Subscribe to Our Insights

Thought Leadership

Let’s Get Physical

By John Hathaway on December 12, 2012

Money printing by world central banks, it would seem, has propelled the prices of all things rare. The list includes fine art, vintage wines and antique sports cars. It is front page news that the flood of paper money has enhanced the quotation of almost any tangible asset perceived to be in scarce supply. In a 11/23/13 article, The Economist reports: “Evermore wealth is being parked in fancy storage facilities….The goods they stash in freeports range from paintings, fine wine and precious metals to tapestries and even classic cars.” The article observes that a key factor fuelling “this buying binge…is growing distrust of financial assets.” It doesn’t hurt that the prices of most of these items have trended steadily higher in price over the past decade.

Most intriguing in this array of ascendant alternative assets, however, is the crypto currency known as Bitcoin, whose advocates offer a rationale that is striking in its parallel to that for holding gold bullion. Bitcoin, as almost everyone knows, is a liquid transactional medium of strictly limited supply. The parallel breaks down, of course, when it comes to price behavior of these two otherwise similar alternative currencies. The price of a Bitcoin has increased to $975/coin (Mt. Gox 12/10/13) from less than $25 in May 2011. At the end of May 2011, bullion traded near $1500/oz, and is quoted today at a price that is 17% lower.

The supply of gold has increased over the past two years by 180 million ounces. As an increment to the existing stock of above ground gold, the percentage works out to about 1.5%/year. In the meantime, the US monetary base increased 14%, or an annual rate of 6.7%.

The supply of Bitcoins is fixed at 21 million. There are 11.5 million in circulation. Mining new Bitcoins requires incrementally more massive upgrades in computing power. According to Raoul Pal’s Global Macro Newsletter of 1/11/13 as seen on Zero Hedge, Bitcoin’s success is due to the fact that “the man in the street understands that central banks and governments are going to take their money via confiscation or default or devaluation and it (Bitcoin) is their way of voting against it and them.”

The man in the street has apparently overlooked the similarities between gold and Bitcoin. The future supply of newly mined gold would seem to be in jeopardy if current pricing holds. The same cannot be said for US dollars. While mine output may continue for a year or two at the current pace, production post 2015 seems set to decline and perhaps sharply. Discovery of new gold bearing ore bodies is down sharply. Miners are challenged by declining grades, poor investment returns, worsening access to capital, and increasing risks due to political instability in gold producing countries, rising tax burdens and growing permitting challenges. At current prices, most gold mining companies are barely breaking even on an “all-in” cost accounting basis.

The Bitcoin-gold incongruity is explained by the fact that financial engineers have not yet discovered a way to collateralize bitcoins for leveraged trades. There is (as yet) no Bitcoin futures exchange, no Bitcoin derivatives, no Bitcoin hypothecation or rehypothecation. In 2000, gold expert Jeff Christian of the CPM Group wrote:

Imagine, if you will, that the (bullion) bank can line up three or more producers and others who want to borrow this gold. All of a sudden, that one ounce of gold is now involved in half a dozen transactions. The physical volume has not changed, but the turnover has multiplied. This is the basic building block of bullion banking.” (Bullion Banking Explained – February 2000). He went on to say that “many banks use factor loadings of 5 to 10 for their bullion, meaning that they will loan or sell 5 to 10 times as much metal as they have either purchased or committed to buy. One dealer we know uses a leverage factor of 40.

The buying and selling of paper gold is the traditional business of bullion banking. It is the core of how business is conducted in the world of gold. Gold miners mine and concentrate gold ore. They send concentrates from the mine site to refiners who purify the ore into bars that are 99.99% gold. Refiners remit cash to the mining companies crediting them for gold content in the ore minus impurities. Refiners sell their gold bars, typically to bullion banks in London, where the physical gold is received for deposit in allocated or unallocated pools and held for distribution to users such as the jewelry trade, industry or mints. The physical gold that remains in London as unallocated bars is the foundation for leveraged paper gold trades. This chain of events is perfectly ordinary and in keeping with time honored custom.

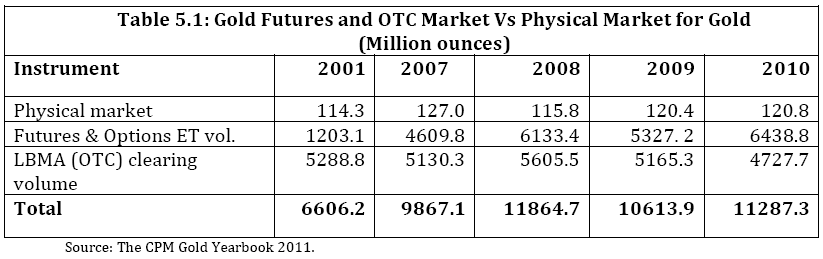

What is interesting, and perhaps not surprising, is the way in which a solid business model has been perverted by extraordinary leverage into an important, unregulated trading profit center for large banks and hedge funds wholly unrelated to the needs of miners, jewelry manufacturers, and other industrial users. In its 2013 study related to gold, the Reserve Bank of India (RBI) commented: “In the Financial Markets, the traded amount of “paper linked to gold” exceeds by far the actual supply of physical gold: the volume on the London Bullion Market Association (LBMA of which the RBI is a member) OTC market and the other major Futures and Options Exchanges was over 92 times that of the underlying Physical Market.”

The LBMA reported that average daily volume of gold cleared in June 2013 was 29 million ounces, a new record. The LBMA estimated in 2011 that trading was 10x clearing volume. Assuming this ratio has held over the past two years, trading volume is the equivalent of 9000 metric tons of gold on a daily basis, compared to annual mine production of 2800 metric tons.

Compliant and unwitting central banks leave much of their gold on deposit in London, to be “managed” by the Bank of England, presumably to produce earnings on an otherwise dormant asset. For example, the central banks of Finland and Sweden announced last month that approximately half of their gold was somewhere in London earning something. Reassuring language from the Bank of Finland suggested that “the risks associated with gold investments are controlled using limits, investment diversification and limitations regarding run times.”

It would not be surprising if “run times” on leasing arrangements of central bank gold span decades. 1970’s documents recently declassified or otherwise unearthed contain extensive discussions among high level policy makers including Volcker, Kissinger, Arthur Burns and others expressing various concerns over the implications of a rising gold price. The policy objective in those days was to establish the SDR and the US dollar as the foundation of a “durable, stable (international financial) system”, an objective which was deemed “incompatible with a continued important role for gold as a reserve asset.” It was therefore resolved to “encourage and facilitate the eventual demonetization of gold …and (to) encourage the gradual disposition of monetary gold through sales in the private market.” (from a 1974 memo written by Sidney Weintraub, Deputy Assistant Secretary of State for International Finance and Development to Paul Volcker, Under Secretary of the Treasury for Monetary Affairs).

At the November, 2013 Metals and Mining Conference in San Francisco, keynote speaker Ron Paul and former lawyer to Governor Ronald Reagan, Art Costamagna, reminisced about their service together for the 1981-1982 Reagan Gold Commission. They noted that the Commission was not allowed to initiate an audit of the Fort Knox gold depository. Paul stated from the podium that no member of Congress has any real information on the status of that gold. He believed that the gold was still physically located at Fort Knox but most likely encumbered by complex derivative transactions.

Several observers have noted the difficulty Germany has encountered in requesting the repatriation of its gold held on deposit at the New York Fed. A return of physical gold that could be easily accomplished in two trans-Atlantic cargo flights must be stretched out over seven years, Germany was informed by the custodian of their gold, the New York Fed. However, the Germans were cordially invited to view their gold bars in the meantime. The reasons for the stretched out delivery schedule are not given by government officials, but we surmise that the difficulty relates to the unwinding of a web of leasing arrangements in which specific bars have been re-hypothecated, perhaps hundreds of times, over many decades. Who knows what counter parties were involved, not to mention their obligations or responsibilities?

One wonders whether the German request was the beginning of a run on the institutional arrangements that govern global depositories of unallocated physical gold. For those of us who have cheered the withdrawl of physical collateral from the system because of its potential tightening effect on derivative transactions, the short term effect may have been to depress the price of paper gold because there is less physical to support the frenetic trading of paper reported in the financial media. The shrinkage of collateral availability may be analogous to a contraction of credit which in a general sense drives down asset prices. At the end of credit liquidation cycles, however, collateral seems to wind up in the strongest hands. While most of the trading in paper gold nominally takes place on Comex, there is a parallel and much larger over the counter and derivatives market based in London where physical trades are also settled. The LBMA vets refiners, dealers, bar purity and other technical matters. It is a trade organization consisting of 143 members ranging from bullion banks, central banks, fabricators, refiners, and brokers who have some participation in the settlement of physical and paper trades. LBMA reports the results of the two daily London Gold Fixes but otherwise has no substantive input, supervisory or regulatory. According to a 11/26/13 Bloomberg dispatch, the fix is controlled by London Gold Market Fixing Ltd, an entity owned by five bullion banks. While the process is unregulated, one of the member banks went on the record for Bloomberg stating that the company has a “deeply rooted compliance culture and a drive to continually look toward ways to improve our existing processes and practices.”

From a regulatory point of view, the City of London is an entity unto itself, with a peculiar and special status, incorporated separately from greater London. It is the birthplace of the offshore banking industry and, as described by Nicholas Shaxson, author of Treasure Islands, the city “provides endless loopholes for U.S. financial corporations and many U.S. banking catastrophes can be traced substantially to those companies’ London Offices.” A July, 2010 Working Paper titled “The (sizable) Role of Rehypothecation in the Shadow Banking System” asserts that in the UK, an “unlimited amount of the customer’s assets can be rehypothecated and there are no customer protection rules.” (Rehypothecation occurs when the collateral posted by a prime brokerage client (e.g., hedge fund) to its prime broker is used as collateral also by the prime broker for its own purposes.) The London offices of AIG, JP Morgan, MF Global and others took advantage of the local “regulation lite” to fund off balance sheet ventures that would ultimately impair corporate and customer credit. It would be hard to imagine that the culture of the City did not extend to gold. In fact, the intersection of the shadow banking system and the pool of unallocated bullion does much to explain the proliferation of paper gold supply.

For the moment, the primary function of the paper gold market appears to be to enable macro hedge fund traders to express bets on the likelihood and timing of tapering the pace of quantitative easing. Made possible by lax oversight, weak accounting systems and otherwise dubious connections to underlying physical, the paper gold market offers substantial capacity for money flows wishing to take a stance on the expected shift in Fed policy. Unlike the physical gold market, which is not amenable to absorbing large capital flows, the paper market through nearly infinite rehypothecation is ideal for hyperactive trading activity, especially in conjunction with related bets on FX, equity indices, and interest rates.

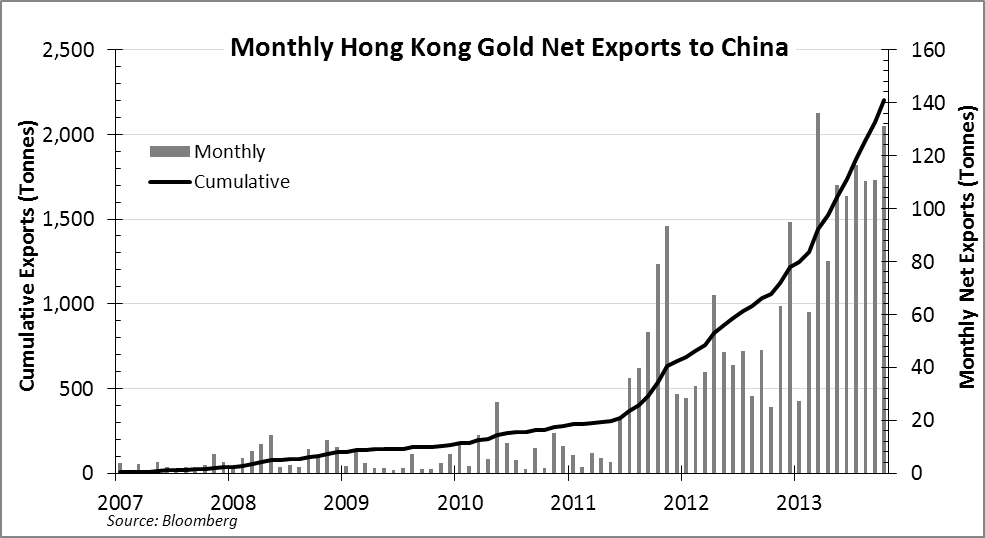

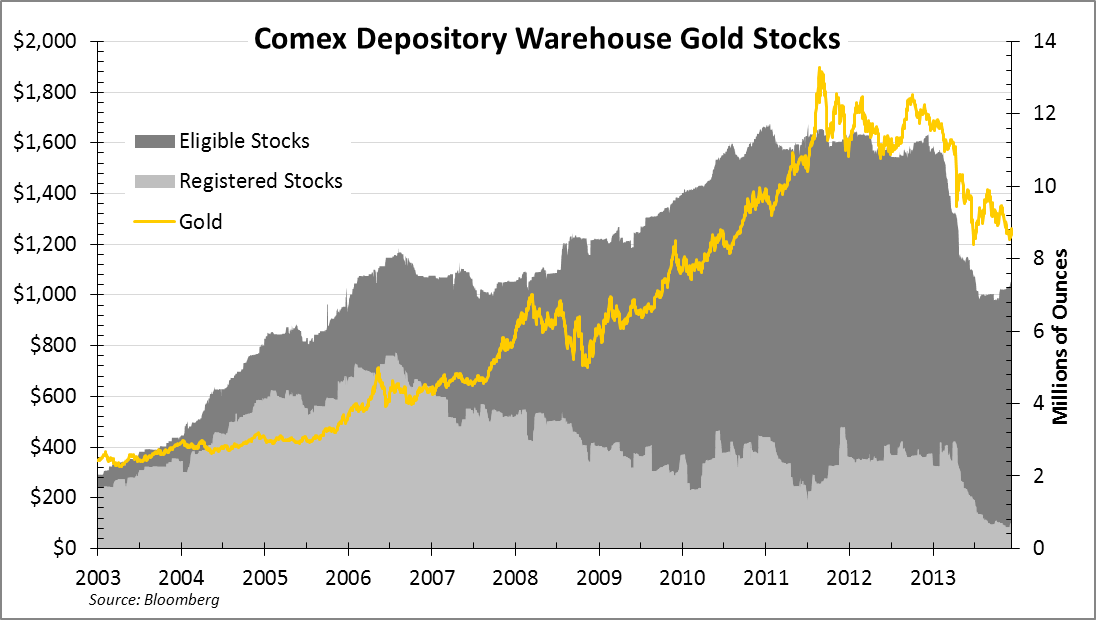

Are high frequency and algorithmic traders that account for over 90% of the futures volume currently having a field day with this worn out trade paying any attention to the steady drain of physical gold on which their speculations are based? As is usually the case in a temporarily successful momentum trade where almost the entire universe is aboard, the answer is probably not. The precipitous 2013 drop in Comex warehouse stocks and ETP holdings has been widely reported. It is also well known that physical gold is showing up in record amounts in China. The manager of one of the largest Swiss refiners stated (12/10/13-In Gold We Trust website) that after almost doubling capacity this year, “they put on three shifts, they’re working 24 hours a day,….and every time (we) think it’s going to slow down, (we) get more orders…..70% of their kilo bar fabrication is going to China.” In his 37 years in the business, he has never experienced this degree of difficulty in sourcing physical metal. In some cases, they are recasting good delivery bars from the 1960’s. He added that there is no evidence of any return of these massive import flows back into Western hands.

China appears to be bent on becoming a dominant force in the physical gold market. There are eight refineries in mainland China converting 400 oz. London good delivery bars into Kilo bars, the preferred format in Asia. An increasing flow of physical is bypassing London and going straight to China. China has not shown its hand in the official sector. At last report (five years ago), China holds only 1000 tonnes of gold in official reserves. Current market weakness certainly benefits large buyers of physical as well as their fiscal agents in Western financial markets. China may be attempting to help their cause by understating import levels and by overstating domestic production. The CEO of a major Canadian mining company, whose research group has done due diligence on every existing producing mine of significance in the world, including China (over 2000 properties globally) believes that domestic Chinese production is less than half of what is reported officially. We have also heard credible stories from other mining executives to the effect that short reserve lives will mean a significant decline in future domestic production. Also uncaptured in Hong Kong import numbers are direct shipments from Russian production, which are said to be conveyed by the Chinese military. The Chinese government continues to encourage its citizens to buy physical gold, but why? Our guess is that Chinese policy makerss take a different view of the future price than Western hedge funds, and we suspect they have a superior grasp of where the gold price is headed.

Rising demand for physical is not simply an Asian phenomenon. The December 3, 2013 U.S. Commodity Futures Trading Commission report shows that commercials, the category which includes bullion banks, have substantially reduced their massive short exposure over the past year while the short exposure of large traders, mainly hedge funds have approached record highs for 2013. The CFTC bank participation report which includes 20 banks shows a swing from a net short position in December 2012 of 106,400 contracts to a net long position of 57,400 contracts for December 2013. Long contracts held by bullion banks are being used to claim physical gold stored at Comex warehouses. JP Morgan accounted for more than 90% of December deliveries. The category of registered bars which must be delivered upon notice stands at a two year low and is not far from a ten year low.

It seems to us that the physical flows we have outlined cannot be supported by new mine supply or scrap only. In our view, these flows could only be accommodated by a significant amount of destocking, the prime source of which would appear to be vaults of unallocated gold in London. While it appears that Western traders don’t seem to mind if their paper claims have a credible backing by physical, we can think of three reasons why this may change and lead to an epic short squeeze: regulatory scrutiny, suspect bookkeeping, and the realization that cash (in the bank) may no longer be king.

1. The limits to leverage are unknown as are the potential flashpoints to collapse the pyramid. The disappearance of collateral may have depressed gold prices in the short term, assuming there is any integrity to the requirements for collateral backing. It is only our speculation, but we believe that increased regulatory scrutiny could provide a major splash of cold water. Such scrutiny could lead, among others things, tighter standards for collateral, rules on rehypothecation, etc. This could well lead to a scramble for physical.

On 11/19/13, the UK Financial Conduct Authority announced that it is reviewing gold benchmarks as part of their wider probe on how global rates are set. Why should the gold market be excluded from review when many of the bullion banks have already been found guilty and paid fines for the manipulation of Libor, energy, biofuels, and aluminum prices or benchmarks? On November 27th, the German financial watchdog, BaFin, announced it was looking into allegations of possible manipulation by banks in gold and silver price-fixing. A WSJ 11/29/13 article began with the innocuous headline: “UBS to Restructure Foreign-Exchange Unit.” The bank is rolling its foreign-exchange and precious metals business into another unit, with the co-head of the unit stepping down to explore “other opportunities in the bank.” In addition to other actions, the bank has also “clamped down on the use of electronic chat rooms by its staff. Chat rooms face scrutiny from regulators as venues for potential collusion and market manipulation.”

On December 5th, Deutsche Bank announced that it would cease trading energy, agriculture, base metals, coal, and iron ore, while retaining precious metals and a limited number of financial derivatives traders. It cited mounting regulatory pressure.” It is more than curious that a similar announcement from JP Morgan in July of 2013 noted that the bank’s exit from commodities trading did not include an exit from precious metals. The exclusion of gold from the newly enacted Volcker rule is the reason these banks are able to retain their precious metals proprietary trading activities. It appears that in the eyes of Washington policy makers, all commodities are not created equal.

In the US, regulators including the US Federal Energy Regulatory Commission are “aggressively targeting uneconomic trading in a crackdown on potential market manipulation” according to Shaun Ledgerwood, senior consultant at the Brattle Group. From his June 2013 white paper, Uneconomic trading, market manipulation and baseball: “A key common feature …is that trades used to trigger the alleged schemes were designed to lose money on a stand-alone basis, while benefiting related physical or financial positions.”

The CFTC is examining position limits on spot trades for gold and other precious metals. CFTC Commissioner Gensler’s deadline for a resolution of the issue is Q1 2014. Among the issues to be settled is how to account for entry of orders by affiliated entities, an area of suspected potential abuse. In question also is whether new Comex position limits, should they be imposed, apply to trades settled in London. The CFTC board is in transition due to the departure of Gensler and two other vacancies on the five member body. Therefore, it remains to be seen when the Commission will act on this issue. Nevertheless, we think that the discussion surrounding the surfacing of this issue is constructive and that the potential enactment of more restrictive rules on limits could be positive development in the direction of more orderly trading. It should come as no surprise that bullion banks are lobbying hard against position limits.

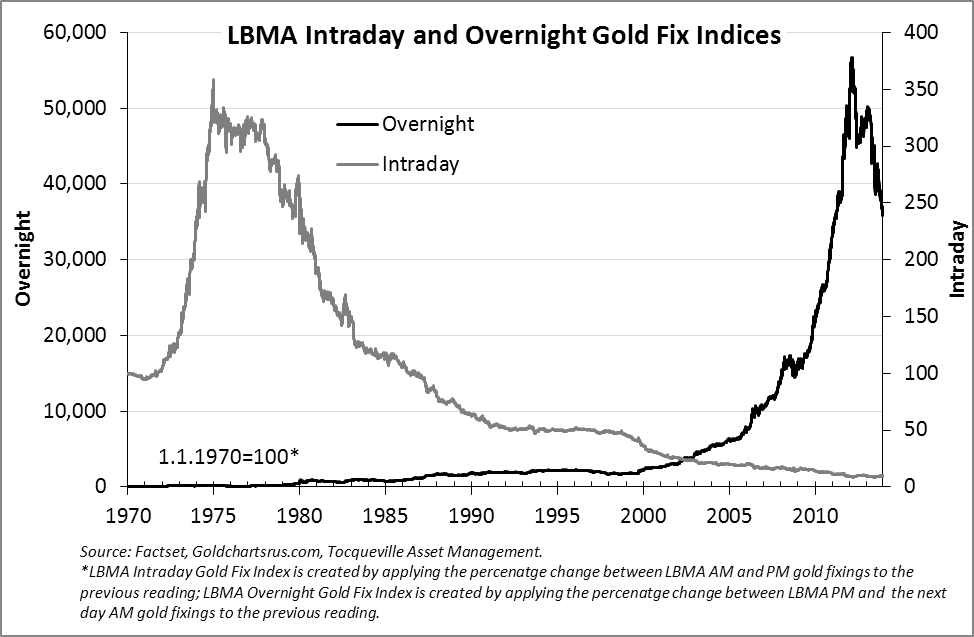

The cumulative discrepancy since 1970 between paper markets in the West and physical markets in the East is displayed in the chart below. It is difficult to fathom how such a discrepancy can exist in the same asset. It is a mystery that we expect might be of interest to the appropriate regulators.

Where scrutiny and possible new regulation leads and what it means for the gold market is only a speculation at this stage. However, we speculate that it will result in a big win for those of us who remain bullish on the future price. In the words of former Supreme Court Justice Louis Brandeis, “sunlight is the best disinfectant.”

2. The intermediation arrangements between the physical and paper gold markets may come under scrutiny for reasons other than regulatory oversight. The LBMA, Comex, and even gold backed ETFs depend on market trust in the ability of owners of paper claims to exchange those claims for physical gold. For unallocated bars vaulted in London, the complexity of cross ownership claims and entitlements to the underlying physical must be bewildering in light of the amount of re-hypothecation necessary to support the kind of frantic trading activity reported by the LBMA. It would not seem out of order to ask whether there are parties asleep at the switch on both sides of the trade – the central banks who lease gold into the pool, and the bullion bank back offices in charge of record keeping. Cutting corners in procedures to protect the chain of ownership of physical to speed transactions to support a pyramid of leverage is not an unreasonable nightmare to awaken central bank custodians whose principal charge is asset protection. Does anyone in bullion banking recall robo mortgage signing?

The pool of unallocated gold bullion in London is the center of the bullion banking system. The gold is vaulted at multiple locations in the hands of separate institutions. Disclosure is minimal and to our knowledge there has never been a comprehensive audit of the bullion and, more important, the systems on which the clearing process is dependent. We have heard instances of where private requests for delivery of allocated gold have been refused. While it is a simple matter for an owner of allocated gold bars to view the metal and check bar numbers against a statement of ownership, it is an entirely different matter to prove solitary unencumbered ownership. It is a matter of trust.

We believe that the very real possibility of an indecipherable web of multiple claims on the same bar of gold should concern both central bank owners, grass roots constituents of politicians in Europe and elsewhere pushing for repatriation, and private investors who hold paper claims against the metal. The potential for slipshod book keeping is a legitimate issue that could lead to a significant decrease in the amount of central bank gold available for lease.

3. The risk of holding a significant portion of personal wealth within the framework of conventional banking and securities arrangements is on the increase. Simon Mikhailovich of Eidesis Capital LLC states in the November 15 issue of Grant’s: “In the old framework, cash was a risk-free asset. In the new paradigm of systemic risks, no asset (even cash) is risk-free so long as it is in custody of a financial institution. Investors and depositors no longer have clear title to their own assets if they are held in financial accounts. There is now a body of law (including Dodd-Frank) that allows custodial assets to be swept into the bankruptcy estate and be subordinated to senior claims.” Hand in hand with the evolution of the banking laws is the subtle but pernicious evolution of the practice of banking: “Various rules and practices have made it almost impossible to use cash and securities. Go try to make large cash withdrawal or cash deposit and see what paperwork you would be forced to complete.”

Should we worry about cash in the bank? Never mind that policy makers and respected private economists are openly campaigning to debase paper currency. “In Fed and Out, Many Now Think Inflation Helps” was the headline for a New York Times article on 10/26/13. “(Fed) critics, including Professor Rogoff, say the Fed is being much too meek. He says that inflation should be pushed as high as 6% a year for a few years.” In addition, there are calls for outright taxes on wealth and movement towards a cashless society in which all money would be electronic. In his recent speech before the IMF, Lawrence Summers stated that electronic money would “make it impossible to hoard money outside the bank, allowing the Fed to cut interest rates to below zero, spurring people to spend more.” Cash and securities within banking and securities institutions are visible forms of wealth. Liquid private wealth captured in electronic form offers endless possibilities for wealth redistribution and other social engineering schemes. Tangible assets that are not securitized or digitized are less visible and therefore less vulnerable to broad edicts targeting private wealth.

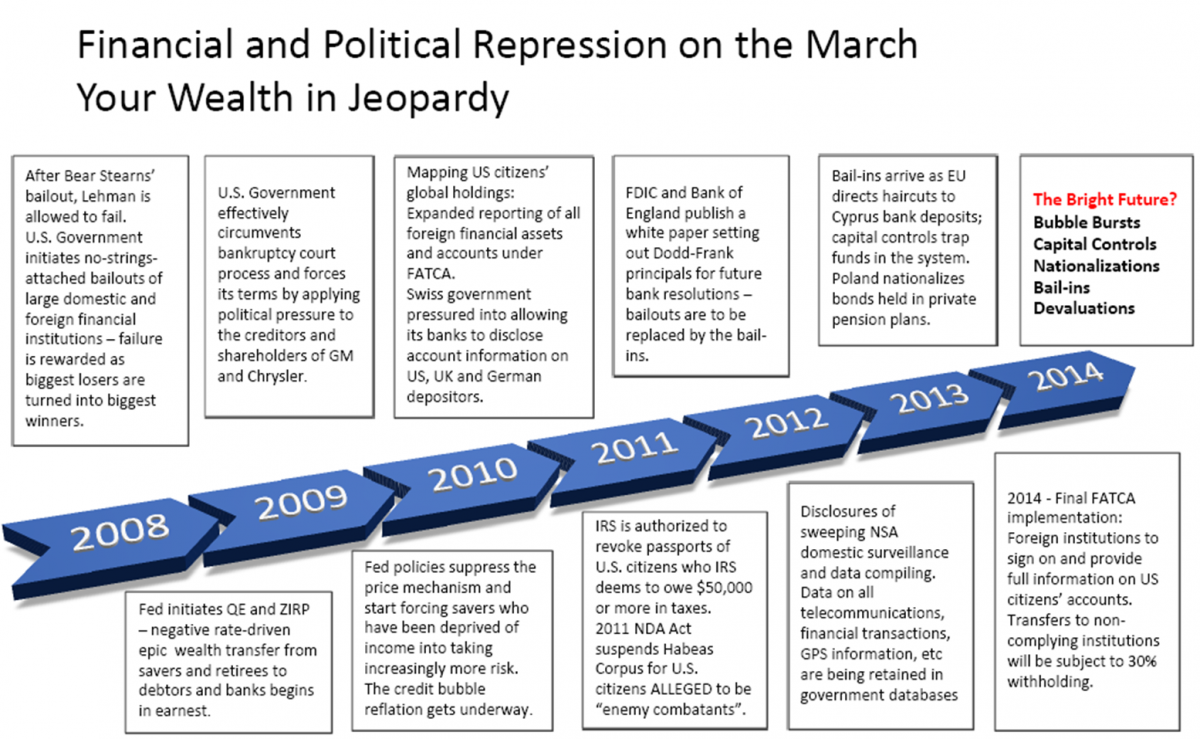

The same Mr. Mikhailovich notes that during the financial crisis of 2008, public policy was mostly an ad hoc reaction to a cascade of emergencies. Since then, policy makers have had plenty of time to plan orchestrated responses to circumstances similar or worse. In a series of steps, many small and some large, almost always cloaked in complexity and obscurity, and always in the name of public interest or national security, policy makers have constructed mechanisms that are substantially and substantively unfriendly to private wealth:

Western investors seem to view gold only as a directional bet based on considerations ranging from micro economic (supply and demand) to macroeconomic (money debasement, fiscal disorder etc.) In our opinion, this view only partially explains what drives long term gold demand. We have always thought that the larger and more encompassing driver was wealth preservation. Gold is insurance against unforeseen events. It is the one tangible asset that is both truly liquid and that can most reliably provide buying power during times of crisis. In this context, the idea of selling it for a “profit” seems absurd. Physical gold is a reserve of liquidity, and it seems inappropriate to think of it as a way to buy a container of milk or a gallon of gas under emergency conditions. For notional apocalyptic purposes, a carton of Marlboros or case of Glenfiddich is better suited than ingots or coins to pacify the hordes of barbarians at one’s doorstep. However, for preservation of large scale wealth over generations there is no substitute. Gold does what expensive homes, crates of Picassos, safe deposit boxes packed with Rolexes, or a garage full of Aston Martin DB 7’s cannot…..morph quickly and easily into liquid buying power, with no haircut, when it matters the most.

Paper claims on gold will always serve well for trading/ gambling purposes. For those who wish to make directional bets on the future gold price, bullish or otherwise, futures contracts, ETP’s, or other paper derivatives, there is no need to hold physical gold. In fact, one could categorically state that physical gold is not for traders. However, time and again throughout history, usually over a weekend, paper claims have been rendered non-functional, useless or worthless. Banks may shut down, securities exchanges may stop trading, wire transfers may be blocked, arrangements may be suspended, or laws may change. The rhyming of history is not limited to far away places such as Cyprus, Poland, or Ireland. Recall the words of President Nixon (Sunday, August 15, 1971):

In recent weeks, the speculators have been waging an all-out war on the American dollar….I have directed Secretary Connally to suspend temporarily the convertibility of the dollar into gold….Let me lay to rest the bugaboo of what is called devaluation.

An article in The Wall Street Journal Op Ed piece on 11/29/13, Romain Hatchuel wrote: “From New York to London, Paris and beyond, powerful economic players are deciding that with an ever-deteriorating global fiscal outlook, conventional levels and methods of taxation will no longer suffice. That makes weapons of mass wealth destruction—such as the IMF’s one-off capital levy, Cyprus’s bank deposit confiscation, or outright sovereign defaults—likelier by the day.” The two year long decline in the gold price has been largely explained in terms of the likelihood of Fed tapering and by inference the return to normal economic conditions for the global economy. Nothing could be further off the mark, in our opinion. It seems to us that the decline, initially a reaction to an overbought spike hyped by headlines of a government shutdown in August of 2011, gained momentum as macro traders saw selling and shorting gold as a vehicle to express views on tapering, Fed policy, jobs reports, and the health of the US economy. It makes perfect sense that confidence in the restoration of normalcy in monetary policy would be bad for gold. It appears to us that the pressure on gold is part of a vast macro trade involving the dollar, interest rates and stocks, with a script that seems to rely in part on encouragement from the official sector and in part on pure fantasy. As the short game gathered momentum, vested interests in lower gold prices have become powerful and entrenched.

The money printing thesis has been supportive of almost every tangible asset deemed to be of limited supply except for gold, a glaring exception. The explanation for the incongruity, in our opinion, is warp speed rehypothecation via the shadow banking system of the murky pool of London’s unallocated gold to create artificial supply of this scarce asset. The murky pool which is the foundation for this trade is draining, perhaps quickly, while the party goes on for the gold bears. The set up for a short squeeze of this overcrowded trade and market reversal seems compelling. Catalysts are awaited and as yet unknown, but in our opinion, it will not take much of a spark to inflict serious damage. A reversal will lift not only the gold price but that of the beleaguered gold mining sector where substantive and positive change has been occurring unnoticed by most investors.

In the financial markets, a person that is one step ahead of the crowd is considered a genius, but two steps ahead, a crackpot. Call us the latter, or just resolute, but we hereby go on record as downgrading the sovereign debt of all democracies to junk status. It seems to us that restoration of sustainable fiscal order remains a long shot and that money printing, thought by most to be only an emergency measure, will become the norm. Our negative view on the prospects for fiat currency has not been invalidated by the steep two year decline in gold price. When the market reverses, the diminished physical anchor to paper claims, concerns over title and encumbrances on central bank bullion, and worries over the drift of public policy will drive liquid capital into gold. However, this time around, it seems to us that the major recipient of flows will be the physical metal itself. Holders of paper claims to gold will receive polite and apologetic letters from intermediaries offering to settle in cash at prices well below the physical market. To those who wish to hold their wealth exclusively in paper assets, implicitly trusting the policy elites to resurrect normally functioning capital markets and economic conditions, we say good luck. For those who harbor doubts on such an outcome, we say get physical.

Best regards,

John Hathaway

Portfolio Manager and Senior Managing Director

December 12, 2013

© Tocqueville Asset Management L.P.

This article reflects the views of the author as of the date or dates cited and may change at any time. The information should not be construed as investment advice. No representation is made concerning the accuracy of cited data, nor is there any guarantee that any projection, forecast or opinion will be realized.

References to stocks, securities or investments should not be considered recommendations to buy or sell. Past performance is not a guide to future performance. Securities that are referenced may be held in portfolios managed by Tocqueville or by principals, employees and associates of Tocqueville, and such references should not be deemed as an understanding of any future position, buying or selling, that may be taken by Tocqueville. We will periodically reprint charts or quote extensively from articles published by other sources. When we do, we will provide appropriate source information. The quotes and material that we reproduce are selected because, in our view, they provide an interesting, provocative or enlightening perspective on current events. Their reproduction in no way implies that we endorse any part of the material or investment recommendations published on those sites.

View PDFPoplar Forest

You are about to leave the site of Tocqueville Asset Management, L.P. The link you have accessed is provided for informational purposes only and should not be considered a solicitation to become a shareholder of or invest in the any mutual fund managed by Tocqueville Asset Management, L.P. Please consider the investment objectives, risks, and charges and expenses of any mutual fund carefully before investing. The prospectus contains this and other information about the Funds. You may obtain a free prospectus by downloading a copy from the Poplar Forest (www.poplarforestfunds.com), by contacting an authorized broker/dealer, or by calling 1-877-522-8860. Please read the prospectus carefully before you invest. By accepting you will be leaving the site of Tocqueville Asset Management, L.P.

Tocqueville Funds

You are about to leave the site of Tocqueville Asset Management, L.P. The link you have accessed is provided for informational purposes only and should not be considered a solicitation to become a shareholder of or invest in the any mutual fund managed by Tocqueville Asset Management, L.P. Please consider the investment objectives, risks, and charges and expenses of any mutual fund carefully before investing. The prospectus contains this and other information about the Funds. You may obtain a free prospectus by downloading a copy from the Tocqueville Funds website (www.tocquevillefunds.com), by contacting an authorized broker/dealer, or by calling 1-800-697-3863. Please read the prospectus carefully before you invest. By accepting you will be leaving the site of Tocqueville Asset Management, L.P.