Subscribe to Our Insights

Thought Leadership

Building Shareholder Value in the Gold Mining Sector

By Ryan McIntyre on June 21, 2019

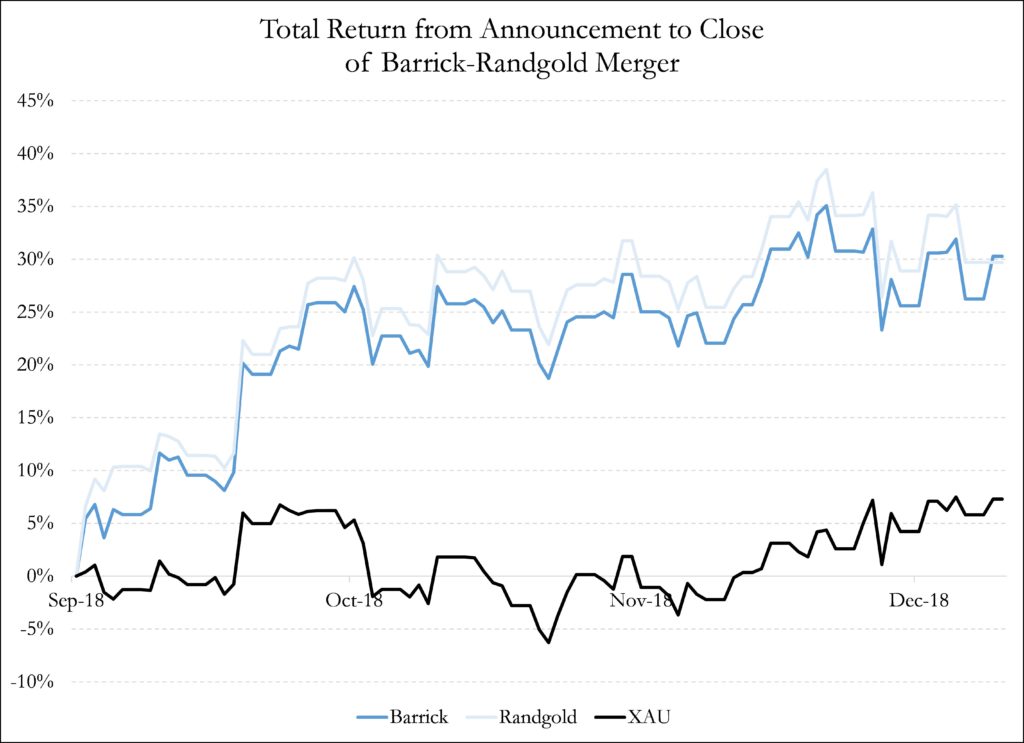

The gold mining sector appears to have turned over a new leaf. It is reshaping itself to generate higher returns on capital in a neutral gold price environment. Over the past nine months we have seen some notable value creating activity in the gold mining sector. The first significant move was the merger between Barrick Gold Corporation (Barrick) and Randgold Resources Limited (Randgold) to form, at the time, the largest gold mining company in the world. The merger was announced in September 2018 and there was no premium paid, which is unique and its success relies solely on the synergies generated together. Barrick brought its high quality diversified asset base and Randgold brought its high quality asset base, focused management, and disciplined capital allocation framework. The market reaction was positive and Barrick outperformed the benchmark (i.e. the Philadelphia Gold and Silver Index [XAU]) by 23% from the time of announcement to the close of the merger.

Exhibit 1

Source: Bloomberg.

Barrick quickly followed this up in March 2019 by announcing a joint venture with Newmont Mining Corporation (Newmont) to combine its operations in Nevada. The net present value of the pre-tax synergies expected from the Nevada joint venture is estimated to be $5 billion. Astonishingly, despite the significant synergies, a combination of the Nevada operations between the companies had been talked about for many years, but was never consummated. It illustrates that conditions in the sector today are such that shareholders demand value creation and will no longer accept excuses that inhibit the obvious.

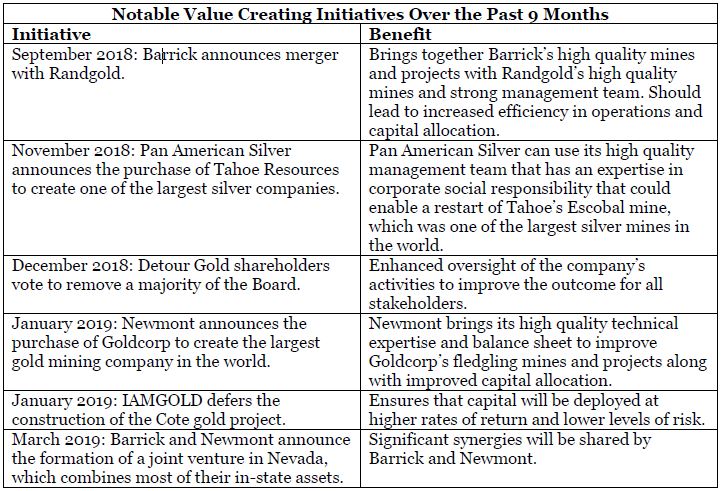

Exhibit 2 below lists a number of recent notable value creating initiatives in the sector. What these examples consistently show is that the industry is helping itself and not waiting for external factors (e.g. gold price) to improve. Ironically, these activities are likely to improve the prospects for the gold price.

Exhibit 2

The gold price and capital markets are forcing discipline and the companies are reacting. Meetings with almost all of our portfolio companies in the past four months indicate serious intent by management to align decision making with shareholder interests. Some of the conversations have already yielded positive outcomes. Today, little money is spent on exploration, development or optimization without a high probability of a positive outcome.

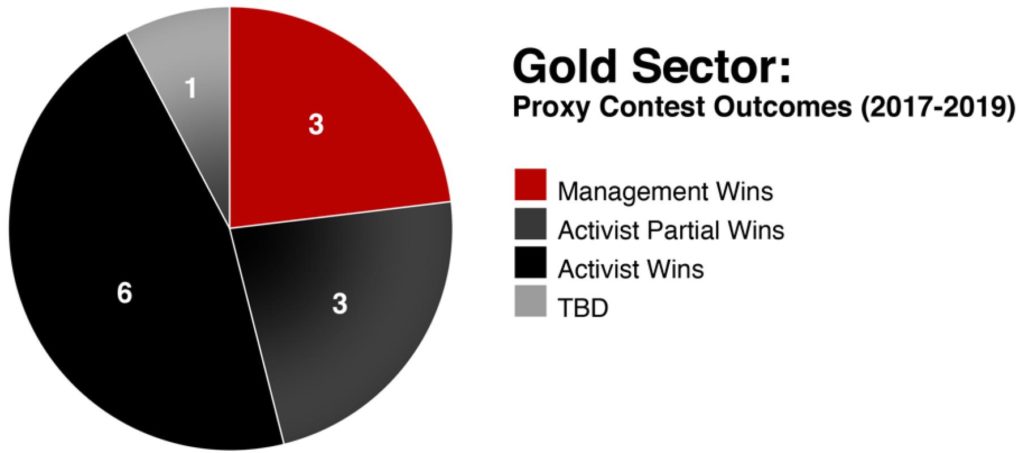

Investors are taking an increasingly active role in the mining sector. According to Kingsdale Advisors, there have been 13 activist campaigns over the past 26 months in the gold sector.[1] More interestingly, the vast majority of activist campaigns have been successful, as shown in Exhibit 3. In December 2018, as noted in Exhibit 2, shareholders of Detour Gold voted to remove the majority of the Board. Shareholders (including Tocqueville) felt that there was not enough focus on its only mine and that the Board needed to be revitalized to ensure a higher probability of success.

Exhibit 3

Source: Kingsdale Advisors.

A few companies in the gold mining sector are developing new technologies and systems that could reduce costs and increase productivity. For example, Torex Gold Resources Inc. (Torex) is currently testing a new proprietary underground mining technology/system called Muckahi. Muckahi is a new underground process and set of equipment that aims to reduce the size of the tunnels and increase productivity. Muckahi was developed by Torex’s in-house team that has a lot of underground experience. If the testing in 2019 is successful it will lower costs and timing for all things underground (i.e. exploration, development, and mining) for many different deposits around the world. Torex could leverage the technology at its own Media Luna project in Mexico and by acquiring marginal or historic mines in good jurisdictions at a low cost and implement Muckahi. Overall, Muckahi could be game changing for Torex and the mining industry by improving returns at static commodity prices. The probability of success is reasonable and the reward, if successful, is extremely high with a low cost of failure. This is exactly the type of investment that shareholders should desire.

These types of “intrinsic” value creating activities in the sector are likely to continue across the gold mining industry. Both large and small companies are examining many alternatives to add value independently of the gold price, which is (and has always been) Tocqueville’s focus in stock selection. Value enhancements we are likely to see involve management teams using their core competencies to unlock value in existing mines or new projects. Mergers and acquisitions will feature prominently in this as assets are rationalized and skills are transferred. Overall, the allocation of capital is being improved by disciplined management who minimize risk and require a reasonable rate of return. All of this will inevitably slow production growth, which should result in the industry being more profitable.

We believe that Tocqueville’s portfolios are well positioned to take advantage of the current situation given our involvement with high quality management teams and mines/projects. Additionally, because all but a few equity investors have abandoned this sector, we are seeing many more opportunities to get involved on very attractive financial terms as well as having significant inputs into shaping strategy. Our portfolios are focused on companies that are adding value as opposed to betting on higher gold prices. Therefore, we are biased toward smaller to mid-cap companies that are more likely to be engaged in value additive activities such as exploration, or development, production expansion/optimization and be sought after in mergers and acquisitions. It also means that we are shunning the “closet indexing” game to mimic ETFs and widely followed indices.

Ryan T. McIntyre

Portfolio Manager

© Tocqueville Asset Management L.P.

June 19, 2019

[1] http://www.kingsdaleadvisors.com/images/resources/PDFs/Activism_in_the_Gold_Industry.pdf

This article reflects the views of the author as of the date or dates cited and may change at any time. The information should not be construed as investment advice. No representation is made concerning the accuracy of cited data, nor is there any guarantee that any projection, forecast or opinion will be realized. References to stocks, securities or investments should not be considered recommendations to buy or sell. Past performance is not a guide to future performance. Securities that are referenced may be held in portfolios managed by Tocqueville or by principals, employees and associates of Tocqueville, and such references should not be deemed as an understanding of any future position, buying or selling, that may be taken by Tocqueville. We will periodically reprint charts or quote extensively from articles published by other sources. When we do, we will provide appropriate source information. The quotes and material that we reproduce are selected because, in our view, they provide an interesting, provocative or enlightening perspective on current events. Their reproduction in no way implies that we endorse any part of the material or investment recommendations published on those sites.

View PDFPoplar Forest

You are about to leave the site of Tocqueville Asset Management, L.P. The link you have accessed is provided for informational purposes only and should not be considered a solicitation to become a shareholder of or invest in the any mutual fund managed by Tocqueville Asset Management, L.P. Please consider the investment objectives, risks, and charges and expenses of any mutual fund carefully before investing. The prospectus contains this and other information about the Funds. You may obtain a free prospectus by downloading a copy from the Poplar Forest (www.poplarforestfunds.com), by contacting an authorized broker/dealer, or by calling 1-877-522-8860. Please read the prospectus carefully before you invest. By accepting you will be leaving the site of Tocqueville Asset Management, L.P.

Tocqueville Funds

You are about to leave the site of Tocqueville Asset Management, L.P. The link you have accessed is provided for informational purposes only and should not be considered a solicitation to become a shareholder of or invest in the any mutual fund managed by Tocqueville Asset Management, L.P. Please consider the investment objectives, risks, and charges and expenses of any mutual fund carefully before investing. The prospectus contains this and other information about the Funds. You may obtain a free prospectus by downloading a copy from the Tocqueville Funds website (www.tocquevillefunds.com), by contacting an authorized broker/dealer, or by calling 1-800-697-3863. Please read the prospectus carefully before you invest. By accepting you will be leaving the site of Tocqueville Asset Management, L.P.