Subscribe to Our Insights

Thought Leadership

Dusting Off the Textbook

By John Petrides on December 14, 2022

“Not since the 1970s…” This line has been a common reference used over the past ten months to discuss the current macroeconomic and financial market conditions. The fall from grace in growth stocks is similar to the collapse of the Nifty-Fifty during the disco era. Tensions with Communist China have increased, and the Russian war on Ukraine brings back memories of the Cold War era. The ramp up in inflation from an overheated economy, fueled by a commodity shock led by geopolitical players, coupled with a mess of a political situation in the US is reminiscent of the challenging decade. Central bankers are taking clues to be more vigilant in slaying the inflationary dragon and not repeat mistakes of a “stop-and-go” interest rate policy of former Fed Chair Arthur Burns. Although not driven by population growth like the 1970s, today, sticky inflationary forces such as wages and rental rates remain elevated. Motorists aren’t waiting in line at gas stations, but transitory inflationary factors such as gas, food, and prices on used cars, although off their peak, remain high and are impacting consumer spending on the margin, meanwhile sapping up savings built during Covid. The current financial market sell-off has many investors asking, “Is it different this time?”

A Walk Down History Lane

Financial markets are discounting mechanisms of future cash flows. Driven primarily by the spike in interest rates to corral inflation, investors are living through the worst performing bond market in 100 years. In addition, the stock market hasn’t looked back since its peak on January 4th , with the S&P 500 – 24%, international stocks (MSCI EFAFE) off 27%, and the Nasdaq -30% through September 30th. What is “unique” about the current situation is that the markets are in a classic business cycle slowdown, something a couple of generations of investors have never experienced before.

Here is a list of some of the market moving events over the past 35 years or so that have led to a major decline in financial assets and or recession:

| 1987 – Black Monday | 1989 – S&L Crisis |

| 1991 – Operation Desert Storm | 1994 – Mexican peso devalued |

| 1997 – Thai Bhat devaluation/Asian Contagion | 1998 – Russia default/Long Term Capital Management |

| 2000 – Dot Com Bubble | 2001 – 9/11 |

| 2002 – Enron/Worldcom | 2008 – Lehman Brothers/Subprime/Housing Bubble |

| 2011 – Greek debt crisis | 2016 – Brexit |

| 2018 – Tariffs on China | 2020 – Covid- 100-year pandemic |

All the events mentioned above were exogenous shocks to the financial system that required some form of central bank intervention. The probability weighted outcomes from these events were too wide and potentially devastating to allow the market to clear itself, or so the government and central bank leaders agreed; no central banker wanted a repeat of The Great Depression. Thus, investors became comfortable with the “Central Bank-Put.” Meaning, that whenever there was trouble in financials markets, investors believed that central banks would come to the rescue, which they eventually would do.

Fast forward to today and if an exogenous shock were to impact the financial system, with inflation so high, and central banks in tightening mode, it is reasonable to question: Can the central

banks come to the rescue if there were another shock to the financial system? “WIN” – What Investors Need What’s unique about today’s environment is that a major cohort of investors have never experienced a stock market and business cycle slowdown during their lifetime. For the Old Guard, it’s been nearly forty years. Unlike the events mentioned above, today is a classic situation where too much money was pumped into the system on the monetary and fiscal side for too long, which allowed the economy to overheat. Shocks such as Covid lockdowns impacting the supply chain, and Russia invading Ukraine haven’t helped, but the underlying reason for high inflation is excessive money printing in our estimation. The inflationary horse is out of the barn and the only way to wrangle it is to create a huge lasso of interest rates. As interest rates continue to move higher, it should continue to slow the

economy, and thus, in theory, bring down inflation.

Financial markets are down. Credit spreads are widening. Lending is being curtailed. Housing is slowing. Weekly jobless claims are slowly rising. Unemployment should begin to increase. Inventories are building. Commodity prices are well off peak levels. However, we believe inflation will eventually cool. Prices will clear. Interest rates will be lowered. Risk appetites will resume and the cycle will be off to the races into its expansionary phase.

Yeah, But When?

This the $64,000 (000,000, or 000,000,000 depending on your generation) question. Financial markets appear to be whipsawed on a daily basis by traders focusing on the trajectory of interest rates given the daily macroeconomic data. The zeitgeist of market is “bad news is good news” and vice versa. The worse the economic data reported, the greater the likelihood that the Federal Reserve has inflation under control, the higher stocks and bonds could rally, or so the thinking goes. Stubborn inflation leads to higher interest rates, which could continue to pressure financial markets. Don’t expect volatility to calm down anytime soon.

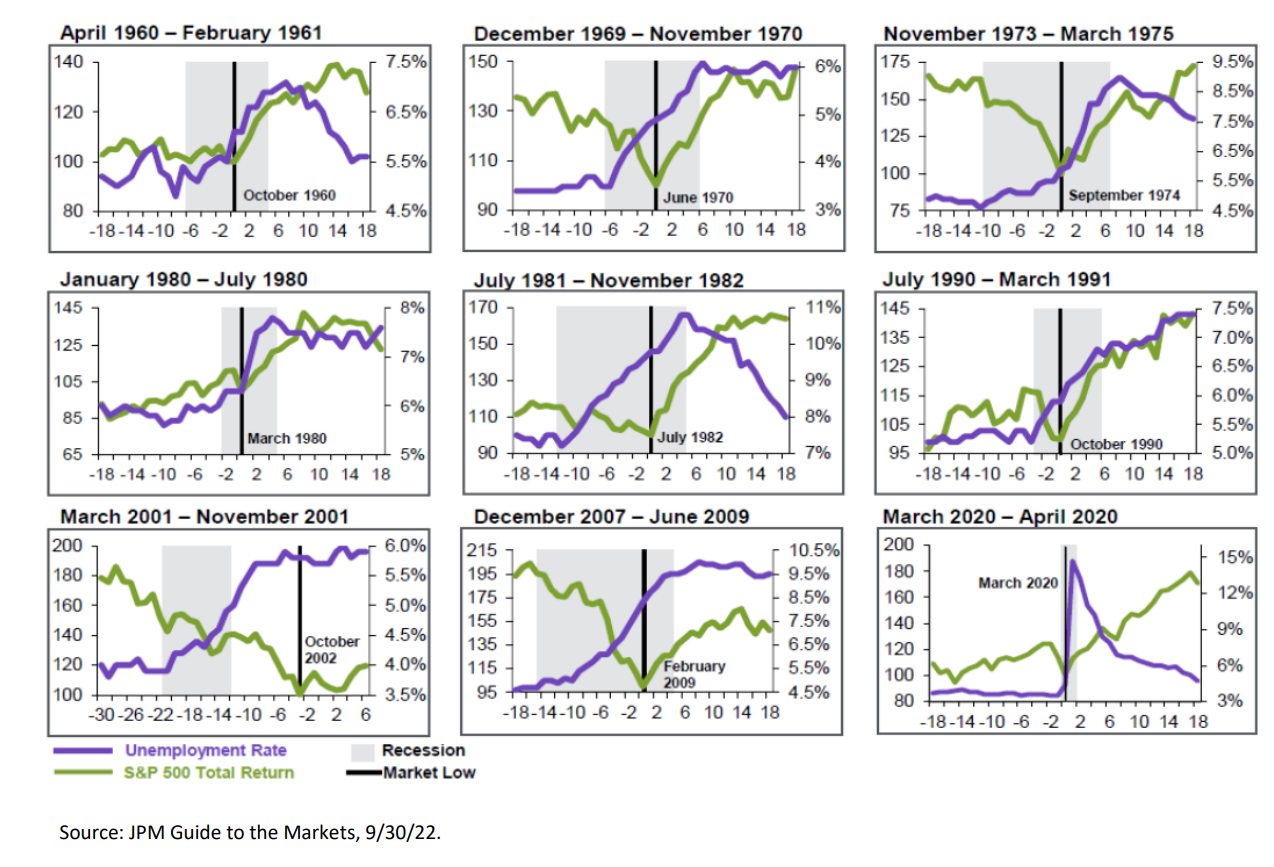

Look at the chart below. This shows every recession going back to 1960. The gray shaded area is the length of the recession. The purple line is the unemployment rate and the green line is the S&P 500. As you can see, in every classic business cycle recession from 1960 – 1982, the stock market rallied well before the recession ended and the economy had healed. True, stocks continued to rally when the economy was on healthier footing, but the bulk of the returns were made when the economy was at its nadir. This chart shows the power of stocks as discounting mechanisms, and the true risk to their wealth investors take if they have a short term view and/or allow emotions to control their decision making.

The Good News?

All downturns do come to an end, we just don’t know when. Chairman Powell has pledged the Federal Reserve’s resolve to use its tool box to tame inflation regardless of the outcome. Recognizing the importance of this is crucial: during 9/11, Lehman, and Covid, investors were in unchartered territory and didn’t truly know what the future would look like. Would Al Qaeda strike again? What if TARP doesn’t work? How long will it take for a vaccine to be administered to the world? Whether they like it or not, in a business cycle slowdown markets will find a new equilibrium. The question remains if Powell wants to be remembered as Arthur Burns or Paul Volker?

One of the interesting revelations of these recessionary charts, especially during the 1960s and 1970s was that the S&P 500 bottomed typically near the middle of the recession (see the green line within the shaded gray section), and generated most if its bull market rally while the economy was in recession, not when the all-clear sign has been given. This is important in understanding and recognizing the discounting mechanism that financial markets are: they attempt to price in the future impact to earnings before it happens. The reaction of stocks is also different when comparing to periods of recession driven by exogenous shocks to the system. Recognizing this is critical because investors have the tendency to be emotional with their money. Just because the economy is weak, doesn’t mean stocks can’t outperform. The question will be the length and depth of the recession and how quickly will expectations adjust?

Focus on the Micro

It feels like everyone today is an economist. It doesn’t matter who you talk to, everyone has an opinion on the economy, interest rates and inflation. The problem with this, in our view, is that

attention has been diverted away from company fundamentals and long term investment opportunities, and rather focused on market volatility. Aside from energy, all sectors have sold off hard year to date. Attention will now shift to the earnings trajectory of stocks, which presumably will be coming down over the next year as the economy slows. Stocks have rallied over the past two months, but still in general remain off double digits. Price-to-earnings (P/E) multiples are back to historical averages, but now investors will scrutinize the ”E” in the multiple. We expect volatility in the markets to continue into 2023. However, the broad based sell off has left investment opportunities abound of companies where balance sheets are strong, cash generation is high, and pricing power resilient. Those investors who are willing to withstand the volatility and areable to look past the perceived upcoming period of business cycle uncertainty will be in the driver’s seat to generate potentially substantial returns on their investments.

© Tocqueville Asset Management L.P.

This article reflects the views of the author as of the date or dates cited and may change at any time. The information should not be construed as investment advice. No representation is made concerning the accuracy of cited data, nor is there any guarantee that any projection, forecast or opinion will be realized. References to stocks, securities or investments should not be considered recommendations to buy or sell. Past performance is not a guide to future performance. Securities that are referenced may be held in portfolios managed by Tocqueville or by principals, employees and associates of Tocqueville, and such references should not be deemed as an understanding of any future position, buying or selling, that may be taken by Tocqueville. We will periodically reprint charts or quote extensively from articles published by other sources. When we do, we will provide appropriate source information. The quotes and material that we reproduce are selected because, in our view, they provide an interesting, provocative or enlightening perspective on current events. Their reproduction in no way implies that we endorse any part of the material or investment recommendations published on those sites.

View PDFMutual Funds

You are about to leave the Private Wealth Management section of the website. The link you have accessed is provided for informational purposes only and should not be considered a solicitation to become a shareholder of or invest in the Tocqueville Trust Mutual Funds. Please consider the investment objectives, risks, and charges and expenses of any Mutual Fund carefully before investing. The prospectus contains this and other information about the Funds. You may obtain a free prospectus by downloading a copy from the Mutual Fund section of the website, by contacting an authorized broker/dealer, or by calling 1-800-697-3863.Please read the prospectus carefully before you invest. By accepting you will be leaving the Private Wealth Management section of the website.