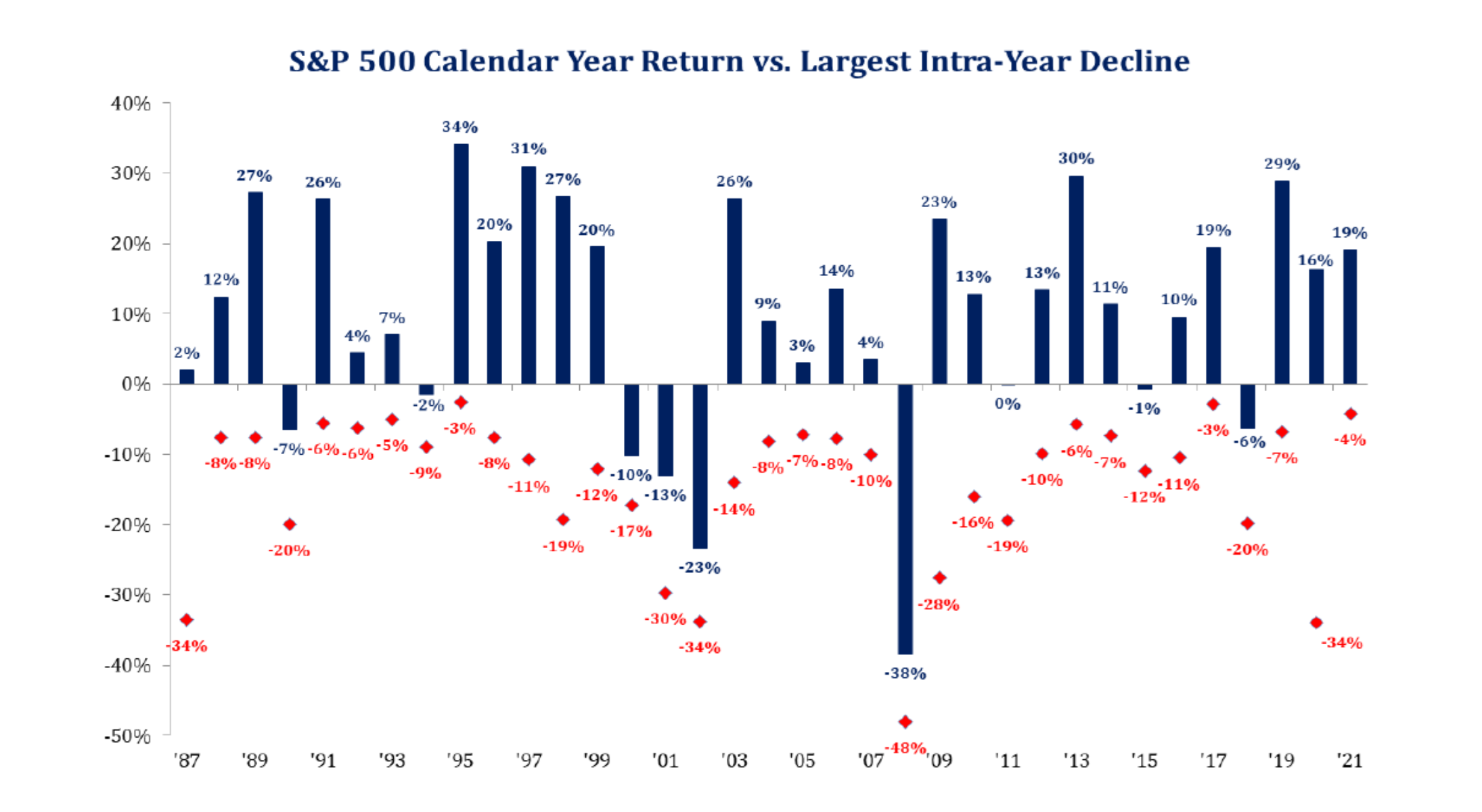

If/when the price of an investment sells off, understand two important elements: First, just because a portfolio value may be down during a certain period does not mean that money is “lost.” There are three ways to lose money: inflation, taxes, and the sale of a bad investment idea at a loss. Investors have limited control over the first two factors. However, selling a stock only because its price is down (and not for company fundamental reasons or personal liquidity needs) guarantees the loss. Second, sell-offs should be viewed as a potentially opportunistic times to buy. See the chart below. The red diamonds show the selloff from the peak during a calendar year for the S&P 500, and the blue bar shows the actual end of calendar year results. For example, in 2020, during the height of COVID, the market was down 34%, yet finished the year up 16%. Consider the generational wealth that was destroyed by those investors who went to cash at the bottom and missed the rally that followed. Also, per the chart, from 1987-through today, 26 of those 35 years, or 75% of the time, the market finished positive for the calendar year despite the intra-year declines.

Investing in equities is always accompanied by risk. However, by having clear objectives of your financial assets, along with a solid understanding of the fundamentals of the underlying investment idea such as: the business model, the earnings drivers, the management team, etc., market selloffs should be embraced, in our view, as a stock potentially for sale, but not necessarily to be sold.

This article reflects the views of the author as of the date or dates cited and may change at any time. The information should not be construed as investment advice. No representation is made concerning the accuracy of cited data, nor is there any guarantee that any projection, forecast or opinion will be realized. References to stocks, securities or investments should not be considered recommendations to buy or sell. Past performance is not a guide to future performance. Securities that are referenced may be held in portfolios managed by Tocqueville or by principals, employees and associates of Tocqueville, and such references should not be deemed as an understanding of any future position, buying or selling, that may be taken by Tocqueville. We will periodically reprint charts or quote extensively from articles published by other sources. When we do, we will provide appropriate source information. The quotes and material that we reproduce are selected because, in our view, they provide an interesting, provocative or enlightening perspective on current events. Their reproduction in no way implies that we endorse any part of the material or investment recommendations published on those sites.

View PDFMutual Funds

You are about to leave the Private Wealth Management section of the website. The link you have accessed is provided for informational purposes only and should not be considered a solicitation to become a shareholder of or invest in the Tocqueville Trust Mutual Funds. Please consider the investment objectives, risks, and charges and expenses of any Mutual Fund carefully before investing. The prospectus contains this and other information about the Funds. You may obtain a free prospectus by downloading a copy from the Mutual Fund section of the website, by contacting an authorized broker/dealer, or by calling 1-800-697-3863.Please read the prospectus carefully before you invest. By accepting you will be leaving the Private Wealth Management section of the website.