Subscribe to Our Insights

Thought Leadership

Volatility vs. Risk

By Paul Kleinschmidt on April 28, 2020

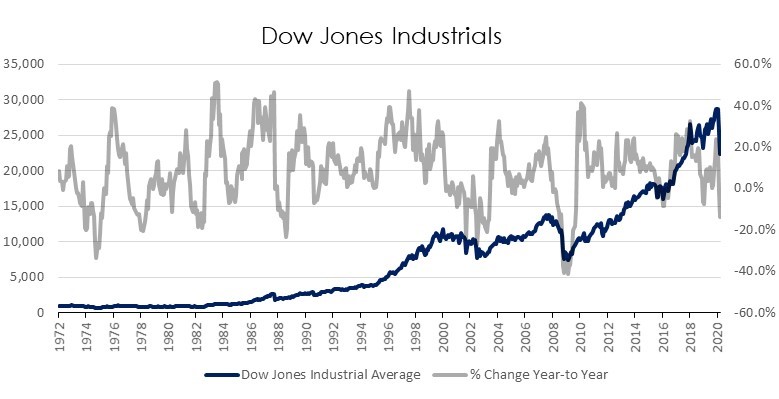

Time is the investor’s friend and the speculator’s foe. Why? One reason is that many market participants tend to confuse risk and volatility. For long term investors (and really, there is no other kind) volatility represents not a true risk, as in complete loss of principal, but an aggravation, and, very often, an opportunity. This is illustrated in the following graph, which depicts the forty-eight-year performance of the Dow Jones Industrial Average against the year-to-year percentage changes in that same index. As can be seen, a patient investor would have done quite well with little absolute risk, while a short-term trader might easily have become financially (and emotionally) unsettled. For patient investors volatility only really becomes a problem when there is an urgent need to sell. This why we consistently urge our clients not to invest when they plan to spend their capital over the near to intermediate term.

This notion of volatility as irritation or a phase as opposed to true risk is not to be taken cavalierly in the face of an extraordinary global pandemic. To be sure, there is no real roadmap for where we find ourselves now. Many illiquid businesses will fold, so will many previously liquid businesses. Unemployment has already begun to soar, consumer behaviors have changes and will be permanently altered in some ways. Millennials are now twice bitten by 100-year events since entering the workforce and beginning to save. They are likely to be risk averse for the rest of their lives.

The world that will emerge after the pandemic subsides will, more likely, face a challenging economic recovery, rather than the sharp rebound many investors continue to hope for. But, no one really know what is on the other side of this and no business will go unaffected. Those who proclaim differently shouldn’t be trusted.

So, we will have volatility, but volatility, in and of itself, if perceived correctly, it is not inherently bad. In fact, volatility can often be an exceptional opportunity for price sensitive, long term investors to upgrade their portfolios. The essential goal of investing is to earn risk adjusted returns that are superior, over time, to those on risk free assets.

Superior returns come with the assumption of reasonable business risks. In due time we will once again be able to make reasonable assumptions about business risk. In the current circumstances, of course, it is impossible to decipher the near-term earnings prospects of most companies, but it is not impossible to ascertain an approximate “through-cycle” estimate of earnings power for quality companies with sound balance sheets and unimpaired end markets. Then, one can discount those estimates based on several different scenarios. If fear induced volatility in the market creates a significant gap between the current price and the intrinsic value derived from such exercises it yields an attractive entry point for long term investors.

“Markets flucuate,” said Bernard Baruch, and indeed they do. In both directions. Over the long term, that direction has been primarily up.

This article reflects the views of the author as of the date or dates cited and may change at any time. The information should not be construed as investment advice. No representation is made concerning the accuracy of cited data, nor is there any guarantee that any projection, forecast or opinion will be realized.

References to stocks, securities or investments should not be considered recommendations to buy or sell. Past performance is not a guide to future performance. Securities that are referenced may be held in portfolios managed by Tocqueville or by principals, employees and associates of Tocqueville, and such references should not be deemed as an understanding of any future position, buying or selling, that may be taken by Tocqueville.

We will periodically reprint charts or quote extensively from articles published by other sources. When we do, we will provide

appropriate source information. The quotes and material that we reproduce are selected because, in our view, they provide an interesting, provocative or enlightening perspective on current events. Their reproduction in no way implies that we endorse any part of the material or investment recommendations published on those sites.

View PDFPoplar Forest

You are about to leave the site of Tocqueville Asset Management, L.P. The link you have accessed is provided for informational purposes only and should not be considered a solicitation to become a shareholder of or invest in the any mutual fund managed by Tocqueville Asset Management, L.P. Please consider the investment objectives, risks, and charges and expenses of any mutual fund carefully before investing. The prospectus contains this and other information about the Funds. You may obtain a free prospectus by downloading a copy from the Poplar Forest (www.poplarforestfunds.com), by contacting an authorized broker/dealer, or by calling 1-877-522-8860. Please read the prospectus carefully before you invest. By accepting you will be leaving the site of Tocqueville Asset Management, L.P.

Tocqueville Funds

You are about to leave the site of Tocqueville Asset Management, L.P. The link you have accessed is provided for informational purposes only and should not be considered a solicitation to become a shareholder of or invest in the any mutual fund managed by Tocqueville Asset Management, L.P. Please consider the investment objectives, risks, and charges and expenses of any mutual fund carefully before investing. The prospectus contains this and other information about the Funds. You may obtain a free prospectus by downloading a copy from the Tocqueville Funds website (www.tocquevillefunds.com), by contacting an authorized broker/dealer, or by calling 1-800-697-3863. Please read the prospectus carefully before you invest. By accepting you will be leaving the site of Tocqueville Asset Management, L.P.