Subscribe to Our Insights

Thought Leadership

Investment Case for Gold

By John Hathaway on January 22, 2002

The investment case for gold centers on the notion that the over valuation and excessive supply of the US currency has funded a decade’s worth of uneconomic investment and unsustainable consumption. According to Professor Robert Mundell, as recently quoted in The Wall Street Journal (WSJ) Europe “There will come a time when the pileup of international indebtedness makes reliance on the dollar as the world’s only main currency untenable. It is no longer necessary or even healthy for the U.S. or the rest of the world to rely solely upon the dollar.”

The price of gold will rise as the dollar based system of credit and commerce falters under an overload of bad debt, weakening financial institutions, and a stagnant economy. The end of the NASDAQ mania marked the beginning of this process. The Enron bankruptcy, de facto default on sovereign debt by Argentina, and a looming financial crisis in Japan are random but high profile reminders of a deteriorating global credit environment. Turning points in long-term market trends rarely achieve completion within the confines of a single business cycle. The NASDAQ blowout was the noisiest and most visible sign of a turning point. Much more quiet has been the failure of the dollar price of gold to make a new low since August of 1999, a good six months before the NASDAQ peak.

A revaluation of the dollar, like a credit downgrade, could choke off the flow of capital destined to be misspent. Its principal manifestation is likely to be a substantially higher gold price. The revaluation of gold will be permanent, based on three factors, each representing time spans of different but overlapping durations. The three factors are:

-

The structure the gold market, including the short positions, the annual flows of physical metal, and the economics of mine production, favors a price rise to $400 – $500. Current gold prices of around $280/oz. do not justify sufficient investment to maintain world gold production. Production is set to decline slowly in the current year and more precipitously in the years after.

-

The deflationary climate prompts economic policies that lead to the increased issuance of dollars including rapid money growth and fiscal deficits. It will inspire protectionist measures, which effectively devalue dollars held offshore. It will lead to rising interest rates, inflation and weakening balance sheets.

-

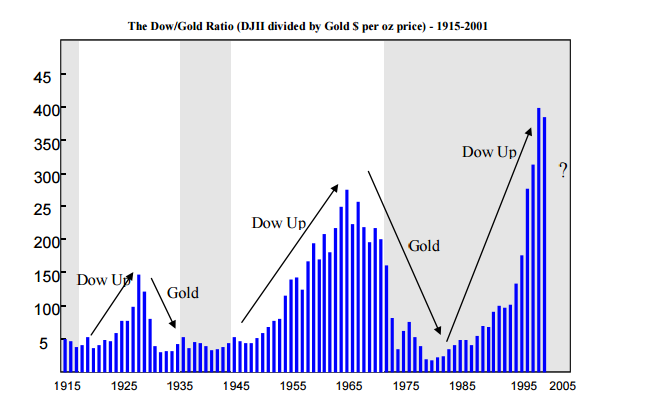

The metaphysics of gold, or market mythology and popular perception, have the potential to exert more influence than the other two factors combined. Market metaphysics change glacially over decades. They explain the vast swings in valuation as demonstrated by the chart depicting the Dow Jones average by the dollar price of an ounce of gold. These very long cycles in the public mood range from mania to depression. Imagine the opposite of the recent mania and you will picture the 1970’s, even if you weren’t there. The 1970’s featured miniscule equity valuations, a cynical and apathetic public regard for investing, and distrust of financial institutions, political leadership, and currency.

Gold Market Structure

The current dollar gold price of $280/oz is inadequate to justify capital investment necessary to maintain mine output. Evidence includes the shrinking capital base of the gold mining industry, continuing poor returns on investment, and the inability to attract new capital. Meanwhile, the gold mining industry is caught up in a frantic contest to see who will be the largest producer. While there are possible strategic benefits for the emerging leaders, the process in the near term promises further dilution to long-suffering shareholders. The market cap of the entire industry approximates McDonalds’s. The two or three “winners” in the consolidation race will still be tiny blips on the radar screen of capital markets. Size achieved at the cost of shareholder dilution will not attract generalist investors who are otherwise indifferent to gold. They are more likely to be turned away by the industry’s disregard for returns on capital. Only a higher gold price will attract new money to gold mining shares.

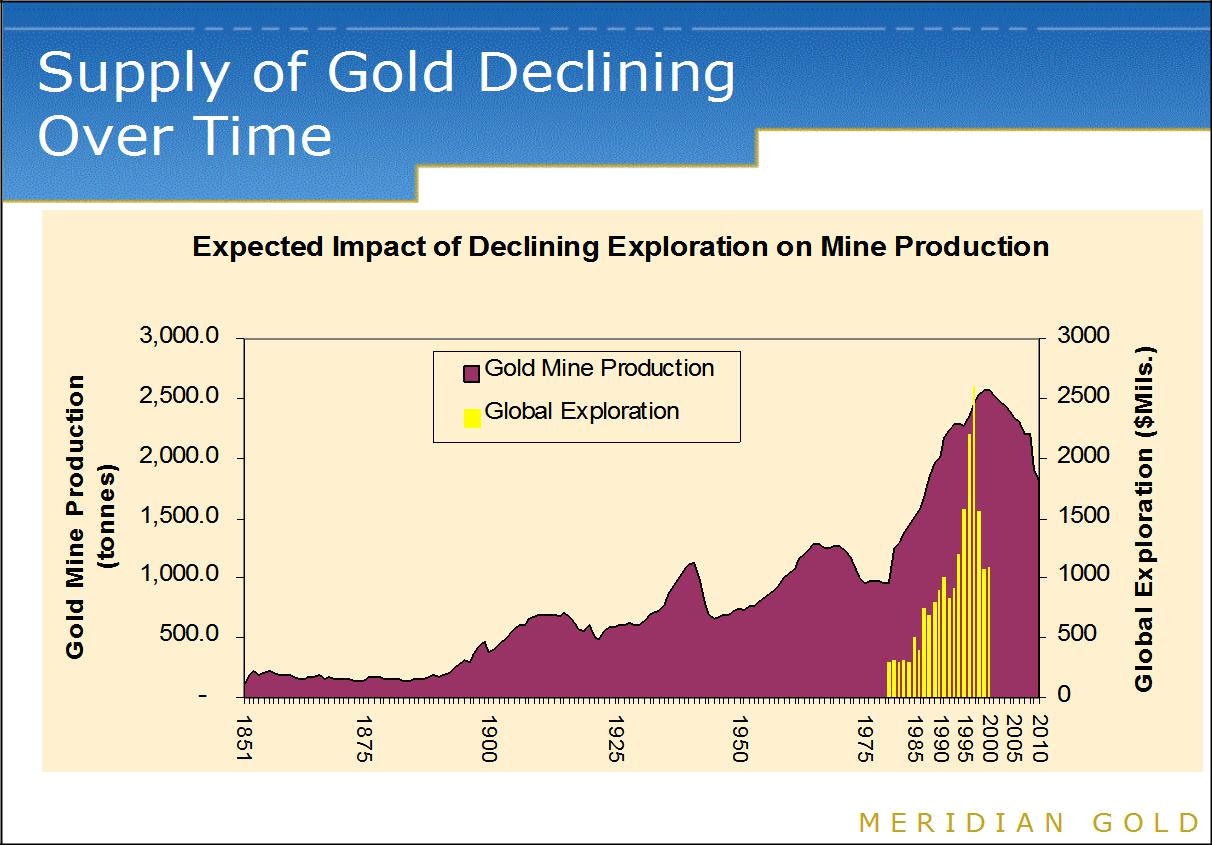

The precipitous decline of exploration expenditures (see chart below) since 1999 will lead to an accelerating decline in mine output:

Mine output in 2001, estimated at 2600 tonnes, is likely to prove to be the peak, assuming no change in the gold price. Even if the gold price were to rise by $100/oz, the supply response would be muted. “Mothballed capacity” is negligible. Lower exploration means fewer ounces are being discovered, and that ounces mined are not being replaced. The lead-time to bring new discoveries into production is measured in multiples of years, even decades. Industry production of 90mm oz per year has been achieved at the cost of depleting capital, especially through high grading and starving mine development expenditures. The “growth” in output achieved by several of the major companies has been via acquisition rather than organic. Following a substantial rise during the 1990’s, world mine production has turned static and will soon fall. A recent UBS Warburg study: “Gold Production Set to Plunge” dated 11/29/01 provides more details and amplification.

The industry’s use of “cash cost” per ounce as its principal performance metric reveals a disregard for return on investment, and partially explains the 18% expansion of global production from 1991-2001 despite falling gold prices. However, the increase of mine supply justified by cash cost thinking is but one explanation for the inadequate gold price. Two additional critical factors responsible for an oversupply of gold were the substantial growth in forward sales by the mining industry and outright sales by central banks.

Forward selling or hedging by gold companies to “lock in” margins is the antecedent of business practices adopted by Enron and other entities that prefer counter party to market risk. The architects of the gold industry’s lamentable dalliance with derivatives will engineer grief well beyond the gold sector. Financial market exposure to interest rate and foreign exchange derivatives dwarfs the notional value of gold and commodity contracts. Gold derivative traders have laden the books of their host institutions with the financial equivalent of toxic waste dumps. The intellectual basis for the existing gold derivative books, representing at least 5000 tonnes, or two year’s mine production, was a bearish view of gold and a uniformly bullish view of the dollar.

Remediation may be costly, long term, and vulnerable to periodic short squeeze attacks by those who recognize that the supply of physical gold is scarce in comparison to gold-linked paper instruments that have been supplied by bullion dealers. The illiquidity of physical gold relative to gold derivatives endangers the creditworthiness of the issuers. A substantially higher gold price is not in the commercial interest of active or former bullion dealers.

The concentration of gold derivatives in the hands of one institution cannot be comforting to central bankers who had originally lent their gold reserves to a wide array of bullion dealers. JP Morgan Chase, also a major counter party to Enron in a variety of energy derivatives, held 80% of the gold derivatives reported by the OCC (Office of Controller and Currency) as of 9/30/01. Although total gold derivatives reported to the OCC have declined from the peak levels of $87.6 billion at year-end 1999, JP Morgan held only 40% of the total that time, which was prior to the merger with Chase. The decline in OCC -reported gold derivatives from the 1999 year end peak is most likely due to an offloading of positions to a non OCC reporting entity such as Enron, an Enron-like organization, or a foreign bank. Now that many have abandoned the gold derivatives trade, it appears that JP Morgan Chase has become the rear guard to defend the derivatives universe against higher gold prices.

The same central bankers might also question the fact that the hedge books of the gold mining industry already border on negative valuations even though the dollar price of gold is languishing. Mining executives might respond that within their hedge books, the real culprits were erroneous bets on local currencies, particularly the Australian Dollar or the South African Rand. However, the same bankers might wonder why the capacity for error should be limited to currency hedges but not the gold price.

Two years after its “hedge book induced” brush with bankruptcy, Ashanti Goldfields still has a substantial book of 8.4mm ounces (down from a peak of 12.2mm ounces) despite earnest efforts to remediate and production of more than 3mm ounces during the time span. Gold hedge books in the best of all worlds, meaning a well -behaved gold price, are difficult to liquidate. The easiest, lowest cost method to repay the borrowed gold as it is mined, returning it the bullion dealer who then repays the central bank. Should sentiment turn more positive or the gold price rise, miners will accelerate deliveries into their hedge contracts. Accelerated hedge book liquidation would shrink supply and accentuate a price spike.

The intellectual rationale for gold hedging no longer enjoys enthusiastic support. As one major mine company hedger said to me recently, “ the dollar price of gold seems unable to break $250 over the last three years, despite having repeated chances to do so.” Based on a low contango, or the spread between short and longer dated interest rates, forward gold prices relative to spot have decreased to the point where short term volatility could easily wipe out the hedging premium. The mining industry has already begun to respond to these new realities by accelerating deliveries into existing hedges or by abstaining from new hedges. Slack demand has deflated the formerly thriving gold derivative trade. The list of former major bullion dealers no longer committed to the business includes CFSB, JP Morgan (Chase has assumed most of the former JPM book), J Aron (Goldman Sachs), UBS, Deutsche Bank, and Dresdner. Even though these institutions are not increasing their exposure, previously written derivative contracts survive somewhere in financial cyber space and constitute a very large stale short position. The exodus has increased the concentration of counter party risk for mining companies and central banks alike. Mining companies face the new headache of rollover risk when existing contracts with departed counter parties expire. Finally, investors have begun to differentiate between the equities of hedgers and non-hedgers. Since 1/2/01, the shares of Barrick Gold, the most prominent hedger, have underperformed declining 2% vs. a 13% gain for the XAU (Philadelphia Exchange Index of Gold Mining stocks) as of 1/22/01.

Of the three known extraordinary factors depressing the gold price in recent years; central bank selling, industry hedging, and rapid expansion of mine output, only the first remains. Central bank selling was motivated in part by a desire to diversify reserve assets away from gold. In addition, they were seeking attractive yields available from paper that could not be provided by the “sterile” metal. The banks have been so successful in accomplishing this that the US dollar represents 76% of central bank reserves (2000 BIS annual report). With dollar interest rates plummeting to barely positive real returns, it clear that this diversification has accomplished little beyond substantially increasing the risk profile of their reserve positions.

This pendulum has swung as far as possible. Look for a change in central banker sentiment towards gold and the dollar. The euro and the yen are liquid alternatives for diversification. In comparison, gold is not liquid at the current dollar price. Gold, like an extremely undervalued stock, might be seen as too difficult to position. However, the cure for illiquidity has always been a higher price. As central banks begin to act on their desire to diversify away from the dollar, gold will initially seem impractical. The practicality issue will vanish at higher prices. At a minimum, central bank selling will dwindle. More likely, sellers at low prices, the banks will become avid buyers along with the odd lotters.

With gold trading below its mining replacement cost, the factors responsible for this aberration dissipating, and a massive stale short position still outstanding, why hasn’t speculative capital been attracted to this opportunity? Perhaps it is only a matter of time. On the other hand, potential new gold longs might be put off by concerns that the gold market, is in some way, manipulated. There is ample and credible evidence of manipulation in a number of financial markets, including gold. History, however, reminds us that price manipulation is unsustainable and creates violent price adjustments when abandoned.

The mining replacement cost of gold appears to be in a range of $400-$500/oz on a sustained basis, all other things being equal. However, that range does not take into account the tendency for speculative excess to overshoot a norm. It also does not take into account factors external to the peculiarities of the gold market. A reassessment of the dollar or a displacement of the dollar by some alternative and as yet unknown reserve currency would drive the gold price well above the equilibrium range suggested, and quite likely into four-digit territory.

The Deflationary Climate

“All the factors that will lead to inflation will operate through first weakening balance sheets, whether of the private sector or of the government or both. Credit worries will mushroom, increasing the attractiveness of outside assets such as gold. Finally, the accelerating trend in the world towards the restriction of free capital movements and towards a contraction in the financial services industry in general will reduce the available alternatives to gold.” (Bernard Connolly, AIG International Research, 1/11/02)

Aggressive rate cutting by the Fed and other central banks, historically high rates of monetary expansion, and a return to deficit spending do not suggest that inflation fears are driving economic policy. Those fears have been displaced by the prospects of stagnant to non-existent growth or even worse, a self-feeding contraction of credit in which borrowers are forced to service or repay debt through sales of assets.

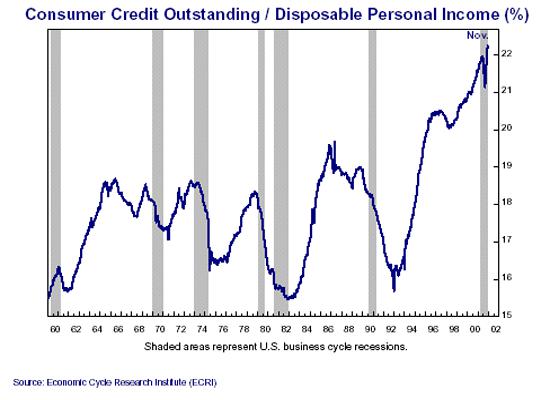

Corporate debt totaled $4.9 trillion as of 9/30/01 versus $2.4 trillion at year- end 1989. During the same period, consumer debt reached $7.9 trillion versus $3.5 trillion. The 100% plus increases in both cases far outpaced the 80% cumulative increase in GDP. During 2001, there were three times as many credit downgrades of corporate-credit ratings as upgrades, the fourth consecutive yearly drop in credit quality and the steepest decline in creditworthiness since 1991, as chronicled in a WSJ article by Gregory Zuckerman (12/31/01). Debt is greater today than when the recession started. It would be unusual for an economic recovery to commence before a cycle of debt liquidation. As the chart below shows, if the current recession is indeed ending, it would be the first time that consumer debt relative to disposable income had not declined:

The essential feature of a deflationary climate is that debt burdens drive decision making by corporations and policy makers. Too much debt causes the economy to contract because interest and principal must be serviced by asset sales. Not only do general price levels decline, but so also do asset prices including stocks and real estate. Declining lender confidence in asset values causes credit to contract further. A weak economy amplifies debt burdens by cutting income, cash flow, and expectations. The greatest threat to economic growth then becomes a psychological shift that favors debt reduction over expanded consumption or investment. That is why the current thrust of US economic policy is to reduce the real and psychological impact of debt. The sole sign of its success will be a subsequent increase in the indebtedness of all sectors. Fearing a market-driven full-blown recession, which would restore liquidity and thereby establish a sound basis for long-term expansion, policy makers prefer the short-term solution of digging an even deeper hole.

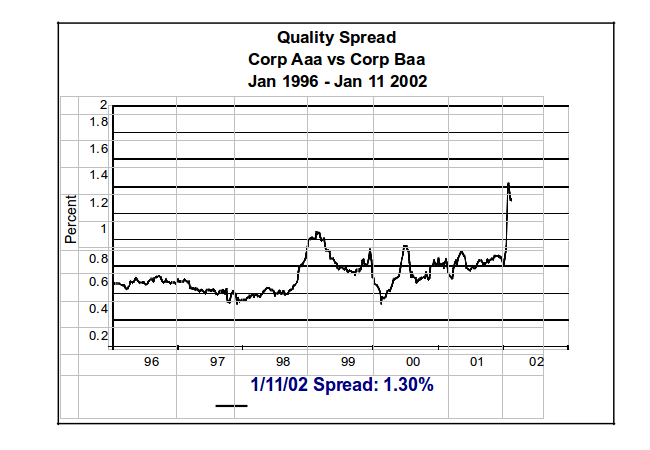

The defining feature of the current economic landscape is not the events of 9/11 but Enron. Does anyone besides TV financial network commentators believe that the use of Enron’s flawed practices were isolated? Maximum leverage and accounting deception were at the core of the 1990’s culture. Corporate icons such as IBM and GE employed these tactics as well as lesser-known entities. Enron has unleashed long simmering concerns about credit and earnings quality that will not quickly disappear. The chart below, which shows the surge in quality credit spreads, clearly depicts credit deflation:

The precipitous and wholesale abandonment of the anti-inflationary policies of the 1990’s, pivotal to the strong dollar, must suggest second thoughts to central bankers sitting on their vast accumulations of dollars. Undoubtedly, the October ’01 downgrade of the dollar by the Chinese was driven by such considerations. In case the first announcement went unnoticed, the Chinese reiterated their intentions rather loudly on January 7th 2002. As reported in the Daily Telegraph, Chinese foreign minister Xiang Huaicheng said “I will instruct the responsible authorities that they should not just have a currency basket but rather that they should buy euros as quickly as possible.” The European Commission added “China and the European Union share a joint suspicion of American ‘hegemony’ in the global economic system and have been edging toward mutual embrace for several years. Beijing has a strong interest in promoting a rival currency, but it has been waiting for evidence that the euro is a viable long-term currency before committing itself….” The Chinese apparently had fewer reservations about another alternative to the US currency. Holding more than $200 billion of US financial instruments, they have been steady, low profile buyers of gold in recent years, and have just announced an increase in their gold holdings of 120 tonnes. Chinese gold reserves now stand at 500 tonnes, still a small percentage of their total reserves.

The Chinese euro announcement preceded by a mere week another interesting downgrade by Moody’s. In the second instance, the recipient of the lower rating was the commercial paper of General Motors from P-1 to P -2. As a result, the strongest of the big three automakers can no longer market its commercial paper to money market funds at a time when growing cash losses are forcing it to rely more on external financing, even though 2001 was the second highest year on record for industry car sales. GM shares a plight similar to Ford and Chrysler, which have together steadily lost market share to foreign manufacturers since the mid 1980’s. Despite years of booming auto markets, GM’s debt has increased and profit margins have decreased.

Both the dollar and GM downgrades were brought about by the all too successful strong dollar policy concocted during the Clinton administration by Treasury Secretary Rubin and Undersecretary Summers. The key tenets of that policy were fiscal surpluses, integrated global capital markets, deregulation, free trade and low inflation. These policies were transmitted ad nauseam through the financial media. The rhetoric and theatrics of transmittal included tame inflation, low interest rates, a rising stock market, and a low gold price. The payoff was the ability to issue dollars to our trading partners without restraint. Unfettered dollar issuance, an “exorbitant privilege” in the words of Charles de Gaulle, permitted the de facto globalization of the supply chain for the American consumer and business. Access to international capacity is the real secret behind low reported inflation. Cheap capital, in the form of low long-term interest rates and lofty equity valuations, was a co-benefit of the low inflation myth. Less favorable was that the decade-long pile up of dollar indebtedness became the foundation of consumer prosperity and booming financial markets. A second unfavorable consequence was a significant deterioration of the US external financial position. Finally, the NASDAQ mania, fueled by underpriced capital, funded a sufficient quantity of uneconomic projects to cripple capital investment and credit markets for years.

Most of the fundamental underpinnings and theatrics of the strong dollar are history. They have been succeeded by down-trending stock prices, fragile consumer confidence, a stagnant economy, and plummeting productivity. Only a weak gold price and an overvalued dollar survive. The original architects and lead proponents of the strong dollar have been succeeded by a new administration, quite possibly with different thinking. That new thinking could include recognition that the quick fix to intractable economic issues would be a cheapening of the currency. Vigorous counter-deflationary policies, current and prospective, threaten to undermine the wealth of non-US investors that hold $6.4 trillion of US assets including 38% of the outstanding treasury debt, 20% of US corporate debt, and 8% of US equities.

The question remains as to against what the dollar will weaken. Neither of its principal rivals, the yen and the euro, seems appealing other than the fact that they represent liquid alternatives to the dollar. Should the expected US recovery fall short of expectations, or should a synchronized global recession prove unexpectedly prolonged, a principal casualty will be the standing and the value of the US dollar. A general downgrading of the dollar will lead to a reversal of capital flows, meaning that $ trillions of US assets held abroad will become a source of funds. A reversal of capital flows will induce a sharp decline against the euro and the yen, warts notwithstanding, and will be followed by rising interest rates, reported inflation, and a much higher gold price.

The perils of deflation are not unrecognized. In July, the NY Times noted that the strong dollar “is making exporters noncompetitive in international markets” and could in part be blamed for weak corporate profits, job losses, and faltering stock prices. In June, Bridgewater Daily Observations noted that “when economies are doing well most everyone believes in the beauty and efficiency of the free markets and free trade, but when the economy turns south people come out of the woodwork to decry the evils of unfettered markets.” (Bridgewater Daily Observations, 6/01). Among those to come out of the woodwork has been the steel industry, which has recently succeeded in paving the way for raising tariffs on imported steel by up to 40%. Free trade advocates note that the annual cost to consumers will approach $2.4 billion a year. Another recent protectionist measure was the recent passage of tariffs to limit imports of Canadian lumber. If economic weakness persists, trade barriers will proliferate.

The dilemma for economic policy is that the exigencies of combating deflation have considerable potential to undermine confidence in the dollar. Former Treasury secretary Rubin testified before Congress, “modifying our strong dollar policy could adversely affect inflation, interest rates, and capital inflows and would lessen the favorability of our terms of exchange with the rest of the world.” Despite these dangers, NY Times columnist Paul Krugman recently wrote “the strong dollar is one of the reasons the Fed is having trouble pulling us back from the brink. So right now, a weaker dollar is in America’s interests.” Krugman likens the rising dollar to a Ponzi scheme, which is about to “run out of suckers.”

Does the recently launched euro have unappreciated merits as some think? Will Japan’s fortunes take a turn for the better and lead to surprising appreciation in the yen? Either possibility has to be considered, but it seems more likely that the overcooked bull market in the dollar will unravel like NASDAQ, under the weight of its own overvaluation. As with that mania, skeptics were pariahs until the damage was obvious. Given the excessive central bank and capital market concentration in the US dollar, its extreme overvaluation relative to its counterparts, and the as yet unrecognized erosion of the dollar’s fundamentals, almost any minor event could tip psychology and trigger an Enron-like meltdown. In that scenario, holders of dollars will look for liquid alternatives and ask questions later. Central banks will suspend gold sales and balk at rolling over bullion loans. Market sentiment towards financial assets will sour further. The bear market in financial assets, already underway, will become more widely recognized.

Market Metaphysics

Markets are above all driven by psychology and emotion. The progression from the previous nadir of pessimism in 1974 to the peak bubble optimism was imperceptible in the moment but a powerful determinant of price extremes. The new economy paradigm and the love affair with technology are transient phases that will be replaced by preoccupation with as yet unidentified concerns.

There is no way to figure extremes of valuation without considering psychology and market mythology. While the usual fundamental considerations of real interest rates and earnings are starting points for valuation, expectations or beliefs as to the future course of events are decidedly non- quantitative. Since 1910, the P/E ratio of the S&P has averaged approximately 15x. In that span of more than 90 years, the P/E has exceeded 25x only six times. Bear markets typically end in single digit territory. Recent S&P P/E measures in excess of 30x suggest confidence remains unbroken by the yearlong drubbing in stocks and the recession. Meaningful change in market psychology spans decades. Shifts are imperceptible in the context of shorter- term market and business cycles. However, there is no mistaking the contrast in mood that existed at the peak of the NASDAQ bubble just a short while ago, and the mood that prevailed at the 1974 low and for several years thereafter. How markets travel from one extreme to the other is unknowable. What is clear is the preponderance of confidence or the lack of it at each extreme.

In a 1997 speech (Leuven, Belgium) Alan Greenspan stated “a nation’s sovereign credit rating lies at the base of its current fiscal, monetary, and, indirectly, regulatory policy. When there is confidence in the integrity of government, monetary authorities—the central bank and the finance ministry—can issue unlimited claims denominated in their own currencies and can guarantee or stand ready to guarantee the obligations of private issuers as they see fit.” This statement, extracted from Dr. Larry Park’s monograph “What Does Mr. Greenspan Really Think?” (see: www.fame.org), describes the essence of the strong dollar policy and suggests the pivotal condition, “confidence in its integrity” for it to remain in effect. Clearly, the highly indebted external position and continuing large trade deficit of the United States suggest that a “high level of confidence” has existed for many years.

For some time, the integrity of the gold market has been a subject of much question by a small minority who maintain an interest in such matters. Although the metal’s dollar price has been relegated to sideshow status by most, there can be little doubt the low price has been one of the most important sound bytes for mass consumption underpinning the low inflation mythology of the new economy and the strong dollar. A long-standing affectation of disinterest by officialdom and market gurus begins to resemble the famous “dog that didn’t bark” in the Sherlock Holmes mystery. Gold retains its financial market role as the “canary in the coal mine.” A sharply rising gold dollar price would send a clear message to even the most casual observer that something is awry with the Fed’s “fine tuning” of the economy and financial markets.

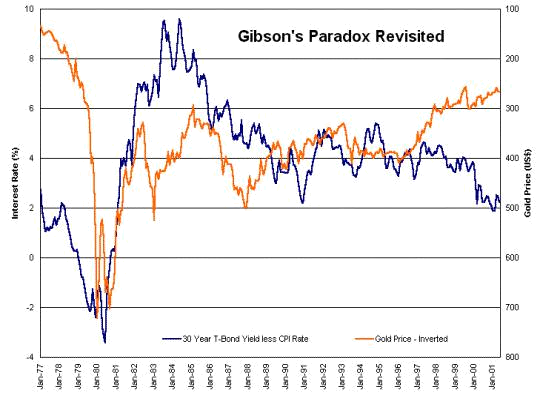

If the dollar gold price’s submissive behavior over the last five years has been the product of opportunistic interventions in the name of crisis management, admission of this would be unthinkable. In the context of world financial flows, gold is small and well within the resources of the US Treasury’s Exchange Stabilization Fund on its own, or in league with other governments and commercial interests, to manage. Undersecretary Summer’s scholarly work completed while a Harvard faculty member, “Gibson’s Paradox”, suggested that dollar gold prices would vary inversely with real interest rates as measured by 30- year bonds. However, this relationship broke down in 1996 during Summers’ tenure at the Treasury. To our thinking, there is no more powerful evidence to support the notion that the gold price has been rigged than the chart below depicting the relationship. Should the distortion of the gold market indicated by this chart come to an end, the subsequent rise in interest rates would severely undermine the viability of interest rate swap contracts. JP Morgan’s derivatives exposure of $ 30.4 trillion as of 9/30/01 and approximately 60% of the total for OCC reporting entities, is dominated by bets on interest rates. It is safe to assume that those bets don’t include interest rate levels that would accompany gold prices in excess of $400/oz.

In isolation, manipulation of the gold market might be dismissed as a well-intentioned exercise in market stability, the thought being that a misbehaving gold price would undermine the very confidence identified by Greenspan as so precious. However, to regard the manipulation of the gold price as an isolated matter would require a suspension of belief greater than for those who found value in dot com stocks. In fact, intervention in all markets including equities, bonds, currencies, and commodities has long been standard operating procedure for the Fed and the Treasury.

The invariable response to market shocks that threatened the now infamous virtuous circle of a strong currency and the bull market was decisive market intervention by the Federal Reserve and US Treasury. For example:

- Market crises triggered by the Asian meltdown, the Russian default, the collapse of LTCM, and plummeting stock prices post the NASDAQ mania, were countered by injections of liquidity by the Federal Reserve along with high profile public statements of assurance to the markets.

- The cosmetics of low inflation were fortified by debasement of Bureau of Labor Statistics inflation measures through dubious hedonic price adjustments and false productivity measures.

- A flare up in the gold price caused by a short squeeze following the Washington Agreement in 1999 was doused by fresh liquidity solicited from Kuwait, the Vatican, and Singapore. As discussed later, these maneuvers included mobilization of US gold reserves.

- The attempt to bring down long-term rates by suspending issuance of 30-year treasuries is the most recent and clumsiest of notable anti-market actions.

- In the true spirit of globalization, the government of Italy manipulated its own bond market to hide the true size of its budget deficit in order to be admitted to the European single currency. In a report published by the International Securities Market Association (November, 01), a currency bond swap was completed in 1997 to mask the true size of the country’s internal deficit. The transaction was orchestrated by Long Term Capital Management, which counted the Italian Central Bank among its clients.

Richard Russell, a veteran stock market observer recently concluded that the stock market was being manipulated: “I’ve resisted this idea for a long time, but slowly and surely I’ve come to the conclusion that yes, the Fed does step in at various times and manipulate the market…. One of those ‘manipulation junctures’ is right now. The Enron mess hit the markets, some indices that I follow were right on the edge, and ‘normally’ I would have expected the markets ….to follow through on the downside today. But lo and behold, buying came in at the opening and the market pushed higher.” He goes on to say that “all manipulation does is hold off the inevitable.”

During the Clinton administration, auctions of 30 year treasuries were scaled back, some suggested, in order to lower interest costs to the government by emphasizing low coupon short-term maturities. Perhaps at a time when a wide spread existed between opposite ends of the yield curve, this might have made sense, but how to explain the recent suspension of 30 year issues altogether? With long-term interest rates already low, many saw this move as a not too subtle attempt to manipulate long-term interest rates by creating a scarcity of paper. As quoted in Grant’s Interest Rate Observer, Ron Ryan (Ryan Labs) said, “When interest rates are low, the logical borrower wants to lock it up for as long as possible…Now they have done the Las Vegas bet that the two-year note auction rolled over 15 times, will have an average interest cost lower than the 30-year today.”

In the same article, Grant says: “A…deserving object of anger is the government’s habitual recourse to market manipulation, whether through interest rates or mind games. We cling to the view that the U.S. dollar is vulnerable to a loss of confidence, with an attendant risk of rising interest rates. Market manipulation by market manipulation, the Treasury and Fed are dissipating this confidence.”

Greenspan reveals the intellectual rationale for market interventions in his Leuwen speech: “open market operations, in situations like that which followed the crash of stock markets around the world in 1987, satisfy increased needs for liquidity for the system as a whole that otherwise could feed cumulative, self-reinforcing, contractions across many financial markets.” Events subsequent to the 1987 market crash that exceed the Fed’s pain threshold included the Asian meltdown, the Russian Defaults, the Y2K scare, the NASDAQ crash, and Enron. While Greenspan is aware that the use of sovereign credit creates moral hazard, i.e., the distortion of incentives that occurs when the party that determines the level of risk receives the gains from but is not exposed to the costs of, the risks taken, he cannot seem to find the appropriate limit for such intervention. To play it safe, the bar for intervention has been steadily lowered while the buildup of debt has multiplied systemic risk.

The Rubin/Summers Treasury and the Greenspan Fed bear the principal responsibility for creating the mania. The liberal use of sovereign credit by the Fed and Treasury over the past decade to bail out bad banks, insolvent hedge funds, and investors in foreign government paper, materially altered the calculation of risk by investors, corporations, and financial institutions. By removing the risk from serious investment mistakes, these policies incentivized the employment of excessive leverage that in turn inflated “the bubble.”

The disrespect for market outcomes reflected in US economic and financial policies is neither new nor inconsistent with the behavior of senior government officials throughout history. The London Gold Pool scheme to hold down the gold price illustrates autocratic anti -market behavior four decades ago. A striking non-economic example came with the recent release of the private tapes of Lyndon B. Johnson, which revealed that his public and private views on the Vietnam War were in complete opposition. It would seem that the grounds for distrust and cynicism are almost always present. What changes is the willingness of the public and the markets to look the other way. That willingness in turn would seem to be driven by whether the course of events appears to be satisfactory or unsatisfactory. The unwillingness of senior officials and policy makers to own up to the adverse consequences of their previous actions explains the phenomenon of digging ever-deeper policy holes. The refusal to accept the retribution of market outcomes explains a “culture of obfuscation”, to employ a former Clinton attorney’s (Lanny Davis) phrase, at the core of all scams, whether in the public or private sector.

The manipulation of the gold price, seen in the context of an autocratic inner circle of policy makers committed to nothing more than their own career advancement, seems highly plausible. The mechanics of this manipulation are murky, at best. However, valuable insight is provided by the work of James Turk in “Accounting for the ESF’s Gold Swaps” (1/7/02 Freemarket Gold & Money Report.) While his complex analysis of the mechanics and the accounting may be less than perfect, it is in my opinion substantially on the money. The bottom line is that US government official gold reserves have been mobilized through swap and loan arrangements to suppress the gold price, particularly in the aftermath of the Sept. 1999 Washington Agreement, which triggered a violent short squeeze. These arrangements in turn have been papered over and covered up by a succession of changes in financial statement nomenclature, accounting artifices, and document destruction (“That Shreddin’ Fed” by Robert Auerbach in Barron’s) reminiscent of Watergate or the most elaborate financial frauds yet known. At the end of the day, far more official sector gold appears to have been squandered to tame the dollar gold price than the generally accepted 5000 tonne short position countenanced by the Bank for International Settlements or Goldfield Mineral Services. Therefore, investors may contemplate a substantially higher dollar gold price target than previously seemed reasonable.

It is not unusual for the perception of a market, such as the dollar gold price, to lag fundamental change to a significant degree. However, the lag in this instance is especially great. Investors need to grasp not only the structural issues pertaining to the market itself, but also the interplay of these issues with the macro aspects of economic policy, currency valuation, and market psychology. This is especially difficult when significant information is withheld or obscured. In light of the substantial shift in fundamentals and the extreme lag in the recognition of these changes, the magnitude of the market adjustment is likely to be surprising. Whether the price adjustment occurs quickly or evolves over several years, the outcome will be a dollar gold price that is comfortably within four-digit territory.

The damage caused by an epic investment mania cannot be undone simply by a one or two year decline in stock prices. A mania causes a vast misallocation of capital. Over investment in high tech was only the most visible manifestation of this capital misallocation. On the other side was under-investment in key areas. We are saturated with computers, cell phones, SUV’s, casinos, lawyers and debt, but there will be shortages of basic materials and industrial capacity when the dollar loses its preeminent status.

What produced the giddy valuations of the mania in part was investor confidence that highly competent management of the economy had produced a new era of business cycle stability, low inflation and continuous growth. In fact, these expectations rest on policies that have increasingly painted their proponents into a corner. In order to maintain credibility, ever more transparent manipulations will be called for and resorted to. In the process, credibility will be destroyed. To quote Grant again, “Mr. Greenspan has become a living symbol of the efficacy of price fixing. But it’s likely that sometime before his career is over, he will become a symbol of the futility of that black art.” (WSJ 4/01)

Greenspan epitomizes the vigorous anti-market culture that has become entrenched at the core of economic policy making. Operating in the shadows of constitutionality, a “plunge protection team” consisting of Rubin/Summers/Greenspan “clones” monitors world financial markets contemplating the need for introducing US sovereign credit to achieve acceptable outcomes. The team was an organic outgrowth of the 1990’s climate of morality that legitimized and institutionalized deception and obfuscation. The intellectual heritage of this group is more in sync with the central planners of the former Soviet Union than with the free market champions they are perceived to be. Unlike their Soviet counterparts, the plunge protection team operates outside the realm of established government institutions and accountability. However, the fate all central planners share is the certitude that market forces will topple their designs.

Conclusion

The new economic paradigm is that credit deflation begets inflationary outcomes. Gold, far from being irrelevant and antiquated, is the ideal lens through which to appraise this reality. As perfect credit, it will become more highly valued when investors attempt to shed assets impaired by decades of imperfect credit. A four -digit handle on the dollar gold price will signify not that the markets love gold. Instead, it will mean that they despise the alternatives. There is no specific reason to think that the movement in this direction should be precipitous. Bear markets have a way of taking their time, the better to deceive and to entrap as many as possible. Those who believe a business upturn will end the bear market will be among them. While there may appear to be no particular rush, violent shifts in market views usually come with little warning. An allocation in favor of gold would seem to be timely. The dollar’s days as the premier global reserve currency are numbered. The repercussions of a dollar revaluation will be profound and long-lived. It is not too soon for investors to assume defensive positions in light of these prospects and it will not be long before they discover that gold is a core component of investment defense.

John Hathaway

January 22, 2002

© Tocqueville Asset Management L.P.

This article reflects the views of the author as of the date or dates cited and may change at any time. The information should not be construed as investment advice. No representation is made concerning the accuracy of cited data, nor is there any guarantee that any projection, forecast or opinion will be realized.

References to stocks, securities or investments should not be considered recommendations to buy or sell. Past performance is not a guide to future performance. Securities that are referenced may be held in portfolios managed by Tocqueville or by principals, employees and associates of Tocqueville, and such references should not be deemed as an understanding of any future position, buying or selling, that may be taken by Tocqueville. We will periodically reprint charts or quote extensively from articles published by other sources. When we do, we will provide appropriate source information. The quotes and material that we reproduce are selected because, in our view, they provide an interesting, provocative or enlightening perspective on current events. Their reproduction in no way implies that we endorse any part of the material or investment recommendations published on those sites.

View PDFPoplar Forest

You are about to leave the site of Tocqueville Asset Management, L.P. The link you have accessed is provided for informational purposes only and should not be considered a solicitation to become a shareholder of or invest in the any mutual fund managed by Tocqueville Asset Management, L.P. Please consider the investment objectives, risks, and charges and expenses of any mutual fund carefully before investing. The prospectus contains this and other information about the Funds. You may obtain a free prospectus by downloading a copy from the Poplar Forest (www.poplarforestfunds.com), by contacting an authorized broker/dealer, or by calling 1-877-522-8860. Please read the prospectus carefully before you invest. By accepting you will be leaving the site of Tocqueville Asset Management, L.P.

Tocqueville Funds

You are about to leave the site of Tocqueville Asset Management, L.P. The link you have accessed is provided for informational purposes only and should not be considered a solicitation to become a shareholder of or invest in the any mutual fund managed by Tocqueville Asset Management, L.P. Please consider the investment objectives, risks, and charges and expenses of any mutual fund carefully before investing. The prospectus contains this and other information about the Funds. You may obtain a free prospectus by downloading a copy from the Tocqueville Funds website (www.tocquevillefunds.com), by contacting an authorized broker/dealer, or by calling 1-800-697-3863. Please read the prospectus carefully before you invest. By accepting you will be leaving the site of Tocqueville Asset Management, L.P.