Subscribe to Our Insights

Thought Leadership

Public Service Warning: Don’t Time the Market

By John Petrides on March 3, 2020

The S&P 500 just hit a record! However, it’s not one to celebrate. The market had its fastest 10% correction ever! It took just six days to turn investor sentiment from being risk-on to risk-off. Since August of 2019, the market’s rise could either be viewed as impressive or ostrich-like.

Stocks ran up in the face of: an inverted yield curve, an overnight shut down of 5% of the world’s oil reserves, a tightening of liquidity in the overnight lending market, military conflict between the U.S. and Iran, an impeachment of the President, and a back-and-forth headline fiesta over trade negotiations between the U.S. and China. Yet the market rallied, riding the coat tails of large cap growth tech stocks. As Warren Buffet would say, the “margin of safety” for further upside for the S&P 500 got a little too thin, too fast, so any new incremental uncertainty put on investors plates could be met with volatility. Enter coronavirus (COVID-19).

We’ve Seen This Before

Investors have experienced health scares in the past: SARS in 2003, Swine Flu in 2009, MERS in 2012, Ebola in 2013/2014, and Zika in 2016, so a negative reaction for stocks to an outbreak is not entirely new. Investors are hoping that the end result for the coronavirus follows a similar pattern to past health scares: that the outbreak is eventually contained, and everyday (economic) life goes back to work. When the coronavirus went public and the outbreak parabolic in Wuhan, China, in January, the country essentially “shut down” entering its New Year. U.S. and Developed markets sat in a wait-and-see mode if the virus would spread. Investors were also probably distracted by earnings season in January and early February, which once again, continued to be better than Wall Street analyst expectations. However, in mid-February, cases of the virus spread to outside mainland China and into Japan, South Korea, Italy and now the U.S. Fears of contagion spreading across the globe has ripped through the stock market, and selling-begot-selling, as more and more countries and companies have reacted by shutting down travel and issuing lower future profit-guidance.

How Impacted Will the Data Be?

From an economic and earnings standpoint, expect the data from the next few months to most likely be messy and confusing. The market is trying to price in what impact the threat of the coronavirus is going have on the economy and future cash flows of companies. This could be a problem for investors.

At the moment, we do not know what the future holds, but assuming the virus is contained, how does one interpret the upcoming macroeconomic data and earnings guidance? Global central banks and investors will have a challenging time parceling through what could be an actual global economic slowdown vs what is coronavirus-induced slowdown, in determining how aggressive they should be with monetary policy actions.

Consensus estimates for macroeconomic and company earnings will start moving all over the map. Analysts will try their best to handicap the results.

So the question becomes, how serious does the market take the reported data? Will investors read through understanding the impact of the virus, or will it extrapolate the data as the economy actually slowing down?

This will keep volatility elevated for a while within the stock market.

Understand Your Investment Time Horizon Rather Than Try to “Time” the Market

We have no idea how far the virus will spread and what the total economic and social impact will ultimately be. We do know that volatility is back for equity investors. Control what you can control. Do not let your emotions drive your decision-making process when it comes to your portfolio. The market selloff is a great opportunity to understand what your risk tolerance is, and acts as a litmus test of how diversified your portfolio is.

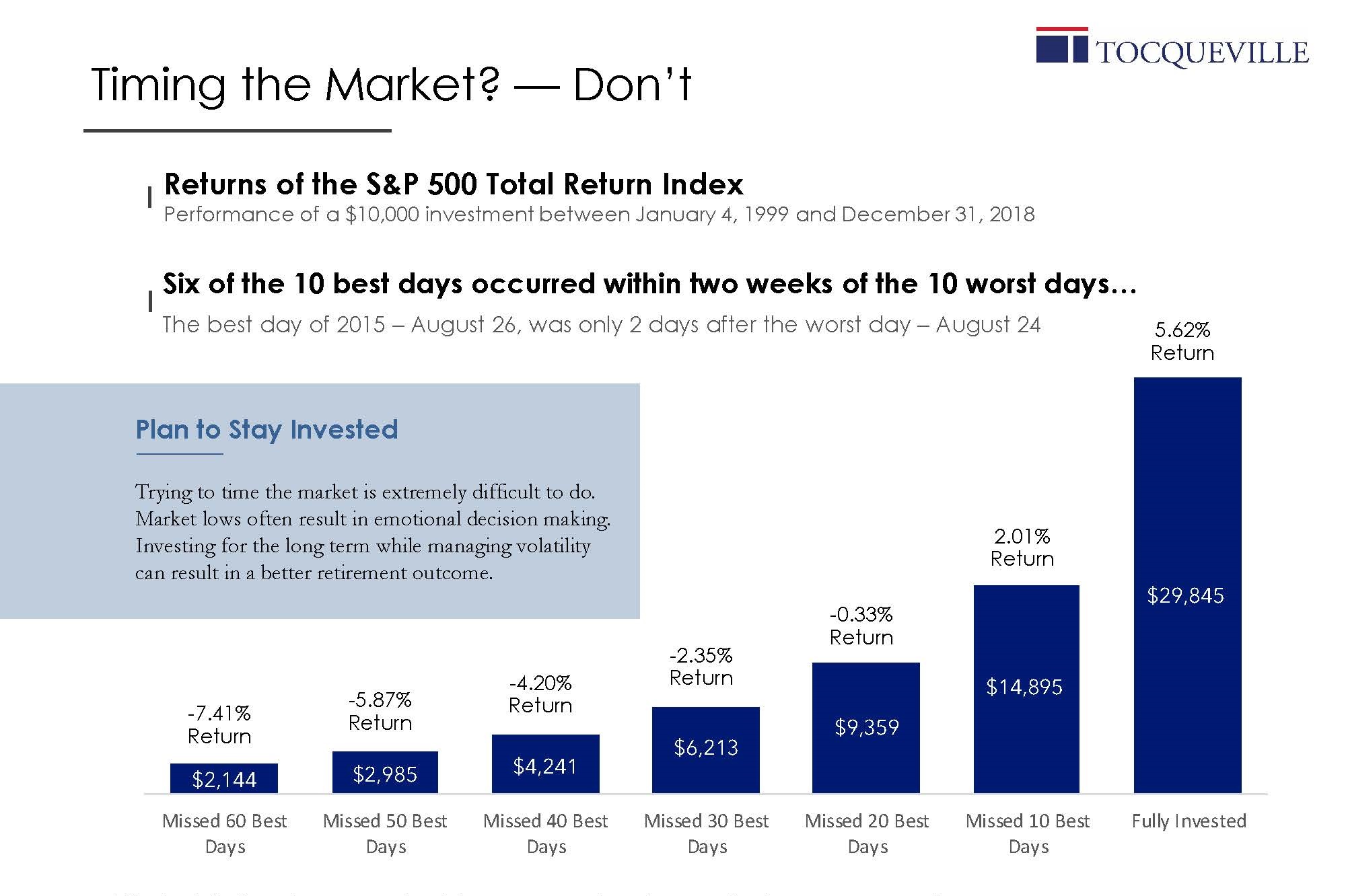

The below chart shows that when investors get scared out of the market because of a volatility event and subsequently try to time when to go back in (“I’ll get back in when I feel better and see stocks rising again”), they have consistently jeopardized their ability to build generational wealth. Without a crystal ball, investors averaged 5.6% annualized returns over time by staying invested and riding out the market selloffs. By being out of the market on the 60 best days, investor returns were a -7.4%. That is a 13% annualized relative performance swing that could determine the outcome of the financial legacy for your generational wealth plan.

Active Management Matters

There is no shame in admitting that volatility in the stock market may be too much handle. However, it may also mean you need to diversify your asset base to temper the ride.

We are here to help you steer through this market storm, answer any questions you may have to the best of our ability, and provide our thoughts and analysis on your entire portfolio diversification strategy.

Portfolio Manager

© Tocqueville Asset Management L.P.

March 2, 2020

This article reflects the views of the author as of the date or dates cited and may change at any time. The information should not be construed as investment advice. No representation is made concerning the accuracy of cited data, nor is there any guarantee that any projection, forecast or opinion will be realized.

References to stocks, securities or investments should not be considered recommendations to buy or sell. Past performance is not a guide to future performance. Securities that are referenced may be held in portfolios managed by Tocqueville or by principals, employees and associates of Tocqueville, and such references should not be deemed as an understanding of any future position, buying or selling, that may be taken by Tocqueville.

We will periodically reprint charts or quote extensively from articles published by other sources. When we do, we will provide appropriate source information. The quotes and material that we reproduce are selected because, in our view, they provide an interesting, provocative or enlightening perspective on current events. Their reproduction in no way implies that we endorse any part of the material or investment recommendations published on those sites.

Source: J.P. Morgan Asset Management analysis using data from Bloomberg. Returns are based on the S&P 500 Total Return Index, an unmanaged, capitalization-weighted index that measures the performance of 500 large capitalization domestic stocks representing all major industries. Past performance is not indicative of future returns. An individual cannot invest directly in an index. Data as of December 28, 2018.

View PDFMutual Funds

You are about to leave the Private Wealth Management section of the website. The link you have accessed is provided for informational purposes only and should not be considered a solicitation to become a shareholder of or invest in the Tocqueville Trust Mutual Funds. Please consider the investment objectives, risks, and charges and expenses of any Mutual Fund carefully before investing. The prospectus contains this and other information about the Funds. You may obtain a free prospectus by downloading a copy from the Mutual Fund section of the website, by contacting an authorized broker/dealer, or by calling 1-800-697-3863.Please read the prospectus carefully before you invest. By accepting you will be leaving the Private Wealth Management section of the website.