Subscribe to Our Insights

Thought Leadership

Nightmare on Wall St.: A Tech Bubble Redux?

By Paul Kleinschmidt on October 22, 2020

The notion of “two Americas” is often discussed by media outlets, particularly in an election year. Meanwhile, Wall Street’s attendant media, usually prone to hyperbole, has largely ignored the extraordinary tale of two markets for stocks. Instead, the focus has principally been on the dramatic rebound in the major indexes since the March lows. Peer beneath the hood however, and you’ll find that this rally has been anything but broad based. While the S&P 500 is up approximately 7.8% year to date (as of this writing), in fact, nearly 60% of the companies that make up the index are in negative territory for the year. More stark is the difference in performance between value and growth stocks. The Russell 1000 Value Index is down 9%, while the Russell 1000 Growth Index is up a whopping 29.2%. That is a historically large spread. But wait, the performance gap is even worse than that. Upon further inspection, less than half of the stocks that comprise the Russell 1000 Growth Index are positive on the year!

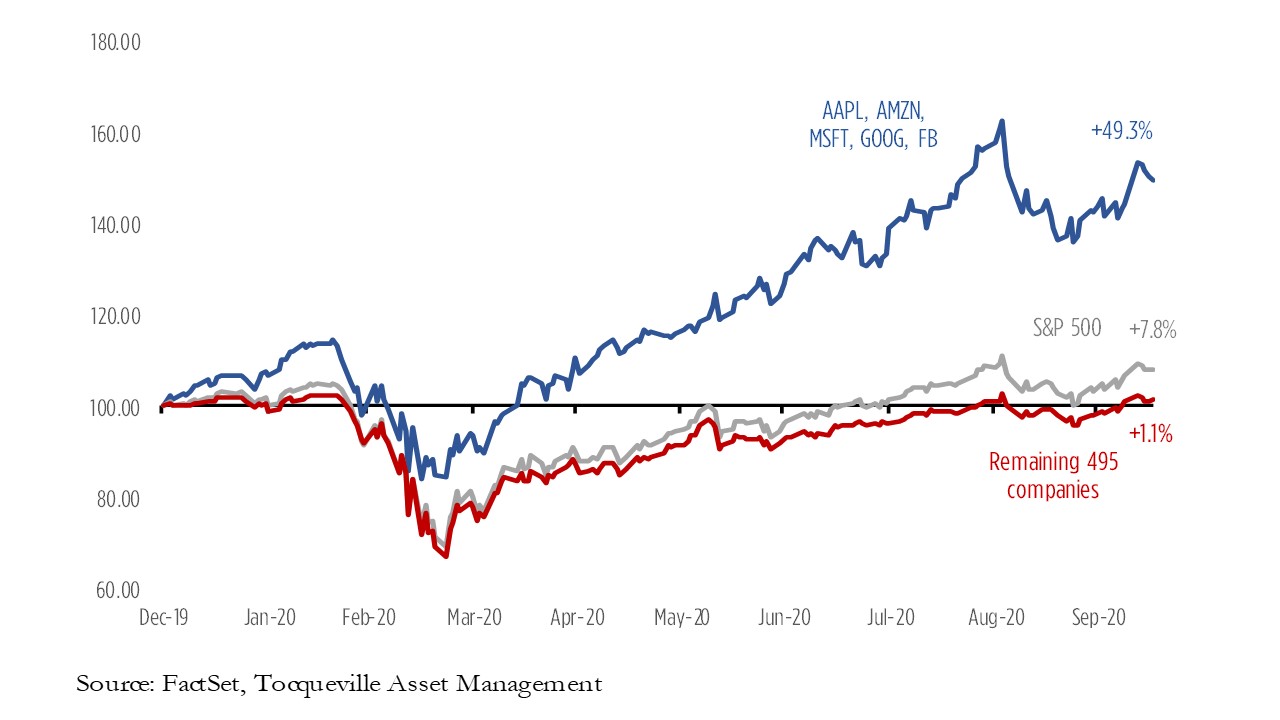

How can this be? How can the broader market be performing so well when most of the companies that compose it are trading lower than they were at the beginning of the year? The answer is that the dramatic gains in only a handful of the largest companies are elevating the entire index, as depicted by the chart below:

All the major indices are market capitalization weighted, meaning, the impact that an individual stock’s price change has on the index is proportional to the company’s overall market value. If, instead, all the companies in the S&P 500 were equally weighted, the index would be down more than 2% on the year, instead of up nearly 8%.* Here again, the spread in performance between an equally weighted S&P 500 portfolio and the capitalization weighted S&P 500 is the largest in more than 10 years, all thanks to the rise in value of a handful of the biggest companies in the world. This kind of concentration within the broader indices, particularly in tech stocks, can conjure nightmares among investors of the Dot-Com Bubble. Does this mean today’s market is ripe for a repeat of the 2000-style tech collapse?

In 2000, the five largest tech companies made up 18% of the S&P 500 index, while today, the five largest tech stocks make up 28% of the S&P 500 index. That would seem like a cause for concern, but there is a huge difference between now and then. In 2000, valuation metrics of every kind for the five largest tech companies, and the sector in general, were either inconceivably high, or, because of a lack of earnings, sales, or cash flow, impossible to apply. The largest companies of this era may yet prove to be overpriced, but one cannot deny the underlying impressive earnings growth, the strength of their cash flow generation, and the dominant competitive moats they control within their respective businesses, which makes them distinctly different from the tech cohort of the late 90’s. On the surface, the valuation multiples of these large technology stocks might seem rich at first glance, but it’s worth remembering that we are in a historically low interest rate environment, and since future cash flows are discounted by current interest rates, this necessarily elevates the multiples for stocks in aggregate, and growth stocks in particular.

A common theme in investing is reversion to the mean. We do not think this phenomenon of Growth trouncing Value can last forever. We also do not think that multiple expansion for only a few large companies can carry the broader market ever higher. Eventually, there will be a swing back of the pendulum to earnings from the current overriding focus on revenue growth. That moment might arise sooner rather than later if the current economic recovery continues apace. Broad based improved earnings across multiple sectors are vital to produce stock market returns in line with the historical average. In that scenario one would expect these bulwark stocks to falter, but not to collapse.

*Based on the Invesco S&P 500 Equal Weighted ETF (RSP).

This article reflects the views of the author as of the date or dates cited and may change at any time. The information should not be construed as investment advice. No representation is made concerning the accuracy of cited data, nor is there any guarantee that any projection, forecast or opinion will be realized.

References to stocks, securities or investments should not be considered recommendations to buy or sell. Past performance is not a guide to future performance. Securities that are referenced may be held in portfolios managed by Tocqueville or by principals, employees and associates of Tocqueville, and such references should not be deemed as an understanding of any future position, buying or selling, that may be taken by Tocqueville.

We will periodically reprint charts or quote extensively from articles published by other sources. When we do, we will provide appropriate source information. The quotes and material that we reproduce are selected because, in our view, they provide an interesting, provocative or enlightening perspective on current events. Their reproduction in no way implies that we endorse any part of the material or investment recommendations published on those sites.

View PDFMutual Funds

You are about to leave the Private Wealth Management section of the website. The link you have accessed is provided for informational purposes only and should not be considered a solicitation to become a shareholder of or invest in the Tocqueville Trust Mutual Funds. Please consider the investment objectives, risks, and charges and expenses of any Mutual Fund carefully before investing. The prospectus contains this and other information about the Funds. You may obtain a free prospectus by downloading a copy from the Mutual Fund section of the website, by contacting an authorized broker/dealer, or by calling 1-800-697-3863.Please read the prospectus carefully before you invest. By accepting you will be leaving the Private Wealth Management section of the website.