Subscribe to Our Insights

Thought Leadership

Tocqueville Gold Strategy Investor Letter Second Quarter 2015 – Part II

By John Hathaway on July 16, 2015

What is required to restore investor interest in gold? In our opinion, a prolonged bout of financial-market adversity would suffice. After all, the cornerstone of coordinated central-bank policy since 2008 has been the levitation of financial assets via Zero Interest-Rate Policy (ZIRP) and Quantitative Easing (QE) by forcing investors into risky assets. We believe that nothing would serve better to undermine confidence in central bankers than a bear market in bonds and equities. The roof above the dollar gold price has been built brick by brick from confidence in central bankers.

In our Q12015 Gold Strategy letter, we stated:

We believe that confidence in central banking is the principal explanation for the current lofty valuations of financial assets and the corresponding low esteem for gold. That confidence, in our opinion, will dissipate if the investment gains of the past five years begin to turn into losses.

We believe that such a reversal is long overdue, and that the vast majority of investors are ill prepared for this eventuality. The demise of the most notable recent bubbles in dotcoms and mortgage-backed securities also seemed to take forever to coalesce. The current bubble in government bonds, supported in our opinion by confidence in central banking, seems to be taking its time to deflate as well. Inflection points in markets take longer to occur than most can imagine, especially when authorities spare no effort to defer the inevitable. Paul Singer of Elliott Management states in his most recent investor letter:

Sometimes inflection points take a while to actualize, even when they are long overdue…. All it would take at the present time for a collapse in developed-country bond markets to begin is a loss of confidence in paper money, central bankers, or political leadership…. The ingredients for a renewed financial crisis are in place, as a possible ‘surprising’ transformation of money debasement into highly visible inflation.

In our opinion, we stand at the threshold of such a shift. Will the shift take weeks, months, or years? There is unfortunately no way to be certain on timing a shift of such potentially epoch magnitude, but several important clues suggest that the timing is sooner rather than later.

The Greek financial crisis: a precursor to the deflation of the bubble in sovereign debt

While Greece is small in relation to the European and global economies, it is emblematic of the disease: excessive money-printing to fund promises to voters that are not financially viable. In our view, the Greek (and the Puerto Rican) drama is reminiscent of the blowup of the two Bear Stearns mortgage-backed securities hedge funds in 2007. Shrugged off by the financial markets at the time, that fiasco was the first sign of trouble to come in the housing/MBS sector that led to the global financial meltdown of 2008. As with the Bear Stearns hedge funds, the Greek episode may well foreshadow a deflation of the bubble in sovereign debt.

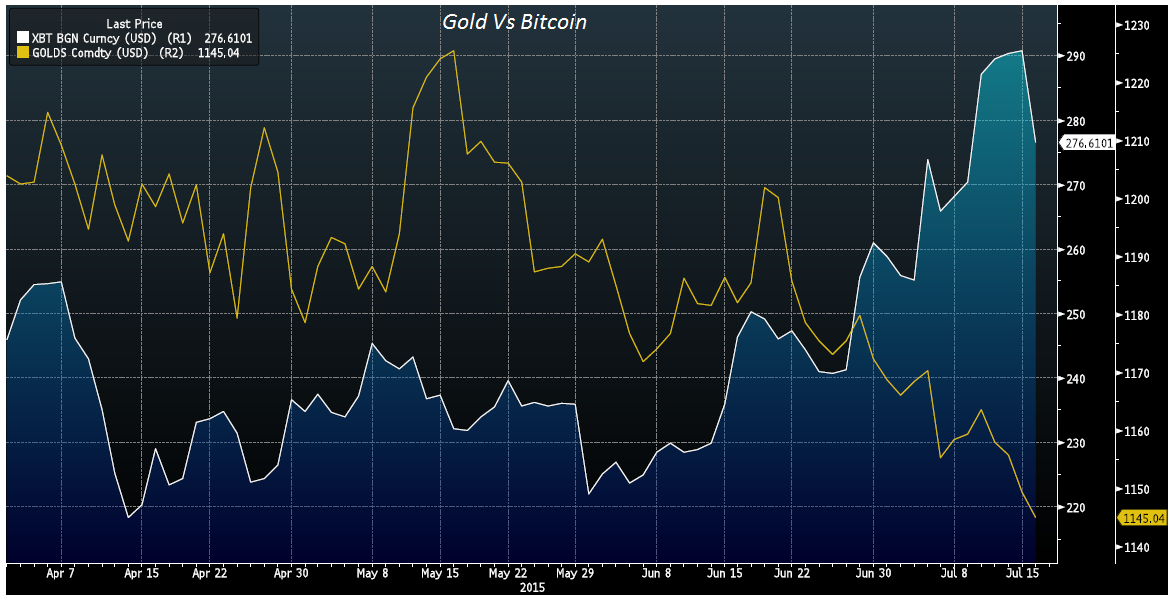

It is counterintuitive that gold has weakened in conjunction with the events in Greece. For example, Bitcoin prices have reacted much differently than gold to these circumstances:

Source: Bloomberg

The potential withdrawal of Greece from the euro at the very least emboldens left wing/nationalist factions in Spain, Italy, and France, who see the results of the Greek referendum as legitimizing rebellion against the diet of austerity imposed by Brussels. Are the events in Greece a prelude to greater instability in the entire Eurozone? The small size of the Greek economy and banking system makes it easy for market bulls to pass it off as a sideshow. Greece has not by itself engendered the sort of fear that would generate massive capital flows into gold. Impatient gold investors may have overemphasized the short-term potential of this skirmish to ignite a rally. However, voter repudiation of fiscal austerity imposed by remote bureaucratic elites seemed to play well in Athens, and there is reason to think that it may catch on in other parts of the globe.

Warnings from former central bankers and the BIS

– According to the most recent annual report of the Bank for International Settlements (BIS):

…central banks have backed themselves into a corner after repeatedly cutting interest rates to shore up their economies. These low interest rates have in turn fueled economic booms, encouraging excessive risk taking. Booms have then turned to busts, which policy makers have responded to with even lower rates…. In some jurisdictions, monetary policy is already testing its outer limits, to the point of stretching the boundaries of the unthinkable.

– Claudio Borio, head of BIS economic research, recently observed, “It’s hard to believe that interest rates that are so extraordinarily low are consistent with a fully rational allocation of resources.”

– At the 2015 Peterson Institute Fiscal Summit, Alan Greenspan stated, “We’re not getting like Greece, we’re getting like Illinois.”

– Former Fed Governor Larry Lindsay: “Unfunded Social Security and Medicare/Medicaid liabilities when added together to US Federal debt take US obligations closer to 300 percent (of GDP) v. 100 percent, which is more than Greece’s debt.”

– And according to former Fed Governor Richard Fisher:

Imagine the political turmoil if you have to cut payments to those you promised and say we still have to pay interest. Both the US political right and left will ask – well, who owns our debt? It’s China, Japan, etc. This is a political train wreck that is about to happen.

Overvalued financial assets

In our 1Q2015 letter, we noted that equity-market valuations were at dangerous levels by three different measures: the CAPE ratio, the Q-ratio, and the Buffett indicator, which are discussed at length in our last letter. Through June 30, the S&P Index struggled and was basically flat, while the NASDAQ rose slightly. The Dow Jones Transportation and Utilities averages are down for the year. Beneath the surface, there has already been significant deterioration. According to Stan Weinstein, the popular averages are misleading because “roughly two-thirds of all issues [are] already in their own private bear markets” (Global Trend Alert, 7/13/15). Many emerging markets are already in bear markets, with 42 percent of stocks in the MSCI World Index down at least 10 percent from their 2014-2015 peaks. Near-zero or negative interest rates on $5.3 trillion of global sovereign debt (as of April 2015) seem to shift the odds heavily towards losses once interest rates rise.

Could lofty equity-market valuations have resulted in part from extensive central-bank investment activity? As of the end of 2013, the Swiss Central Bank held 15 percent of its foreign-exchange (FX) assets in equities, according to a June 2014 MarketWatch. The Official Monetary and Financial Institutions Forum has identified $29 trillion in equity investments by official-sector institutions, including central banks (June 2014). The CBOE provides rate incentives for central banks to trade various instruments, including S&P contracts, and has extended these incentives through year-end 2015. The rationale voiced for such exposure is lack of return on low-yielding debt instruments. It seems that central banks are themselves victims of their own ZIRP and QE.

We believe that equity exposure has become a key central-bank policy instrument to suppress currency-exchange rates and to grope for yield that they cannot achieve in traditional safe assets. Their presence in equity markets, especially in option and futures contracts, may explain the growing discrepancy between the path of stocks underlying the averages and the averages themselves. We believe that we can observe this presence in recent market down days, when mysterious rallies occur as indices approach dangerous technical levels defined by conventional moving averages. It would appear that the trading desks of central banks are more attuned to moving averages and other technical indicators than down-and-dirty fundamental analysis.

Rising signs of US economic weakness

S&P earnings declined in the fourth quarter of 2014 and in this year’s first quarter, and are expected to do so again in the second quarter, according to FactSet. The NACM Credit Managers Index is showing the lowest readings since 2013. The Philadelphia Fed’s business-conditions index (Aruoba-Diebold) indicates general deterioration of current activity. Shipping indices, including the Baltic Dry Freight Index, World Container Index, and Shanghai Containerized Freight Index – the sort of data that cannot easily be massaged or beautified for political purposes – have all shown significant recent declines. Retail sales have been weak, and the June number was surprisingly so, according to Evercore ISI commentary: “Discretionary categories were notably weak. Even categories that had been strong, restaurants and building materials, witnessed sales declines in June.” The IMF, which has a forecasting record superior to all central banks, as documented by Arbor Research, has downgraded its second-half outlook for US growth and reiterated its call for the Fed to put off any rate hikes until 2016 or risk stalling growth altogether. Needless to say, unanticipated economic weakness could force a downward adjustment in expectations for future earnings and is inconsistent with highly valued financial assets.

Challenges to dollar dominance

The dollar’s status as the world’s reigning reserve currency is taken as a given by the vast majority of investors. The strength of the dollar relative to the euro and yen has often been cited as a key factor in gold’s weakness since last September. However, a reordering of the international financial system seems to be underway. “The global economy and global finance is at a turning point…. New rules have been discussed not only inside advanced economies but all the emerging economies, including…China” (from remarks by former ECB President Jean-Claude Trichet, 10/14).

It is quite conceivable that the status of gold would be elevated in a new order. In a 6/25/15 address to the London Bullion Market Association (LBMA) forum (brought to our attention by Luke Gromen in his newsletter, The Forest for the Trees), Dr.Yao Yudong of the People’s Bank of China stated, “Main reserve currency issuers may either fail to adequately meet the demand of a growing global economy for liquidity as they try to ease inflation pressures at home, or create excess liquidity in the global markets by overly stimulating domestic demand.” There are two takeaways from this presentation: (1) the RMB should be elevated to reserve currency status; and (2) gold needs to be reintroduced into the mix of international monetary arrangements, as it is not subject to the flaws inherent in government-issued currency.

As noted by Mr. Gromen, it would be cheaper for China to import oil by settling transactions in a combination of gold and RMB than in US dollars. That is exactly what is taking place. Since most of the oil imported by China is from Russia or Saudi Arabia, and since both buyers and sellers of oil have been large accumulators of gold in recent years, it is easy to see that a more congenial arrangement for all would be to settle accounts in a “better currency.” The significance of the recently formed Shanghai Gold Exchange is that it will facilitate the recycling of trade surpluses into gold and reduce the need to recycle trade surpluses into US Treasuries. China’s holdings of US Treasuries peaked in 2011; their net purchases over the last 12 months have declined by $42 billion, or nearly 33 percent. We plan to increase our focus on Treasury International Capital Flows (TIC) data as the Shanghai Gold Exchange begins to hit its stride.

Gold drain

We and others have commented at length about the contradictions between the markets for paper (synthetic) and physical gold. The declining price of paper gold quotes in NY and London doesn’t square with worldwide physical flows that reflect demand far in excess of mine production. It appears to us that gold positions traded in London and NY among bullion banks, HFT’s, hedge funds, and commodity traders constitute highly levered derivatives with only distant and notional relationships to the physical substance. The power of synthetic gold markets (COMEX in NY and over-the-counter in London, in conjunction with the LBMA fix) to determine gold prices could start to ebb as physical gold migrates to Asian financial centers. China has built an institutional infrastructure in the form of the Shanghai Gold Exchange, shortly to be merged with the Hong Kong Gold Exchange, which will facilitate settlement of international transactions in physical, not synthetic, gold, as described by Yao Yudong in his recent LBMA presentation. We expect an increasing percentage of gold transactions to be denominated in RMB.

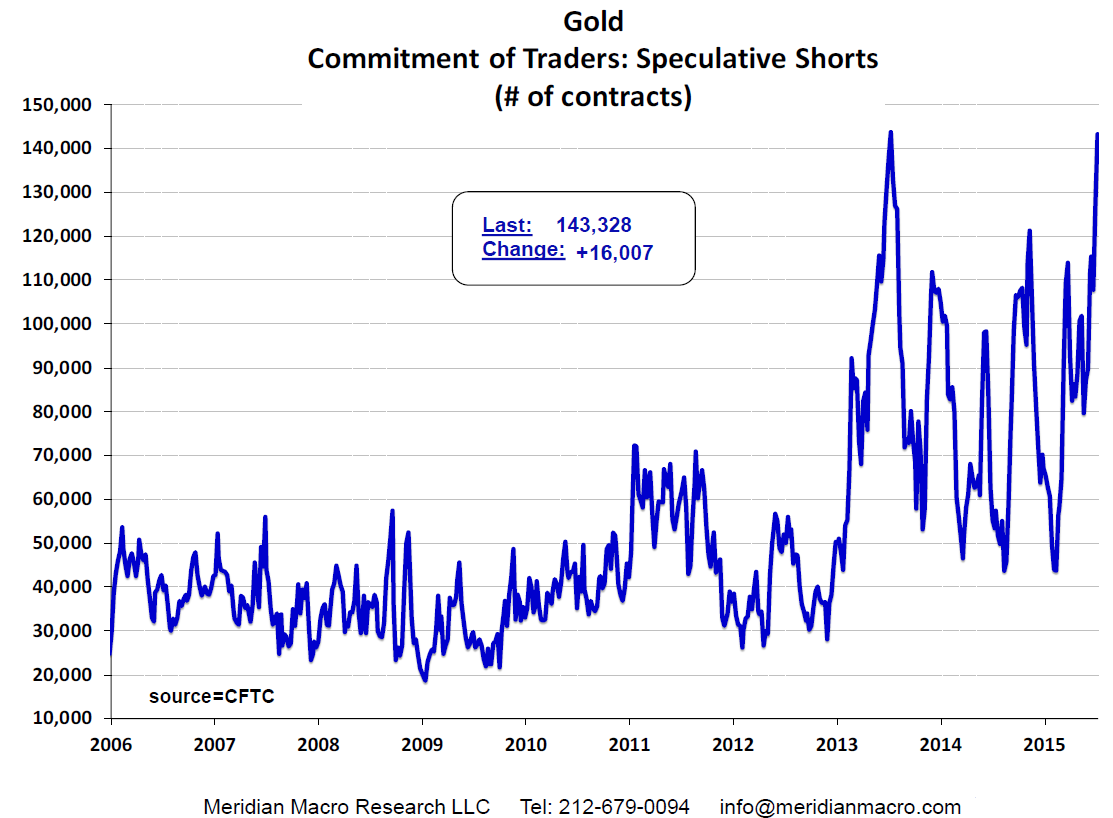

The well documented disappearance of bullion from Western vaults may mean that credit required for transactions in synthetic gold – i.e., some sort of claim on underlying physical gold – will become increasingly difficult to obtain. These changes coincide with speculative COMEX short positions at record levels, as indicated in the Meridian Macro chart below:

Evidence of possible stress on this system of credit links between physical gold and derivatives may have been revealed by the first-quarter Office of the Comptroller of the Currency (OCC) report, which showed that JPMorgan’s commodities derivative contracts (less than one year) exploded from $131 million to $3.8 trillion in just one quarter – a staggering and unprecedented change. The mystery deepens because the OCC for the first time inexplicably obfuscated the reporting categories by eliminating the separate, long-standing category (at least 10 years) for gold by including it together with FX. This curious retreat from transparency by the OCC suggests to us attempted deception. By whom and for what reasons we can only speculate. For our part, it makes us wonder whether we are witnessing the final moments of a second, more sophisticated version of the 1960s London Gold Pool (the “Gold Pool”), a scheme organized by US and European governments to suppress the free-market gold price in order to camouflage the growing adverse fundamentals for the US dollar.

Inflation is rising

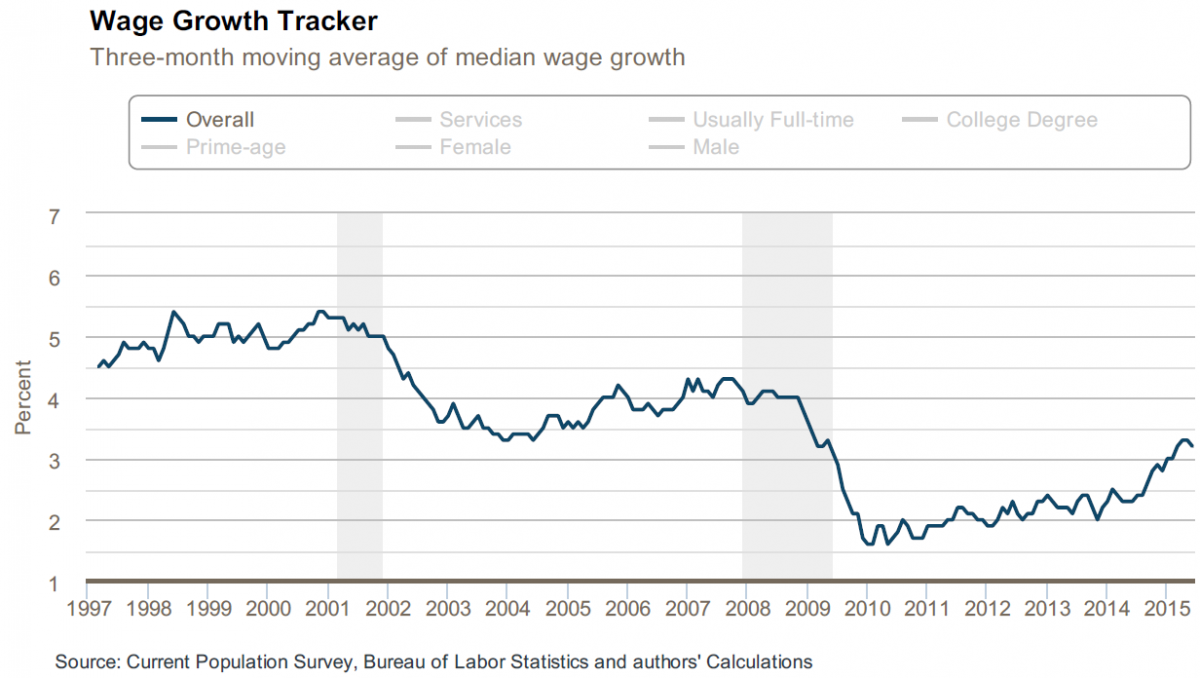

As noted by Fred Hickey in his July 2015 The High Tech Strategist report, consumer price inflation, understated by highly biased government measures, is starting to heat up. It is manifested in wages, rents, insurance, and basic food items. Median wage pressure has increased from 1.6 to 3.1 percent in the last 12 months, as shown on the Atlanta Fed’s Wage Growth Tracker report:

The Consumer Price Index (CPI) understates the real rate of inflation, in our opinion. For example, as noted by Mr. Hickey, apartment rental rates have grown twice as fast as wages since 2000. A recent Wall Street Article titled “Rents Continue their Steep Climb” stated that 49% of all renting households had “severe cost burdens, paying more than half of income for housing.” Because the CPI is jerry rigged with respect to rent (owners’ equivalent rent), this highly important component of measured inflation cannot be taken seriously as an accurate representation of reality.

Hedonic price adjustment is another important example of why the CPI is not a reliable gauge of inflation. Hedonic adjustments lower the inflation rate for consumer goods such as autos and appliances for quality improvements. All well and good, but according to Arbor Research:

The problem with hedonic adjustments is they are not applied evenly. They are applied only to products, not services…the Commerce Department believes the price of washing machines should be adjusted downward since they are made better and have more features. However, the Commerce department makes no attempt to adjust the prices of washing machines for the degradation in services to fix that same washing machine.

Without hedonically adjusting services, which most agree have become worse, the current set of adjustments serve to understate CPI.

The Commerce Department should consider dropping all hedonic adjustments until they can add a similar set of adjustments for services.

The bottom line to us is that real interest rates, basically nominal rates adjusted for the CPI, are more deeply negative than common perceptions. Therefore, the investment proposition for low-yielding sovereign and other fixed-income securities is highly dubious in our opinion, another bubble waiting to implode.

Warnings from investment luminaries

High-profile, successful, and gold-agnostic investment-world luminaries assess the macroeconomic risks of radical monetary policies and reach a similar conclusion: This will end badly:

– Seth Klarman: “All the Trumans (reference: a 1998 movie [The Truman Show] in which the main character’s entire life takes place on a TV set which he perceives as reality) – the economists, fund managers, traders, market pundits – know at some level that the environment in which they operate is not what it seems on the surface…. But the zeitgeist is so damn pleasant, the returns so irresistible, that no one wants it to end. (Zero Hedge, 3/14)

– Bill Gross: “While Dodd-Frank legislation has made actual banks less risky, their risks have really just been transferred to somewhere else in the system (i.e., Exchange Traded Funds, Mutual Funds)…. Even in milder ‘left tail scenarios’ it is price that makes the difference to mutual fund and ETF holders alike, and when liquidity is scarce, prices usually go down, not up, given a Minsky moment.” (From “It Never Rains in California,” 6/15)

– Stan Druckenmiller: “The Fed keeps talking about deflation, but there is nothing more deflationary than creating a phony asset bubble, having a bunch of investors plow into it and having it pop…. Our monetary policy is so much more reckless and so much more aggressively pushing the people in this room and everybody else out the risk curve that we’re doubling down on the same policy that really put us there and enabled those bad actors to do what they do.” (Talk at the Lost Tree Club, 1/15)

– Paul Singer: “History shows that it is fiendishly difficult to preserve the value of money which is backed by nothing but promises…. Our view is that central bankers have chosen, and doubled down on, a palliative (super-easy money and QE), which is unprecedented and extreme, and whose ultimate effects are unknowable.” (From his investor letter)

– Jeff Gundlach: “The Fed has never kept rates stable for six years, let alone at zero…. They must be aware that the longer they keep rates at zero the more distorted investor psychology and behavior becomes.” (ValueWalk interview, 1/15)

In our view, evidence suggests that the secular bull market in gold is far from finished. In addition to the possible reasons we have suggested in this report, we know that history is on the side of gold versus paper currency. Gold is uncorrelated with financial assets. We believe that the trigger for renewed interest among Western investors will be an unfortunate but long-overdue bout of financial-market adversity; but the specific trigger can only be a matter of speculation. The high valuation of financial assets and the low valuation of gold open the door for many possible sources of disruption. Nobody anticipated the 12-year rise in gold from below $300 in 1999 to $1900 in 2011. Even the minute bullish camp that existed in the late 1990s could not foresee the scale of the rise, or articulate the reasons for it. The same is true today.

A bit of history is instructive here: The collapse of the 1960s “Gold Pool,” the aforementioned secret and collusive effort by seven central banks to keep a lid on the gold price, preceded a most difficult decade for financial assets. A lesson to be learned from the 1960s is the unpredictability of government actions, their inherently anti-free-market nature, and the unintended consequences that can arise from them.

The Gold Pool was, in retrospect, a clumsy attempt by Western democracies to disguise the deteriorating fundamentals of the US dollar stemming from the Vietnam War, rising inflation, and the weakening balance of payments. The dollar had been pegged to gold at $35/ounce since the end of WWII, a number that proved too low in light of the changing fiscal realities for US sovereign credit caused by the escalation of the Vietnam War and the introduction of large scale welfare policies under the umbrella of the Johnson administration’s Great Society initiative. In retrospect, the scheme was clumsy because the manipulation of the gold price was accomplished by the exchange of physical gold for dollars held by foreign creditors who saw the writing on the wall. The objective of the Gold Pool was to disguise reality. In the long run, that price-suppression scheme did not work. The failure of Gold Pool of course was resolved by the suspension of dollar/gold convertibility in 1971. When free-market gold trading resumed in 1974, the gold price rose by nearly 20 fold over the next eight years.

The present-day magnitude of fiscal and monetary irresponsibility in our view exceeds the precedent of the 1960s by multiples. It is only fitting that the elaboration and complexity of disguise required to beautify the underlying realities would be proportional. Government Intervention via price suppression (interest rates, currencies) or price inflation (financial assets) seems to pervade all financial markets. Why should gold be exempt? At some basic level, all investors are aware of the gold price. Unruly behavior by the metal could render the “Truman Show” dysfunctional. Allowing free-market expression of gold prices may have been seen as a serious risk at the highest policy levels. The strong rise of the gold price amidst liberal doses of QE post-2008 through 2011 would have been a note discordant with an otherwise happy fable. Gold strength might confirm what many investors suspect: QE and ZIRP have failed to produce economic growth and may well have jeopardized future prospects for a return to solid economic footing.

We hypothesize that, having learned from the misadventures of the 1960s, the policy elites, well versed in the practice of financial engineering and market manipulation, would have seen no need to dump stocks of government gold reserves onto the market, 1960s style, to keep the price in check. Instead, synthetic gold, sourced in pyramids of credit extended to bullion bankers by central banks with little or no claim on physical substance, have provided a more efficient, better-camouflaged form of intervention. COMEX synthetic gold and related over-the-counter derivatives are traded in macro strategies implemented by hedge funds, HFT’s, and commodity funds in pair trades with interest rate, currencies, equity futures, or even more exotic offsets. The volumes traded are huge, and bear little resemblance to actual flows of physical metal.

We suspect that shorting gold has come to seem like a riskless proposition as long as there is confidence in the Fed. Synthetic gold is the perfect substance for a carry trade: an easy borrow with very low carrying cost and little upside basis risk. Such a hypothesis, in our opinion, does much to explain the incongruity of a declining gold price while fundamentals for paper currency, and the US dollar in particular, obviously deteriorate; while demand for physical gold has exceeded new mine supply for several years running; and while above-ground 400-ounce .999 gold bars located in London, New York, and other financial capitals (in cohabitation with speculative trading activity in paper markets) have steadily dwindled and disappeared into Asian financial centers reformulated as .9999 kilo bars.

History instructs us that it is common for politicians of all stripes to rely on overvalued currency to achieve policy goals. We believe gold-price suppression to be a natural adjunct of this predisposition. Paul Singer believes that shorting low-yielding sovereign debt represents an excellent opportunity to profit from the fallacies of “money that is backed by nothing but promises.” We agree. However, in our opinion, the even greater opportunity, and certainly the more accessible one for most investors, is a long position in gold and gold-mining shares. At the very least, it offers protection against potential bear market downside for equities and bonds. At best, and despite the requirement for substantial patience and fortitude to question the wisdom of the investment consensus, it may prove to be an opportunity of generational proportion.

Tocqueville Gold Strategy Monitor

John Hathaway

Senior Portfolio Manager

© Tocqueville Asset Management L.P.

July 16, 2015

This article reflects the views of the author as of the date or dates cited and may change at any time. The information should not be construed as investment advice. No representation is made concerning the accuracy of cited data, nor is there any guarantee that any projection, forecast or opinion will be realized.

References to stocks, securities or investments should not be considered recommendations to buy or sell. Past performance is not a guide to future performance. Securities that are referenced may be held in portfolios managed by Tocqueville or by principals, employees and associates of Tocqueville, and such references should not be deemed as an understanding of any future position, buying or selling, that may be taken by Tocqueville. We will periodically reprint charts or quote extensively from articles published by other sources. When we do, we will provide appropriate source information. The quotes and material that we reproduce are selected because, in our view, they provide an interesting, provocative or enlightening perspective on current events. Their reproduction in no way implies that we endorse any part of the material or investment recommendations published on those sites.

View PDFMutual Funds

You are about to leave the Private Wealth Management section of the website. The link you have accessed is provided for informational purposes only and should not be considered a solicitation to become a shareholder of or invest in the Tocqueville Trust Mutual Funds. Please consider the investment objectives, risks, and charges and expenses of any Mutual Fund carefully before investing. The prospectus contains this and other information about the Funds. You may obtain a free prospectus by downloading a copy from the Mutual Fund section of the website, by contacting an authorized broker/dealer, or by calling 1-800-697-3863.Please read the prospectus carefully before you invest. By accepting you will be leaving the Private Wealth Management section of the website.