Subscribe to Our Insights

Thought Leadership

Turn! Turn! Turn!

By Paul Kleinschmidt on July 27, 2022

The song “Turn! Turn! Turn!” — based on the biblical Book of Ecclesiastes – was written by Pete Seeger in the late 1950’s and recorded by The Birds in the mid ‘60’s. It reminds us that there is a time for everything in life. A time to laugh. A time to cry. A time to gain, a time to lose. Investing is no different and there are, of course, times to sow and times to reap. Almost all contrarian investors know that the time to buy is when the future looks most bleak. Whether they do this or not is another matter altogether. But how about a time to sell? If so, when? Are we in one now?

Current financial markets have been in a vicious state of retrenchment since the start of the year. The S&P 500, led by the Technology sector, finished the first half of the year down nearly 20% (the worst start to a year since 1970). The bond market, often considered a ballast to equity volatility in balanced portfolios, is on pace for its worst calendar year ever. Even gold, the vaunted safe haven in times of uncertainty or inflation, is negative for the year.

The rush for the exits has been breathtaking. Even when there is a very good reason for markets to de-rate, the speed and depth of the downside move can make investors very timid.

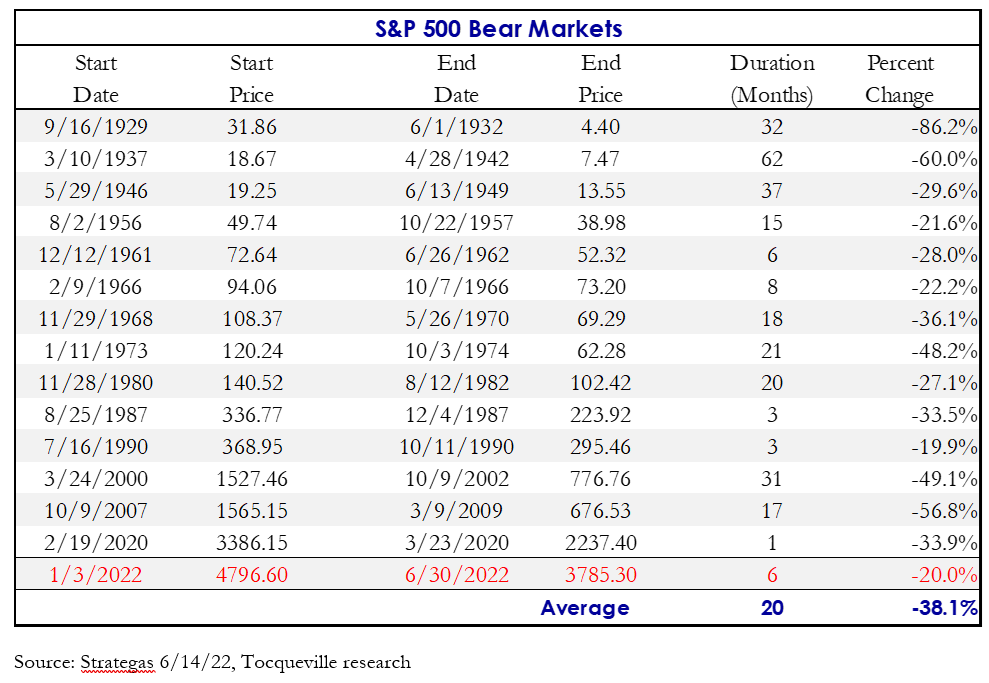

Below is a chart detailing every time the S&P 500 fell into a Bear Market (defined as at least a 20% sell off from peak). On average, since the Great Depression, bear markets have lasted twenty months and have declined an average 38% from their previous highs. But these averages overstate the case. Taking just the post war period, the average duration of the Bear market is just over fourteen months, while the decline has averaged a still debilitating 33%.

Although the S&P 500 has now entered its seventh month of the current bear market, it may feel like twenty months already, leave alone a mere fourteen. The truth is, no one knows where the bottom is, and how long it will take to get there. While household and corporate balance sheets are in superior shape than they were in the 2008/9 period, when markets fell by more than fifty per cent, the balance sheet of the US Government is not. A prolonged increase in the rates our government pays to finance its accumulated debt could well lead to a market with far more to fall. The interest expense on $30 trillion can get out of hand quickly. If it does, it could prove to be the sum of all fears for the investment class, and hardly only they. But it is also true that the precarious state of government finances has been the case for these past ten years, at least. Meanwhile, US treasuries have been and still remain far more appealing than those of other governments. Moreover, the yield curve suggests no such danger to the U.S. credit situation is imminent.

Back to our original question: Is now a time to sell? There are three important lessons to take from the above chart. The first is obvious. Bear markets come to an end. It may not feel like it now, but there will come a point when the market is at equilibrium and poised to rebound.

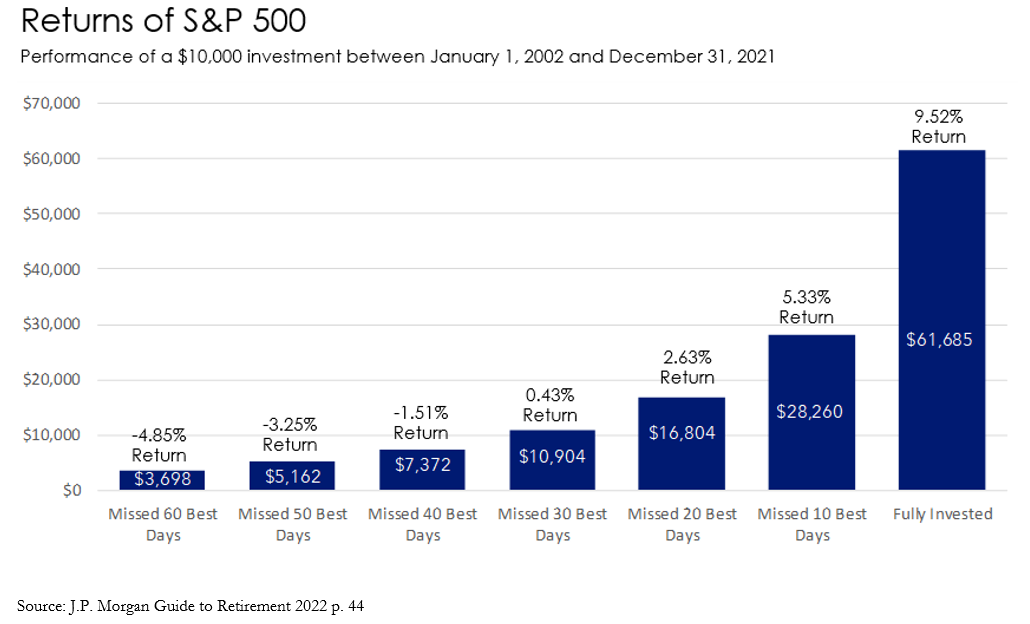

Second is the disparity of returns. While it certainly would have felt good (and far be it from me to be unsympathetic to psychic income) to sell out of everything seven months ago, failure to reinvest at the right time carries a significant penalty. Even much of the benefit from that fortuitous timing might have been captured by taxes. Certainly, that would have been the case for most investors at the end of 2021.

Third, trading is not investing. Trading ignores the long view and requires being right (or lucky) at least twice in every market cycle. Once is not enough. Alternatively, one could simply bet heavily when a “fat pitch” comes their way. It happens, but good luck with that approach. Truth is, neither strategy is sustainable, and sustainability is what is required to preserve and grow wealth.

Consider the record of nearly 100 years of investing from the 1929 peak. Long term investors in the stock could have grown their money by 100-fold, and that is AFTER a nearly 90% drawdown in the several years that followed the crash. Those returns simply are not possible if one misses the biggest up days.

Timing the market is impossible. No one truly know when the bottom and or top will be. A path to succeeding in investing requires three characteristics: First, to remain focused on your investment objectives and long-term time horizon; Second, to remain disciplined in your investment process and philosophy; Third, be willing to invest against the mainstream view.

So, what to do if selling is not really an option? One of our favorite quotes comes from JP Morgan, who once said “In Bear Markets, Stocks Return to Their Rightful Owners.” Now is the time to upgrade portfolios and to take advantage of the fear that recent volatility has created. Do the valuation and analytical work and prune weaker holdings to make way for higher quality names that previously might have been too dear to own. Finally, be incremental in one’s approach. It is ok to be early so long as the initial investment leaves room for further investment should things move in the wrong direction at first. Again, the goal is not to create wealth, it is to preserve and grow it, there is no need to take unnecessary risk.

Paul Kleinschmidt

Portfolio Manager

This article reflects the views of the author as of the date or dates cited and may change at any time. The information should not be construed as investment advice. No representation is made concerning the accuracy of cited data, nor is there any guarantee that any projection, forecast or opinion will be realized. References to stocks, securities or investments should not be considered recommendations to buy or sell. Past performance is not a guide to future performance. Securities that are referenced may be held in portfolios managed by Tocqueville or by principals, employees and associates of Tocqueville, and such references should not be deemed as an understanding of any future position, buying, or selling, that may be taken by Tocqueville. We will periodically reprint charts or quote extensively from articles published by other sources. When we do, we will provide appropriate source information. The quotes and material that we reproduce are selected because, in our view, they provide an interesting, provocative, or enlightening perspective on current events. Their reproduction in no way implies that we endorse any part of the material or investment recommendations published on those sites.

View PDFPoplar Forest

You are about to leave the site of Tocqueville Asset Management, L.P. The link you have accessed is provided for informational purposes only and should not be considered a solicitation to become a shareholder of or invest in the any mutual fund managed by Tocqueville Asset Management, L.P. Please consider the investment objectives, risks, and charges and expenses of any mutual fund carefully before investing. The prospectus contains this and other information about the Funds. You may obtain a free prospectus by downloading a copy from the Poplar Forest (www.poplarforestfunds.com), by contacting an authorized broker/dealer, or by calling 1-877-522-8860. Please read the prospectus carefully before you invest. By accepting you will be leaving the site of Tocqueville Asset Management, L.P.

Tocqueville Funds

You are about to leave the site of Tocqueville Asset Management, L.P. The link you have accessed is provided for informational purposes only and should not be considered a solicitation to become a shareholder of or invest in the any mutual fund managed by Tocqueville Asset Management, L.P. Please consider the investment objectives, risks, and charges and expenses of any mutual fund carefully before investing. The prospectus contains this and other information about the Funds. You may obtain a free prospectus by downloading a copy from the Tocqueville Funds website (www.tocquevillefunds.com), by contacting an authorized broker/dealer, or by calling 1-800-697-3863. Please read the prospectus carefully before you invest. By accepting you will be leaving the site of Tocqueville Asset Management, L.P.