Subscribe to Our Insights

Thought Leadership

Regimes Change, Processes Don’t

By Joseph Piropato on January 30, 2023

We hope that this finds you well and that 2023 is off to a productive and healthy start.

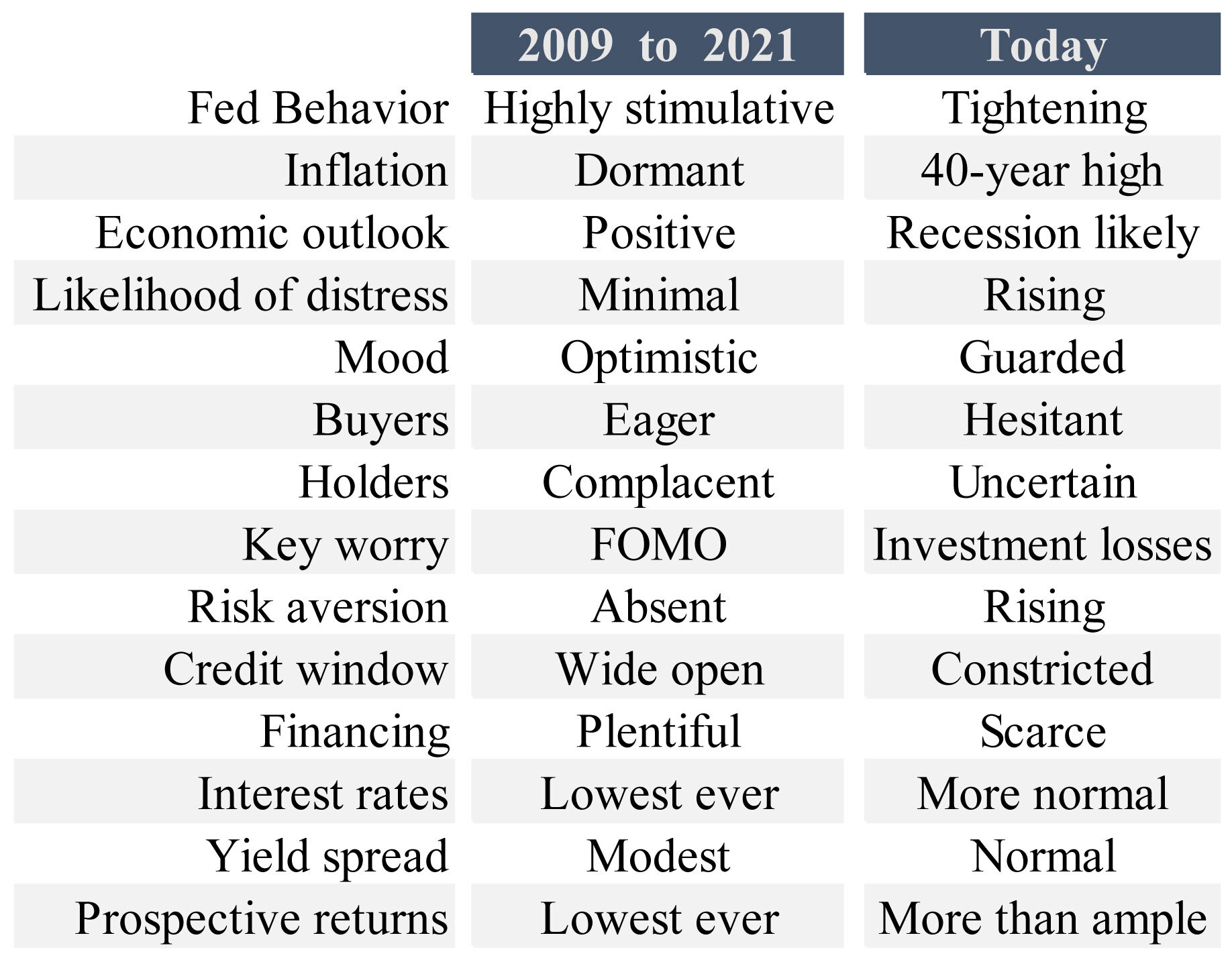

Over the past six weeks we have caught up with colleagues, friends, family and trusted advisors, and have done a lot of reading. One piece that stands out to us is a memo by Howard Marks, who is the cofounder and current co-Chairman of Oaktree Capital Management. Marks is one of the most judicious and successful investors of the past 50 years, particularly in high yield credit. Marks’ recent memo is titled “Sea Change” and in it, he reminds readers of the various circumstances that influenced the investment environment from 2009 through 2021 and how these relate to today’s circumstances based on the events of the last twelve months. His descriptive impressions and inferences are summarized in the following table:

Source: Howard Marks, Oaktree Capital Management, “Sea Change”, December 2022

Each of these impressions on its own is worthy of further exploration, but here we will focus our brief comments on what we think are the two most important, interest rates and inflation.

In 2022 we observed the Federal Reserve aggressively increase overnight rates from 0 – 0.25% in January, to 4.25 – 4.50% by December. In parallel, the Fed also implemented quantitative tightening (QT). QT is the Fed’s process of selling ~ $90 billion of bonds each month to market buyers from its ~ $9 trillion balance sheet. The stated purpose of QT operations is to drain liquidity and elevate interest rates, the opposite of quantitative easing (QE), which was implemented in the aftermath of the Great Financial Crisis of 2008-9 and at the onset of the 2020 pandemic.

The ten-year US Treasury began the year at 1.5% and ended the year at 3.9% (as of this writing it is now 3.5%). The long-term rate is lower than the short term, resulting in an “inverted yield curve” which is often a precursor of an economic recession. Based on the current circumstances, it could also indicate that market participants believe that long-term inflation expectations (as opposed to short term expectations) remain well anchored.

The most popular measure of inflation is the Consumer Price Index (CPI). The CPI rose 7% in January 2023 over the prior year. Throughout 2022, CPI remained elevated and not until December did it optically ‘slow’ to 6%.

Additionally, we observe many drivers of inflation that could further contribute to the further slowing of the CPI:

- Labor markets and wage income visibly slowed in 2022; with typically higher relative income tech-sector layoffs underway, wage pressures are starting to diminish

- Oil and gasoline prices, and most other commodity prices, are down sharply from peak.

- Housing prices are beginning to moderate their increases.

- Supply chains are easing.

- Consumer inflation expectations have been steadily falling since late last year.

- The impacts of monetary policy adjustments are not instantaneous; a significant amount of last year’s tightening is already in the pipeline.

- As such, since the rate of inflation, while still elevated, is slowing faster than market participants expected, the balance of other risks, similarly, is changing.

The cost of pushing the US economy into eventual recession is not merely statistical. It could result in millions of lost jobs, more reduced wealth, political upheaval and emotional carnage. Through zero interest rates and quantitative easing, the Fed created an era of unprecedented easy money. Now, the Fed, in their attempt to slay the dragon of its own creation, needs to balance the risks of over-tightening. Last but certainly not least, higher interest rates mean higher borrowing costs not only for consumers and businesses, but also for the largest borrower in the world, the US Government.

In a recent e-mail exchange about interest rates and inflation, Tocqueville CEO Robert Kleinschmidt, made the following astute observation: “It is not rising interest rates which will defeat inflation. Interest rates are not the cost of money. They are the cost of credit. The cost of money is the rate of increase in the price level, a subtle but significant difference. Raising rates will shut down credit and the economy, but it will not necessarily slow inflation.”

The interest rate increases of 2022 spearheaded by the Fed caused a significant repricing of all financial asset classes. Even though they were late in reversing course, we think the Fed has been largely successful is front loading rate increases in 2022, and we do not anticipate that additional rate increases in 2023 will have the same impact on asset prices as they did in 2022. The bond market is currently pricing in two more Fed increases in early 2023, but it is also pricing in two rate decreases by year end. As of this writing, the forward curve indicates a year-end Fed Funds rate of ~ 4.50%. Over the better part of the past 500 years, short term rates have averaged around 3%. The path of interest rates, a headwind in 2022, could prove to be a tailwind as 2023 progresses.

We expect that business valuations, having gone through a significant contraction, will stabilize for those companies that are financially strong and that generate robust free cash flow. Companies at the high end of the risk spectrum will likely continue to be penalized. In a tighter money and more normalized interest rate environment performance is likely to diverge. We are reminded of a famous Buffett quote: “Only when the tide goes out do you discover who has been swimming naked”. Companies that over-earned during the pandemic have been exposed. Businesses that rely on their customers to finance their purchases or the capital markets to finance their operations will most likely continue to struggle as a result of the sea change in credit conditions. Rational allocators of capital – ourselves included – should be able to find investments that perform satisfactorily in a world of 3.5 – 4.5% short term interest rates and stable to declining inflation, even if some components of that inflation, such as in labor costs, remain persistent.

No one can estimate precisely when the current period of inflation and central bank interest rate increases will end. But we do know that a once in millennia era of cheap credit and easy money is over. This explosion caused an extreme devaluation of near-term cash flows in favor long duration ones. Correlation for all assets was nearly 1 and just a half dozen large companies were responsible for most of the gains in the broad indexes. Small wonder then that passive ETF’s proliferated during this time frame. Meanwhile, stories of flying robot taxis, crypto-currencies, loose debt covenants, SPACs etc were all the rage. The discipline of evaluating through cycle, individual investment opportunities was under assault.

Despite all of the issues on the macro level (not to mention in Washington and on the geopolitical front) we take a step back and remember to stay disciplined to becoming investors in businesses that meet certain criteria of the following list of characteristics such as:

- Balance sheet resiliency: excess cash and capital, so as to withstand, and take advantage of, market and economic volatility.

- Companies that can demonstrably earn returns in excess of their cost of capital. In a zero interest rate world, every deal was accretive; this world is no longer.

- Ability to pass on higher costs. Companies that have pricing power will not automatically lose ground.

Our overarching investment objective remains to generate positive absolute returns and to exceed the returns of the major indices over the course of a full economic cycle, which includes recessions and expansions. To protect and grow your capital, we continue to seek out compelling long-term investment opportunities in companies that have defensible business franchises, are out of favor or misunderstood, and trade at a discount to our estimate of intrinsic value. In the world from 2009-2021, this philosophy was underappreciated, going forward, we suspect it won’t be.

Portfolio Manager

© Tocqueville Asset Management L.P.

This article reflects the views of the author as of the date or dates cited and may change at any time. The information should not be construed as investment advice. No representation is made concerning the accuracy of cited data, nor is there any guarantee that any projection, forecast or opinion will be realized. References to stocks, securities or investments should not be considered recommendations to buy or sell. Past performance is not a guide to future performance. Securities that are referenced may be held in portfolios managed by Tocqueville or by principals, employees and associates of Tocqueville, and such references should not be deemed as an understanding of any future position, buying or selling, that may be taken by Tocqueville. We will periodically reprint charts or quote extensively from articles published by other sources. When we do, we will provide appropriate source information. The quotes and material that we reproduce are selected because, in our view, they provide an interesting, provocative or enlightening perspective on current events. Their reproduction in no way implies that we endorse any part of the material or investment recommendations published on those sites.

View PDF

Mutual Funds

You are about to leave the Private Wealth Management section of the website. The link you have accessed is provided for informational purposes only and should not be considered a solicitation to become a shareholder of or invest in the Tocqueville Trust Mutual Funds. Please consider the investment objectives, risks, and charges and expenses of any Mutual Fund carefully before investing. The prospectus contains this and other information about the Funds. You may obtain a free prospectus by downloading a copy from the Mutual Fund section of the website, by contacting an authorized broker/dealer, or by calling 1-800-697-3863.Please read the prospectus carefully before you invest. By accepting you will be leaving the Private Wealth Management section of the website.