Subscribe to Our Insights

Thought Leadership

Picking Up Nickels in Front of Steamrollers

By Heather Perlmutter on June 7, 2021

Over the past twelve months or so, concerns among global investors have shifted dramatically from that of a possible economic depression to heightened inflation. The maestros leading this cacophony of sentiment change have been global central banks flooding the world with liquidity, governments injecting massive stimulus directly into the economy, and now continued progress toward normalizing the global economy as the vaccine gets distributed. This time last year, the discussion during earnings season for most of corporate America was centered around access to liquidity, cutting costs, suspending share buybacks, and reducing dividends – all in the name of protecting the going-concern of the business. Today, the world is flush with cash, with companies in the S&P 500 collectively holding $2 trillion in cash and short -term investments on their balance sheets. Risk appetite among the investment community seems high, and although asset values continue to reflate higher, fears of complacency are ringing loud.

Ironically, one of the perceived riskier places to invest new capital today could be in the bond market. With central banks continuing to pump the world with liquidity and the underlying economy recovering, locating bonds with acceptable yields has become a challenge. The hunt for yield has pushed investors into a corner: either buy very long-dated bonds and take on potential inflation risk, or buy very low-quality bonds and assume credit risk. As the chart below shows, despite the sell-off in bonds year to date, $13 trillion of fixed income (or approximately 11% of the global fixed income market) has a negative yield. Low yields and rising rates, coupled with the prospect of inflation without employing careful selection, makes buying bonds with new money a bit like choosing “return-free risk” (bonds, particularly U.S. Treasuries, are intended to offer risk-free returns).

Source: Strategas Research, Daily Macro Brief, May 7th, 2021

Transitory or not transitory? That is the question. If one believes the inflationary forces making their way through the economy will slow a year from now and be contained, and that interest rates will rise in a gradual and measured fashion, then buying longer-dated bonds, particularly following the sell-off year to date is not unreasonable. However, if the economy takes off faster than the Fed has planned, then monetary policy would need to be adjusted to raise rates faster than expected, which could possibly lead to bond prices at the long end of the yield curve to fall further.

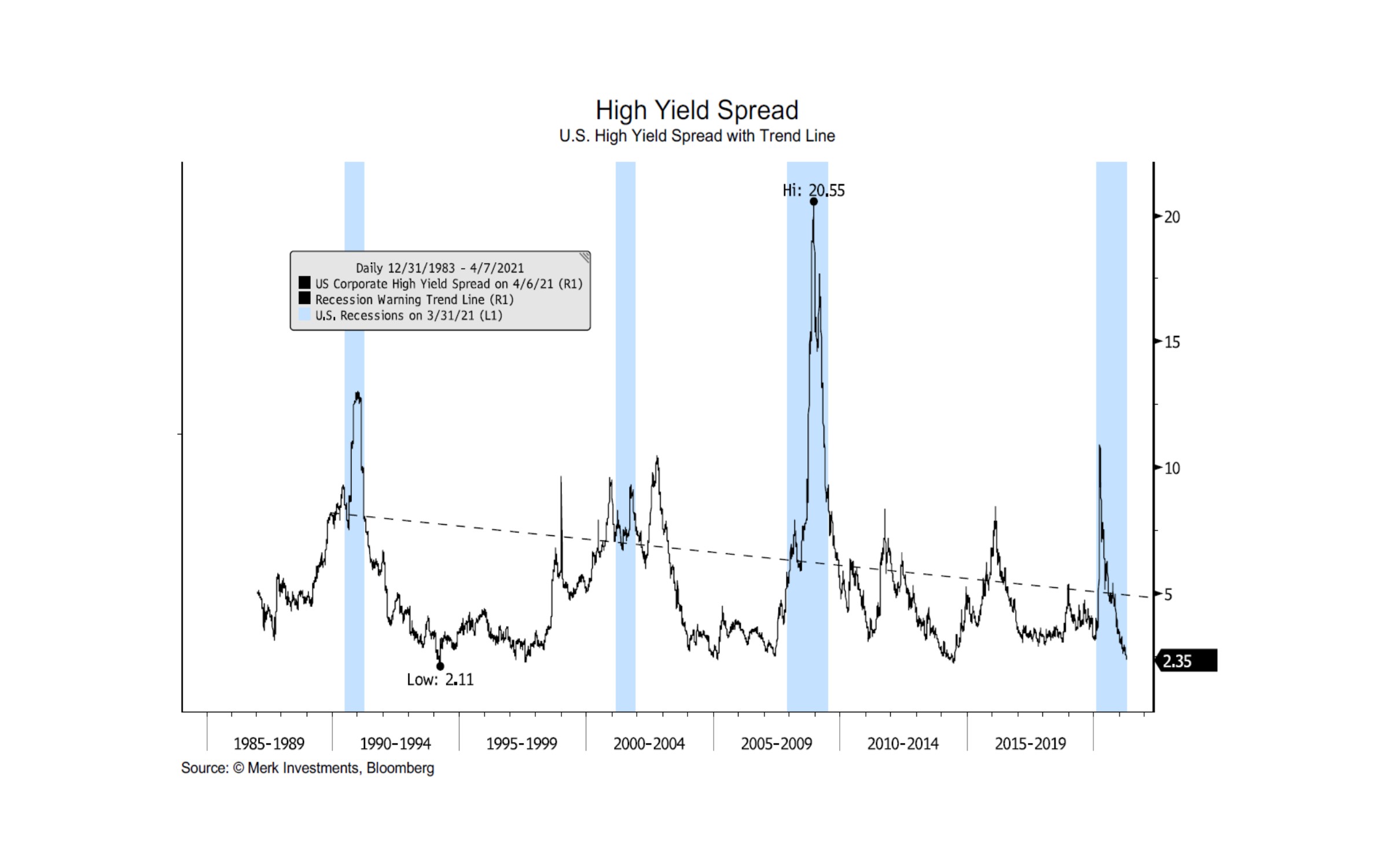

Whereas rising interest rates is one of the hallmark risks to a bond portfolio, the other is credit. A bond is a contract between two parties and is theoretically always at risk of default. The fixed income market priced in massive potential defaults this time last year given the unprecendented nature of COVID. Now, credit concerns have abated and investors are scouring the bond market for yield. If inflation is a concern, but liquidity is not, investors have been tempted to travel down the dark and spooky road of buying lower rated bonds. As the chart below shows, the spread between junk bonds and U.S. Treasuries is currently at its lowest in a generation. This is a risk because, as we saw with COVID, if an unforeseen credit event were to happen again in the future, investors in junk bonds do not appear to be adequately compensated for the credit risk they are taking.

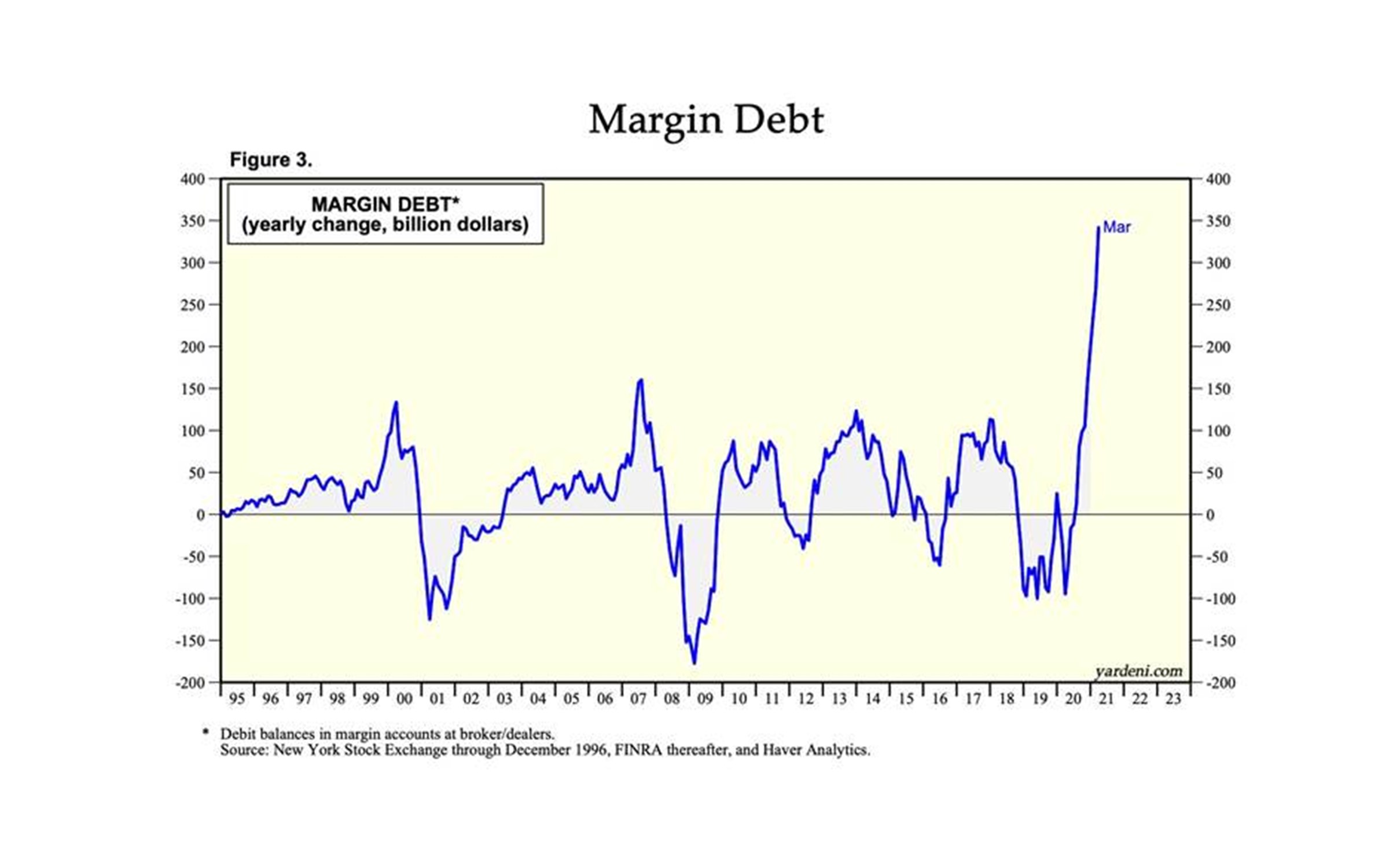

Finally, the increasing use of margin debt appears to be another example where investors appear to be whistling past the graveyard in this environment of easy access to cheap capital. The rise in the amount of margin debt is at its highest level in twenty-five years. In some instances, investors are using their portfolio (going on margin) as an ATM machine to borrow for some other cash flow need, or possibly another investment. Lately there have been a few examples of hedge funds blowing up because of excessive use of margin in positions that have sold off dramatically. The hedge funds then need to raise capital by selling off other investments to meet their margin requirements, and thus begins a potentially viscous, self-perpetuating downward spiral of selling.

In an environment where access to liquidity is open and cheap, investors’ risk appetites can easily be stretched. An actively managed fixed income allocation is still a key element to a well-balanced portfolio. Finding income investments is still possible, but investors need to do more due diligence on their investment ideas than in the past. Remaining disciplined to an investment process and philosophy is paramount in these times, as is the ability to “just say no” to investment ideas that might seem too good to be true. As Warren Buffett once said, “It’s only when the tide goes out that we see who is swimming naked.” Considering the rewards versus the risk of participation in a frothy, low yielding market can best be described as picking up nickels in front of steamrollers. The discerning investor should ask: Is the yield worth it?

This article reflects the views of the authors as of the date or dates cited and may change at any time. The information should not be construed as investment advice. No representation is made concerning the accuracy of cited data, nor is there any guarantee that any projection, forecast or opinion will be realized. References to stocks, securities or investments should not be considered recommendations to buy or sell. Past performance is not a guide to future performance. Securities that are referenced may be held in portfolios managed by Tocqueville or by principals, employees and associates of Tocqueville, and such references should not be deemed as an understanding of any future position, buying or selling, that may be taken by Tocqueville. We will periodically reprint charts or quote extensively from articles published by other sources. When we do, we will provide appropriate source information. The quotes and material that we reproduce are selected because, in our view, they provide an interesting, provocative or enlightening perspective on current events. Their reproduction in no way implies that we endorse any part of the material or investment recommendations published on those sites.

View PDF

Mutual Funds

You are about to leave the Private Wealth Management section of the website. The link you have accessed is provided for informational purposes only and should not be considered a solicitation to become a shareholder of or invest in the Tocqueville Trust Mutual Funds. Please consider the investment objectives, risks, and charges and expenses of any Mutual Fund carefully before investing. The prospectus contains this and other information about the Funds. You may obtain a free prospectus by downloading a copy from the Mutual Fund section of the website, by contacting an authorized broker/dealer, or by calling 1-800-697-3863.Please read the prospectus carefully before you invest. By accepting you will be leaving the Private Wealth Management section of the website.