Subscribe to Our Insights

Thought Leadership

Tocqueville Gold Strategy Investor Letter Year End 2014

By John Hathaway on January 15, 2015

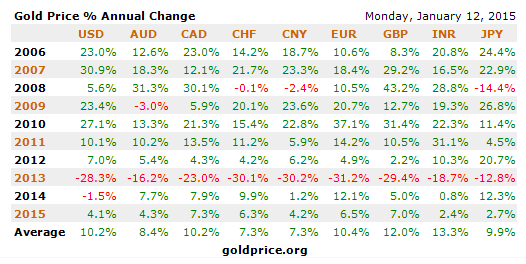

It is a little-known fact that gold outperformed all currencies in 2014, except for the US dollar. In dollar terms gold declined 1.7 percent, but as the table below shows, it posted solid gains against all other currencies. While the dollar price of gold was essentially flat in 2014, highly negative media coverage created the impression that gold was a disaster. Negative sentiment weighed heavily on the performance of gold-mining shares, with our benchmark XAU index down 17.3 percent.

Meanwhile, dollar bulls appear dangerously overcommitted to the greenback, with open interest at an all-time high. The dollar’s strength relative to other currencies has camouflaged the strength of gold. Both dollar and gold strength in our opinion portend trouble ahead for financial assets (click here). It seems to us that with financial assets at all-time highs and red flags proliferating, this is an opportune moment to acquire cheap wealth insurance in the form of physical metal and precious-metal mining shares.

We share the view of many contrarians that the six-year bull market in equities has been powered in large part by the Fed’s policy of zero-interest rates and quantitative easing, which has driven investors into risky assets. As noted by Fred Hickey in his January 4, 2015, newsletter (High Tech Strategist), “The market’s price to sales ratio is at an all-time high, the market capitalization to GDP ratio (Warren Buffett’s favorite indicator) is the second highest in history…. The Shiller Cyclically Adjusted P/E Ratio for the S&P is 27. That level has been exceeded only two times before – in 1929 and 2000.”

It seems to be the consensus view, and it is certainly the party line of the Fed, that the money printing of the past six years is history. As Hickey points out, if the fuel for the market advance has been spent, what is there left to support lofty equity valuations? Numerous factors point to spreading economic weakness for the global economy. These include the weakness of foreign currencies relative to the US dollar (which increases the debt load of dollar-denominated debt, fueling the growth of emerging market economies), falling commodity prices, widening credit spreads, and a broad assortment of feeble economic reports that market bulls choose to ignore. If we are correct in our view, corporate earnings are set to decline, undercutting a key pillar of the bullish case for equities.

We believe that a serious market correction, or the onset of a bear market, would exert extreme pressure on the Fed to reverse course and resume money printing. The Fed, most likely aware that their credibility is at stake, would probably resist this option at all costs. Capitulation to market weakness by the Fed at this juncture would in our opinion lead to the evaporation of confidence in all central banks, since investors would be forced to accept the proposition that money printing, once started, can never be stopped.

A return to quantitative easing would be transformational for the perception of gold. We believe the transformation would happen suddenly. As noted by investment luminary Paul Singer in a letter to his clients, confidence, especially when it is not deserved, is a thin veneer. When confidence falls apart, the consequences can be quite severe. In a recent interview, Jeffrey Gundlach, CEO of investment giant DoubleLine, commented, “It is interesting how you have been beginning to see signs of investor concern around the edges about the health of the economy and about the financial system. Historically, when junk bonds give up the ghost and treasuries remain firm, it is a signal that something is not right.” In our view, the hidden strength of gold during 2014 is another sign that investors are starting to sense that something is not right.

We believe that capital is beginning to scramble towards higher ground in anticipation of a monetary crisis. To us, this explains the relative strength of the US dollar. The same concern is reflected in the less obvious strength of gold. As of this writing, the euro price of gold has surpassed the 1,000 level. The downtrend of the past three years seems to have been broken in euro terms. Investment flows from Asia continue strong. China and India now buy as much gold as the mining industry produces. While the Chinese central bank remains secretive, not having updated gold reserves reporting since 2009, the sharp decline in purchases of US Treasuries (see below) implies a step up in gold purchases.

Central bank buying, led by Russia, is robust; central banks have added gold bullion to reserves for 14 straight quarters. Political pressure to repatriate gold bullion has also been on the rise. Countries considering or successfully repatriating gold include the Netherlands, France, Belgium, Austria, and Germany. As noted by Casey Research, repatriation has led to the biggest drawdown in gold held at the NY Fed in more than 100 years.

Source: MeridianMacro

We believe that a breakdown of trust in financial intermediaries – including bullion banks, “synthetic” gold substitutes such as ETFs, and derivatives, as well as the integrity of central-bank custodial relationships – is behind the growing clamor to repatriate physical gold bars owned by sovereign states. Ebbing confidence is not limited to the official sector. Gunvor, the world’s fifth-largest commodity trader, decided to discontinue gold trading in part “because of difficulties in finding steady supplies of gold where the origin could be well documented” (Bloomberg, 12/12/14). Grant Williams, of Vulpes Investment Management, explains, “Because of the mass leasing and rehypothecation programs [the use by financial institutions of clients’ assets, posted as collateral] by central banks, there are multiple claims on thousands of bars of gold. The movement to repatriate gold supplies runs the risk of causing a panic by central banks.”

Loss of trust is the genesis of bank runs. Bullion banking is a fractional reserve system in which large amounts of credit are extended based on a relatively small quantity of physical metal. Sovereign gold bars are a major component of the credit base. We believe this is a story to watch very closely in the coming year.

It seems to us that that the circle of those disparaging gold has dwindled to a rear guard of hard-core, dollar-centric addicts still hooked on a monetary policy designed to herd investors into risky assets. In a truly Orwellian transposition, gold, the safest asset in history, is maligned by the financial media as risky, while financial assets at near-record valuations are viewed as compelling. In the simplistic logic that passes for financial wisdom, if equities are good, then gold must be bad. If there has been a Greenspan/Bernanke put for equities, why not a Yellen cap for gold?

Such a notion might explain the fearless manner in which gold has been periodically trashed. A skidding $US gold price confirms that all is well. “Synthetic” gold, created by bullion banks for propriety-trading desks, high-frequency traders, and commodity traders, is dumped (often following Fed policy pronouncements) onto thin markets during non-trading hours to trigger stops and spread panic. No physical gold changes hands during such raids. Sellers abandon any pretext of “best execution,” the usual standard for discrete distribution of positions. Instead, the raids are crafted to smash the price with as much noise as possible.

We believe that the gold market has been manipulated, which to us is no surprise. Rigging has become a central feature of financial markets since the onset of quantitative easing. Too-big-to-fail banks, US and European, have admitted to manipulating Libor, energy, and currencies. Zero-interest rates and quantitative easing are to us blatant manipulations of bonds, interest rates, and equities. Why should gold be exempt? On December 15, 2014, a class-action lawsuit filed in the United States District Court, Southern District of New York (In Re: Commodity Exchange, Inc., Gold Futures and Options Trading Litigation) named the Bank of Nova Scotia, Barclays plc, Deutsche Bank AG, HSBC plc, and Société Générale SA as defendants on allegations of price fixing in the gold market. The various allegations in the Complaint include the following:

The PM Fixing aligns with the opening of the New York market, and specifically the Commodity Exchange, Inc. (COMEX) market on which gold futures and other derivative contracts are traded…. The economic and other evidence overwhelmingly shows that Defendants sought to avoid the uncertainties and risks associated with the gold derivatives market – i.e., that the market would move against a Defendant’s short position – by agreeing to manipulate the PM Fixing through repeated conduct to artificially suppress the price of gold.

The Complaint is now in the hands of the district judge. The allegations are supported by exhaustive statistical data, similar to those produced in the previous successful action against Libor manipulation. The defendants have filed a motion to dismiss; the judge will decide in the coming months whether to allow the case to proceed. If the case proceeds, we would hope it results in placing important participants on the witness stand. However, should it get to that point, there is a possibility that the defendants could propose a settlement to avoid discovery, which in our opinion would be disappointing.

Regardless of how the litigation is resolved, we believe that the scrutiny from regulators in Germany, Switzerland, and the UK (FCA), along with these legal actions, has already caused a change in behavior by bullion banks and other institutions involved in price manipulation. Deutsche Bank, for example, has withdrawn from precious-metals trading. In other cases, internal and external legal scrutiny of precious-metals trading activity will most likely lead to reduced participation by many of these institutions.

For investors, the overriding question is what these changes might imply for future gold prices. In the short run, we believe that price raids mounted by synthetic supply will become less frequent and less intense. We believe that in time, should our expectation prove correct, the gold market may come to seem less dangerous and perhaps less mysterious to those who wish to initiate long exposure. Over the longer term, we believe that the diminished presence of Western institutions in precious metals markets, and the supplies of synthetic gold in which they specialize, will allow the very bullish supply and demand equation for physical metal to be reflected in the price. Should this shift occur in concert with a diminished role for the US dollar as a reserve currency – a prospect most certainly desired by the BRICs and other developing economies – gold will play an expanded role and the dollar gold price will benefit. The perfect storm for gold would be for these structural changes in the gold market to occur in conjunction with a loss of confidence in central bankers.

Mining Stocks

While gold held its own during 2014, mining stocks did not. Even though our benchmark XAU index rose 20.60 percent through the first half of the year, those gains were more than erased during the second half; on the year the index declined 17.29 percent. However, the index does not tell the entire story. Many of our holdings showed decent gains during the year, and on the whole our clients’ portfolios outperformed the index by a substantial amount.

Positive factors for the mining industry include declining costs (oil being a major input) and better discipline applied to capital allocations. Scotiabank estimates that each $1/barrel decline in the oil price translates into a $1/ounce reduction in cash costs. The impact of oil alone therefore would amount to a roughly 7-percent reduction in production costs globally. In addition, the strength of the US dollar also impacts costs favorably, as most of the world’s gold is produced outside the US. These two factors alone, in our estimation, would result in a 10-percent decline in global cash costs for the coming year. The benefits of cost-cutting initiatives, including significant workforce reductions launched in 2013 and 2014, are likely to become more visible in 2015 and beyond.

For the intermediate term, mine supply seems likely to decline (assuming flat gold prices), which should ultimately be constructive for gold prices. The industry is in the midst of a period of reassessment and restructuring that began at the end of 2013. There are many new CEOs whose principal mandate is to improve returns on capital. Obviously, some companies will be more successful than others in achieving those returns. Overall, we expect to see divestitures, balance-sheet improvement, and M&As.

A good part of our success last year arose from our exposure to the royalty companies. Their business thrives during periods of capital scarcity for gold miners. In addition, several of our important holdings were able to add value through the advancement of mine construction or astute acquisitions. Lastly, one of our largest holdings, Osisko Mining, was taken over by Agnico Eagle and Yamana. The residual piece of the original company has been reconfigured as a royalty company and remains an important holding.

It is essential to remember that the gold-mining industry is not monolithic. There are some companies that are well managed and are able to create value despite the difficult gold market of the past few years. Of course, there are other companies that seem to destroy value year in and year out. Clearly, our strategy is to concentrate our holdings in those companies that add value for shareholders during difficult periods, independent of the gold price. When the gold market improves, we believe that our core holdings will perform consistent with the gold price and our relevant benchmarks.

Tocqueville Gold Strategy Monitor [PDF]

With all best wishes for a prosperous 2015!

John Hathaway

Senior Portfolio Manager

© Tocqueville Asset Management L.P.

January 15, 2015

This article reflects the views of the author as of the date or dates cited and may change at any time. The information should not be construed as investment advice. No representation is made concerning the accuracy of cited data, nor is there any guarantee that any projection, forecast or opinion will be realized.

References to stocks, securities or investments should not be considered recommendations to buy or sell. Past performance is not a guide to future performance. Securities that are referenced may be held in portfolios managed by Tocqueville or by principals, employees and associates of Tocqueville, and such references should not be deemed as an understanding of any future position, buying or selling, that may be taken by Tocqueville. We will periodically reprint charts or quote extensively from articles published by other sources. When we do, we will provide appropriate source information. The quotes and material that we reproduce are selected because, in our view, they provide an interesting, provocative or enlightening perspective on current events. Their reproduction in no way implies that we endorse any part of the material or investment recommendations published on those sites.

Mutual Funds

You are about to leave the Private Wealth Management section of the website. The link you have accessed is provided for informational purposes only and should not be considered a solicitation to become a shareholder of or invest in the Tocqueville Trust Mutual Funds. Please consider the investment objectives, risks, and charges and expenses of any Mutual Fund carefully before investing. The prospectus contains this and other information about the Funds. You may obtain a free prospectus by downloading a copy from the Mutual Fund section of the website, by contacting an authorized broker/dealer, or by calling 1-800-697-3863.Please read the prospectus carefully before you invest. By accepting you will be leaving the Private Wealth Management section of the website.