Subscribe to Our Insights

Thought Leadership

Shall We Play a Game?

By Alexander Stock on July 30, 2023

During the second quarter financial markets participants assessed the consequences of (1) high-profile bank failures, (2) the debate over raising the debt ceiling, (3) the uncertainty with respect to the Federal Reserve’s (Fed) rate trajectory, and (4) the prospects for a recession. In June, the Fed “pause” dominated the economic headlines, prompting more debate about the odds of a recession. As we approached the end of June, the “soft landing” adherents gained more support and interest rates increased: the two-year US government bond yield rose from a low of 3.7% (May 4) to 4.9% (June 30). The ten-year US government bond yield rose from a low of 3.3% (April 6) and to 3.8% (June 30).

The Consumer Price Index (CPI) now has a “3” in front of it as opposed to the “9” twelve months ago. Another inflation measure that provides more business-to-business or commercial insights: the Producer Price Index (PPI) declined from 2.7% (March) to 1.1% (May).

Equity Return Breadth: Narrow

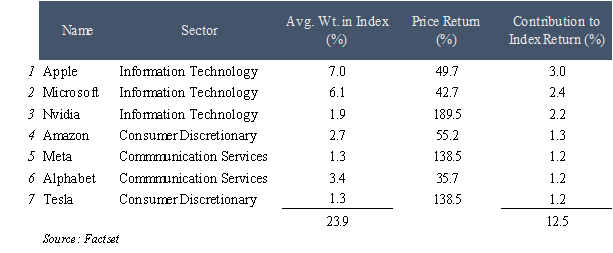

Equities, especially technology stocks, shrugged off higher interest rates and posted strong and in some cases eye-popping returns. However, we are reminded by the premise that we deal in a market of stocks, not a stock market. It is true that the “stock market” as defined by the S&P 500 increased 16.9% in the first half of 2023, but seven stocks contributed 70% of that increase:

“The S&P 493”, which are the other 493 holdings in the most popular US stock index, were up in price by approximately 5%, on average. What accounts for the imbalance in returns?

First, and most practically the seven standouts are already among some of the largest market capitalization stocks. Apple, Microsoft, Amazon and Alphabet comprise approximately 19% weight in the S&P 500 index. Adding Nvidia, Meta and Tesla bring the weighting of the seven to approximately 24% of the S&P 500 index. When an asset allocator rationalizes a choice to increase exposure to equities, the easiest button to click is “BUY SPY” – the S&P 500 index fund. In reality, the S&P 500 is not as diversified as one might think; it is, for all practical purposes, a large cap technology index. The repeated buying of the “index” has the domino impact of increasing the market cap of those largest companies thereby self-reinforcing their entrenched dominance to maintain their winning position. Moreover, the technical aspects of market structure, index composition and definitions are important determinants of the “stock market” return. To illustrate this point further: Apple, with a market cap of $3 trillion, exceeds the market cap of all of the companies in the Russell 2000, a popular index of smaller capitalization companies with wide representation across a broad swath of the American economy. [Of note, the Russell 2000 Index increased by 8% in the first half.]

Second, the large technology sector’s outperformance was also likely due to the speculation of revenue and earnings prospects for these seven companies due to advancements in Artificial Intelligence (AI). When we think about AI we recall the 1983 movie War Games, which now can be seen as perhaps foreshadowing 2023, arguably still with the threat of nuclear war. In the movie, David Lightman, played by a young Matthew Broderick, hacks into a computer system that does not identify itself, but is able to conduct near-human-like dialogue and play games. In parallel, the Department of Defense’s North American Aerospace Defense Command (NORAD) team was recently convinced to swap-out human controllers for a WOPR (War Operation Plan Response) which is a self-learning and decision-making mainframe computer. As David plays tic-tac-toe with “Joshua” he realizes that it learns from its mistakes. Accordingly, David then malevolently asks “Joshua” to play Global Thermal Nuclear War. This sets off alarm bells at NORAD’s underground bunker, which believes a nuclear attack is imminent, without really knowing “Joshua”, also known as WOPR, is merely simulating an attack. Since “Joshua” – now a fully anthropomorphized flashing LED-light mainframe computer – learned from its tic-tac-toe playing mistakes, it then attempts to really win the ‘war game’, and calculate and deduce the actual nuclear warhead launch codes. Consequently, the fear of AI and its nuclear feature: machine learning, is nearly realized, to the total wipeout of humankind. The lesson here is that permission-ing a computer to control the end-to-end decision-making process without a fail-safe plan entailed risk in 1983. The same risk remains in 2023. How much do we let computers manage the lives of free-will-thinking humans?

What We Don’t Know

- Are new applications such as Chat GPT the key to moving the ball closer to economically viable adoption of these powerful new technologies?

- Will AI technology ultimately be more of a sustaining or disruptive innovation?

- Will AI be democratized or ultimately controlled by a few platforms/companies?

- Are there industries/applications/companies that seem particularly at risk of disruption and

vice versa? - Is AI and specifically generative AI, on the cusp of being the next “Cloud”?

- What new types of business models might emerge in concert with technological advancements?

These are all important questions for which we are searching for answers and considering in our research analysis of tech companies and in fact, every company in which we consider for inclusion in a portfolio’s investments; AI is an evolving space requiring constant learning.

When discussing and reviewing investment performance it is important to remember that over the long term, stock prices generally rise, and fall based on the trajectory of the earnings that companies produce for shareholders. In the short term, it’s hard to pinpoint exactly, all the various reasons, why stocks rise and fall when they do.

Being Invested Staying Invested

However, many stocks are now trading at prices higher now than they did only six months ago, confirming our longstanding belief that being invested and staying invested in uncertain times and through cycles is one of the best strategies to grow wealth for the long term. Allowing capital in accounts to be put to work, especially in periods of inflation, can likely increase long-term wealth. That’s because companies have the ability to increase their earnings through various strategies and levers, concomitant with shareholder return, and in tandem with, or, in excess of, inflation, unlike fixed-rate investments such as bonds. In addition, capital withdrawn from investment accounts and used for spending or paying bills is capital that is not able to grow and is money eroded by inflation. Each withdrawal or series of withdrawals can be a high hurdle to overcome if the original intent was to meet capital appreciation goals. Higher inflation and higher interest rates have impacted budgets across the income spectrum – high and low. In this era of monetary tightening, we recommend a review of the assumptions that are used in personal budgeting and calculating daily, monthly and annual living expenses.

The reality is that we as investors, and the company managements to whom we entrust capital, must constantly navigate murky waters, much like the classic game Battleship. Our success as investors stems from holding good companies and taking advantage of opportunities to purchase more of them when the going gets tough. Our overarching investment objective remains to generate positive absolute returns and to exceed the returns of the major indices over the course of a full economic cycle, which includes recessions and expansions. To protect and grow capital, we continue to seek-out compelling long-term investment opportunities in companies that have defensible business franchises, are out of favor or misunderstood, and trade at a discount to our estimate of intrinsic value. We aim to combine the best practices of both the “growth” and “value” investment disciplines as we create and curate enduring portfolios for all seasons.

© Tocqueville Asset Management L.P.

This article reflects the views of the author as of the date or dates cited and may change at any time. The information should not be construed as investment advice. No representation is made concerning the accuracy of cited data, nor is there any guarantee that any projection, forecast or opinion will be realized. References to stocks, securities or investments should not be considered recommendations to buy or sell. Past performance is not a guide to future performance. Securities that are referenced may be held in portfolios managed by Tocqueville or by principals, employees and associates of Tocqueville, and such references should not be deemed as an understanding of any future position, buying or selling, that may be taken by Tocqueville. We will periodically reprint charts or quote extensively from articles published by other sources. When we do, we will provide appropriate source information. The quotes and material that we reproduce are selected because, in our view, they provide an interesting, provocative or enlightening perspective on current events. Their reproduction in no way implies that we endorse any part of the material or investment recommendations published on those sites.

View PDFPoplar Forest

You are about to leave the site of Tocqueville Asset Management, L.P. The link you have accessed is provided for informational purposes only and should not be considered a solicitation to become a shareholder of or invest in the any mutual fund managed by Tocqueville Asset Management, L.P. Please consider the investment objectives, risks, and charges and expenses of any mutual fund carefully before investing. The prospectus contains this and other information about the Funds. You may obtain a free prospectus by downloading a copy from the Poplar Forest (www.poplarforestfunds.com), by contacting an authorized broker/dealer, or by calling 1-877-522-8860. Please read the prospectus carefully before you invest. By accepting you will be leaving the site of Tocqueville Asset Management, L.P.

Tocqueville Funds

You are about to leave the site of Tocqueville Asset Management, L.P. The link you have accessed is provided for informational purposes only and should not be considered a solicitation to become a shareholder of or invest in the any mutual fund managed by Tocqueville Asset Management, L.P. Please consider the investment objectives, risks, and charges and expenses of any mutual fund carefully before investing. The prospectus contains this and other information about the Funds. You may obtain a free prospectus by downloading a copy from the Tocqueville Funds website (www.tocquevillefunds.com), by contacting an authorized broker/dealer, or by calling 1-800-697-3863. Please read the prospectus carefully before you invest. By accepting you will be leaving the site of Tocqueville Asset Management, L.P.