Subscribe to Our Insights

Thought Leadership

To The Power Of…

By Alexander Stock on December 21, 2021

Elementary school math classes often begin with the core facets of arithmetic: addition, subtraction multiplication and division. Derivatives come later, in the middle school years: exponents, factorials and PEMDAS[1], show how big numbers can get, quickly.

Coupling this basic math with portfolio management and stock investing can yield attractive results. Specifically, compounding is a focal point of long-only active portfolio management. The secret element is time.

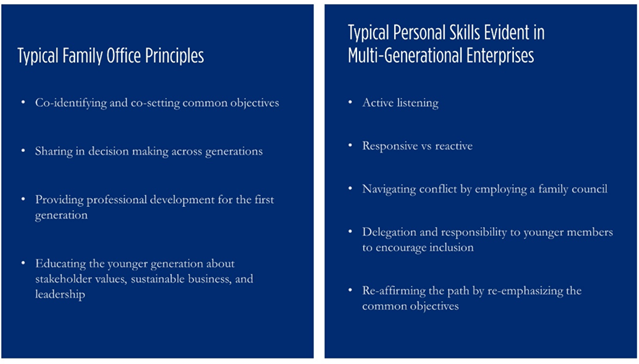

Critically, the younger generation of investors are at the cusp of the largest intergenerational wealth transfer in centuries. 2019 estimates from multiple surveys and sources range between $15 and $68 trillion. Consequently, the next-gen are in an ideal position to leverage this element as a resource for the new socially conscious paradigm for which they commonly aspire. But this won’t be possible without a collaborative multi-generational planning framework to meet those tangible impact goals.

Uniting investment compounding and multi-generational investment planning can crystalize a sustainable century-long family legacy.

Multi-plication

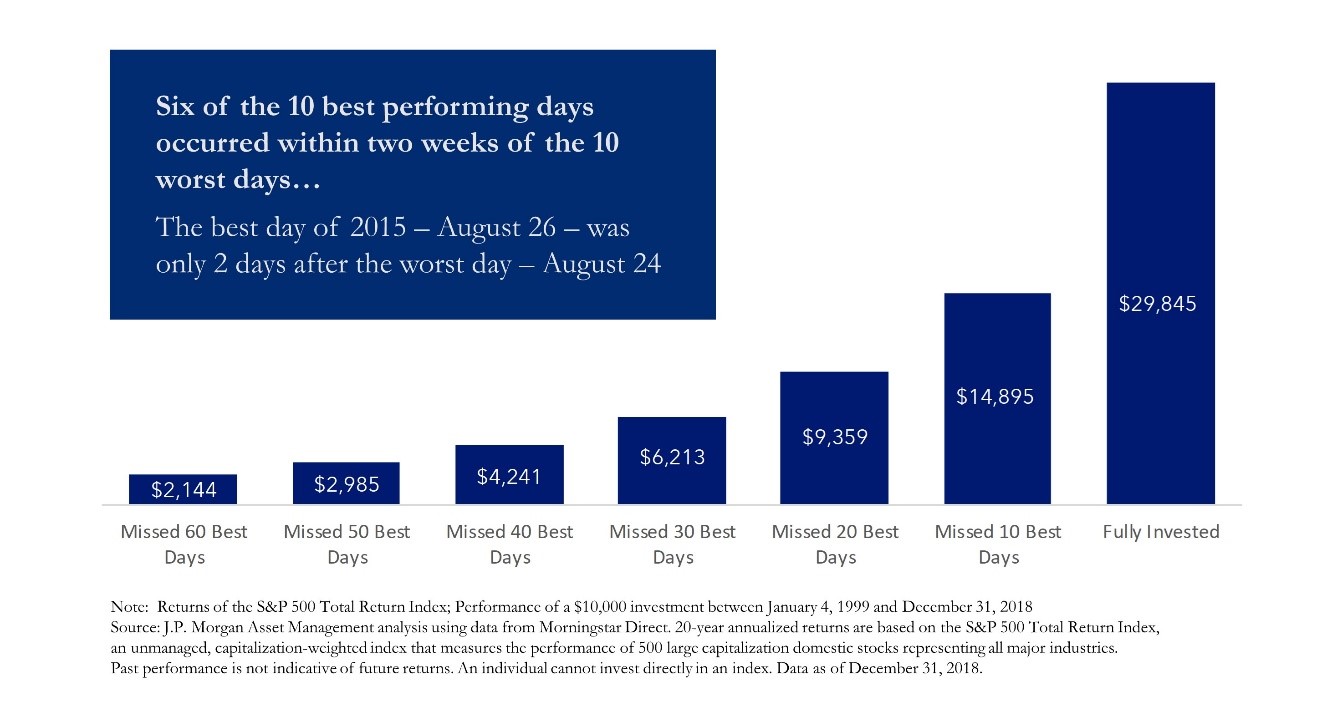

Staying invested in the market statistically has shown to be one of the best methods to increase the probability of achieving superior investment performance results. A Morningstar analysis showed that missing – defined as taking principal off the table – the best 60 days of the market between 1999 and 2018 would have yielded just 7% of the ultimate upside. In contrast, if one had stayed invested throughout this period, one would have profited nearly 200% on that original investment. See Exhibit 1: Compounding Interests

[1] Order of operations: Parentheses, Exponents, Multiplication, Division, Addition, Subtraction

Moreover, the secret sauce, time is the foundation of the compounding mechanism. Allowing capital to grow and multiply through the ongoing tick-tock of days, weeks, months and years enables those monies, beyond the original principal, to add to the overall return. They earn interest and accumulate value through price gains. Furthermore, contributing capital to a portfolio or fund or account, on a regular basis, enhances the compounding effect. That supplemental principal increases the base on which interest is earned and can increase the quantity or units of an instrument that are owned. For portfolios, it enables employment of several strategies: dollar cost averaging, buying at a discount to future value, and creating and preserving capital for future generations.

No doubt there are ups and downs in the stock market and frequently, nervous investors order managers to sell in times of extreme uncertainty. Staying put in the market, and jibing with market prices can offer both opportunity and a test of firepower and aptitude. However, over time, developing immunity to those unnecessary portfolio tacks can clearly add to the performance results, as evidenced by this example.

Multi-generation

The younger generation of investors demands tangible results on everything from plastic reduction in the world’s oceans, to the improvement in test scores or grades due to expanded access to after school tutoring programs in underprivileged neighborhoods in the US. However, achieving results cannot happen without a governance framework and resources. The next-gen are fast becoming the new stewards of wealth and empowering them with the information, tools and critical analysis skills that made the family business a success will be crucial to ensuring a lasting legacy in the hands of descendants.

Reinforcing the mathematical concept of compounding can aid the younger generation to connect with the impact that their inheritance may have on people around them and society-at-large. Common mission and ethos setting can acclimate children into the fold of the family business and prepare them to take ownership in order to achieve those social impact goals which they co-set years ago.

Multi-power

Combining math education and family office principles can unify a sustainable century-long family legacy. The compounding effect of money grounded by time is a crucial part of multi-generational wealth planning. Critically, getting into the market and staying in the market for the long haul offers investors the best probability to achieve those tangible key performance indicators all so popular with today’s socially conscious investors.

Alexander Stock

Portfolio Manager

This article reflects the views of the author as of the date or dates cited and may change at any time. The information should not be construed as investment advice. No representation is made concerning the accuracy of cited data, nor is there any guarantee that any projection, forecast or opinion will be realized. References to stocks, securities or investments should not be considered recommendations to buy or sell. Past performance is not a guide to future performance. Securities that are referenced may be held in portfolios managed by Tocqueville or by principals, employees and associates of Tocqueville, and such references should not be deemed as an understanding of any future position, buying or selling, that may be taken by Tocqueville. We will periodically reprint charts or quote extensively from articles published by other sources. When we do, we will provide appropriate source information. The quotes and material that we reproduce are selected because, in our view, they provide an interesting, provocative or enlightening perspective on current events. Their reproduction in no way implies that we endorse any part of the material or investment recommendations published on those sites.

View PDFMutual Funds

You are about to leave the Private Wealth Management section of the website. The link you have accessed is provided for informational purposes only and should not be considered a solicitation to become a shareholder of or invest in the Tocqueville Trust Mutual Funds. Please consider the investment objectives, risks, and charges and expenses of any Mutual Fund carefully before investing. The prospectus contains this and other information about the Funds. You may obtain a free prospectus by downloading a copy from the Mutual Fund section of the website, by contacting an authorized broker/dealer, or by calling 1-800-697-3863.Please read the prospectus carefully before you invest. By accepting you will be leaving the Private Wealth Management section of the website.